Tydzień w gospodarce

Kategoria: Raporty

Here is a brief commentary from Panzner Insights, my members-only website, which I posted yesterday:

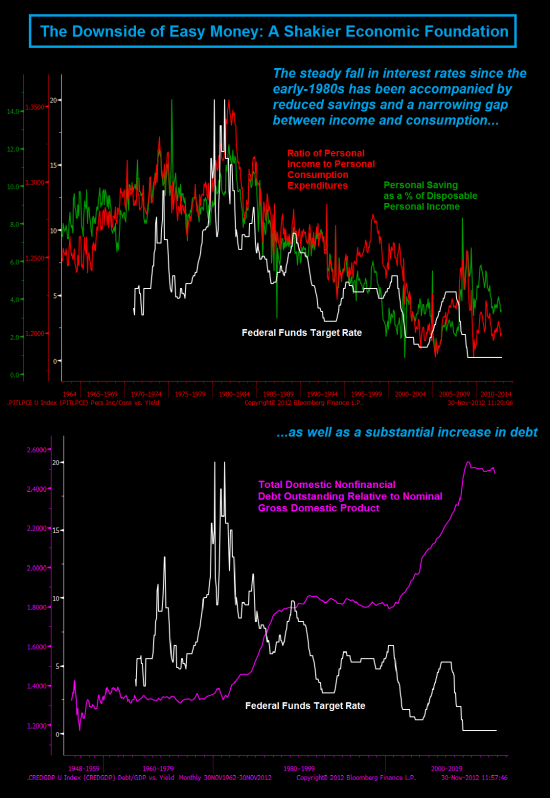

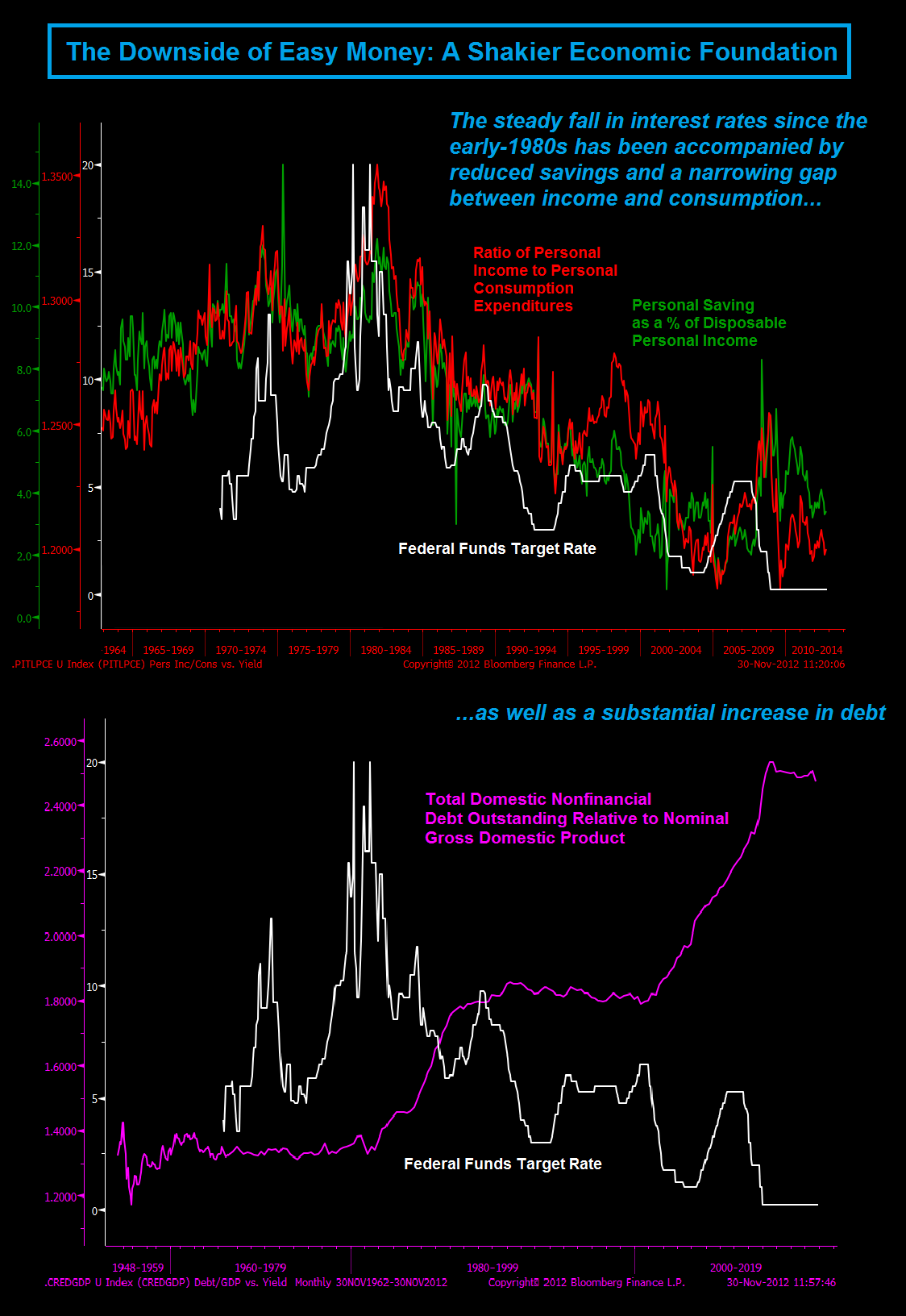

Leaving aside the question of whether correlation equals causation, there appears to be a strong link between the level of U.S. interest rates and the overall health of the U.S. economy.

As the chart shows, the Federal Reserve-orchestrated slide in interest rates over the past three decades has been accompanied by a falling savings rate, a narrowing of the gap between personal income and expenditures, and a substantial increase in total credit market debt.

While there may be more to it than that, including government policies that favor debt over equity and a deregulation trend that encouraged bad behavior by banks and other financial intermediaries, one could readily conclude that the Fed’s current aggressive monetary stance is doing little to return the economy to good health.

In fact, the central bank’s policies may well be making things a lot worse than they already are.

W styczniu 2020 roku Wielka Brytania formalnie opuściła Unię Europejską. Oczekiwane korzyści z brexitu, poza odzyskaniem suwerenności w zakresie kształtowania prawa i zewnętrznych relacji gospodarczych, jednak się nie zmaterializowały. Widoczny jest natomiast spadek wydajności i konkurencyjności brytyjskiej gospodarki, co wpływa także na kondycję rynku pracy.