The Bank of Japan Unprecedented Monetary Easing Experiment

Category: Macroeconomics

Professor of Economics, Faculty of Policy Management, Keio University, former Board Member, Bank of Japan.

Price stability mandate has been BOJ’s unaccomplished mission since the enforcement of the revised BOJ Act in 1998. To accomplish this mission within his five-year term, therefore, Ueda said the BOJ will maintain the yield curve control (YCC), which has been effective, at this stage. The YCC was implemented in 2016 by targeting the 10-year yield at around 0%, shifting from the previous approach of controlling the monetary base through asset purchases like Japanese government bonds (JGBs). Subsequently, the 10-year target range was explicitly defined and expanded to the current level of ±0.5%. The central bank clarified that any policy adjustments to the YCC will depend on whether the underlying inflation outlook shows significant improvement, ensuring the sustainable attainment of the 2% inflation target. The policy adjustments are understood as introducing more flexibility in the 10-year yield control or taking steps towards normalization, as elaborated below.

Current Inflation Exceeding the 2% Target

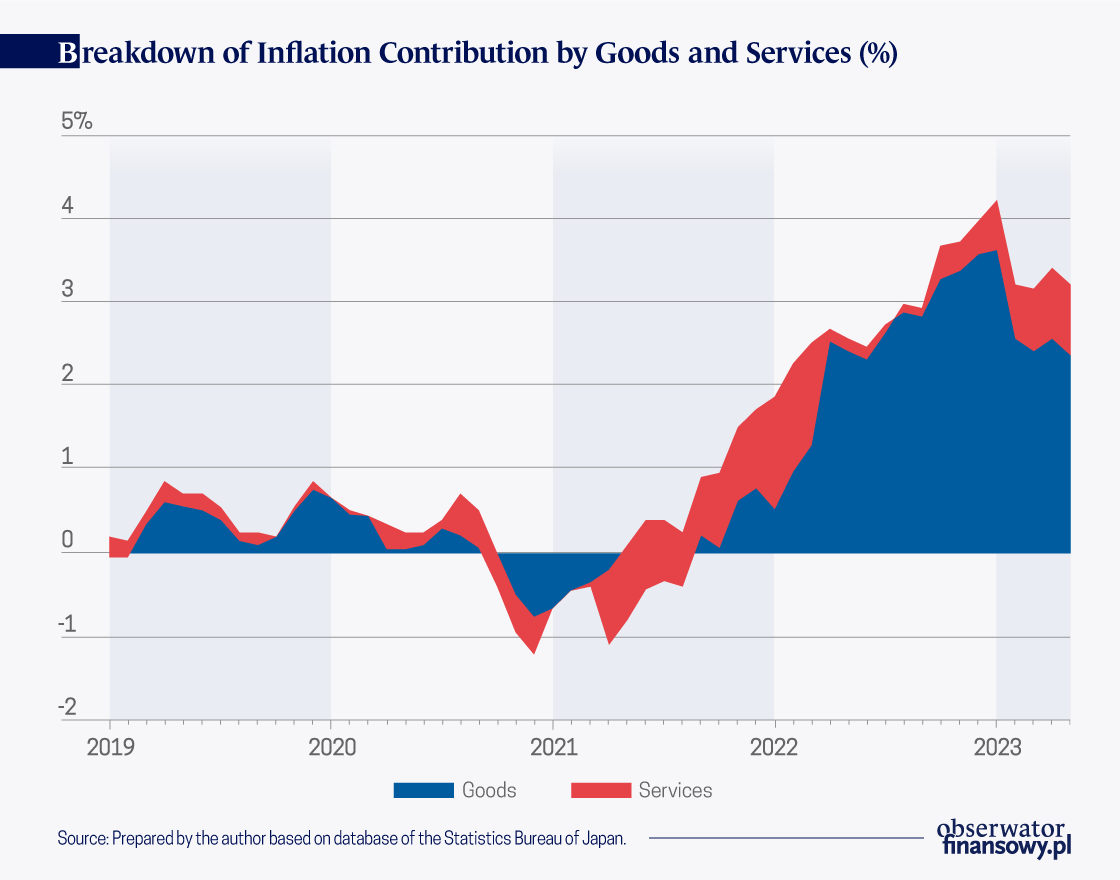

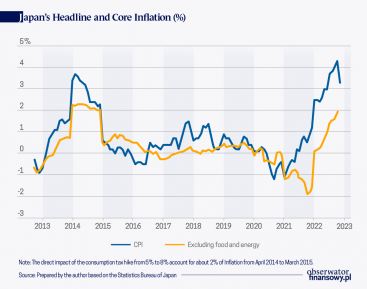

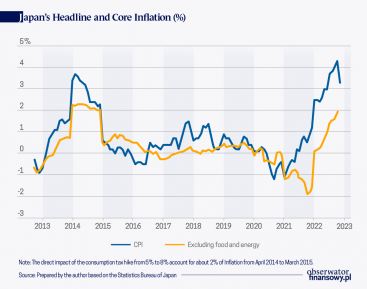

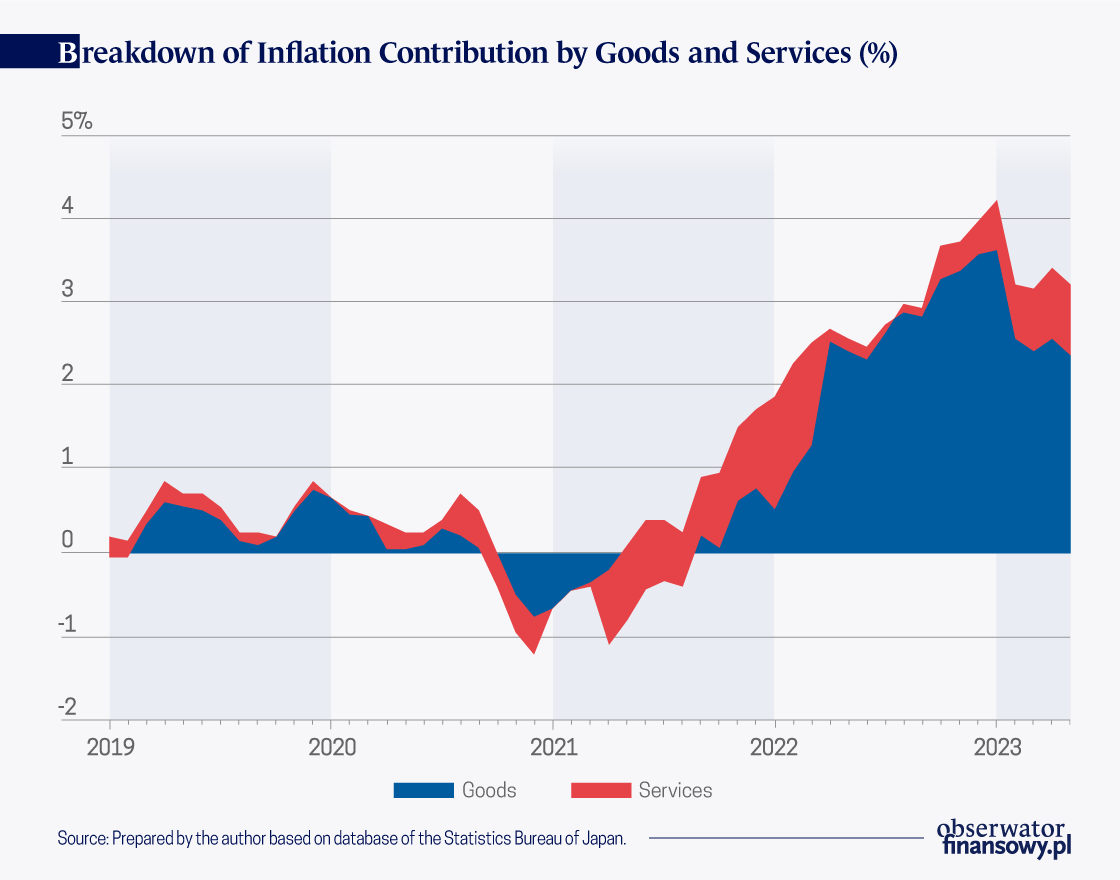

During the past decade, the BOJ struggled to achieve the 2% price stability target during the leadership of former Governor Haruhiko Kuroda, despite implementing an unprecedented scale of monetary easing and various innovative measures. Inflation remained well below 2% constantly, except for a temporary increase resulting from a consumption tax hike in 2014. Since April 2022, this situation has made a drastic change as inflation surpassed the 2% mark and has remained at 3% or higher since August 2022. Inflation dropped to a little over 3% in recent months, from the peak of 4.3% recorded in January 2023, due to a decline in global energy prices and a provision of government subsidies for utility bills. As a result, food has emerged as a primary driver of inflation, accounting for approximately 70% of the total inflation according to the latest data. Goods inflation, which stood at 4.7%, was primarily influenced by rising food prices, while services inflation remained relatively low at 1.7%. Figure 1 illustrates the respective contributions of goods and services to overall inflation.

The Bank of Japan (BOJ) anticipates a decline in inflation towards late 2023, influenced by diminishing unfavorable cost-push factors and the base effect. However, the central bank projects that inflation will start to rise again in 2024, driven by more favorable factors such as a positive output gap, a tight labor market, and wage-price hikes. Nominal wages have experienced a significant increase, reaching 2.5% in May of this year (on a year-on-year basis), compared to 0.8% in the previous month, reflecting higher spring wage settlements between large companies and labor unions. Although the persistently high inflation has continued to generate negative real wage growth, a projected slowdown in inflation will eventually lead to a modestly positive real wage growth. This year’s wage increases were implemented in response to the government’s repeated call for higher wages and companies’ efforts to mitigate the adverse impact of rising living costs on their employees. With a declining working-age population and rapid pace of aging leading to serious labor shortages, wage increases driven by labor scarcity are expected to become more prevalent from next year onwards.

To ensure the long-term sustainability of 2% inflation, the central bank must pay attention to services inflation. This reflects that goods inflation typically decreases over time in many developed countries, including Japan, due to quality improvements (which are adjusted downward in price statistics) and that commodity inflation is volatile. Currently, services inflation stands at 1.7%, but drops to 0.9% when excluding two items with inflationary pressures. The price of meals consumed outside the home (such as easing-out fees) increased by 7.1%, primarily driven by high food prices followed by wage hikes resulting from a severe shortage of low-wage non-regular workers. Hotel charges rose by 9.2% due to growing inbound tourists attracted by the undervalued yen and the lifting of entry restrictions, high food prices, and labor shortage.

In the services sector, passing on increased costs and higher wages to service sales prices is inevitable due to limited labor productivity growth. At the same time, raising service sales prices is challenging since real consumption has remained weak over the past two decades. This is partly due to sluggish wage growth and partly due to the aging population, with one-third of the population aged 65 years or older, many of whom are retired or employed on a non-regular basis. In the aging society like Japan where both supply and demand constraints are increasingly tightening, the implications of labor shortage on sales prices and thus inflation are not as clear as those in emerging economies with growing young populations. Thus, it is premature to conclude that achieving 2% inflation in a sustainable manner from 2024 onwards is feasible. The BOJ believes that maintaining the YCC framework is crucial to support businesses, as raising interest rates in the current cost push inflationary environment would negatively impact the economy and employment.

Market Participants’ Desire for Monetary Policy Normalization

While making judgement as to the feasibility of achieving stable 2% inflation in the near future seems too early, market participants anticipate a monetary policy shift by the BOJ. This perspective stems from concerns regarding the prolonged control of the 10-year yield, which is uncommon in the contemporary central banking community. The BOJ currently holds about a half of the outstanding balance of JGBs issued. Its substantial holdings, especially with regards to 10-year JGBs accounting for approximately 80%, have significantly diminished market trading focused on 10-year interest rates, raising concerns about market functionality. There are also apprehensions that a delay in normalizing monetary easing could make it more challenging for the BOJ to do so in the future.

Since March this year, the manageability of the YCC improved somewhat. This can be attributed to Japan’s long-term yield dropping below the 0.5% ceiling, initially triggered by banking sector issues in the US and Europe, which led to a decline in those yields. More recently, Governor Ueda’s repeated emphasis on maintaining the status quo has also played a role. The previous distortion, where shorter-term yields (such as 8 or 9 years) exceeded the 10-year yield, has now been rectified, resulting in a smoother upward-shaped yield curve. Additionally, the liquidity conditions in the JGB markets have somewhat improved due to the central bank’s limited intervention. There was no need for the BOJ to conduct the 0.5% fixed-rate operation (which involved unlimited JGB purchases until yields fell below the ceiling) since around this time.

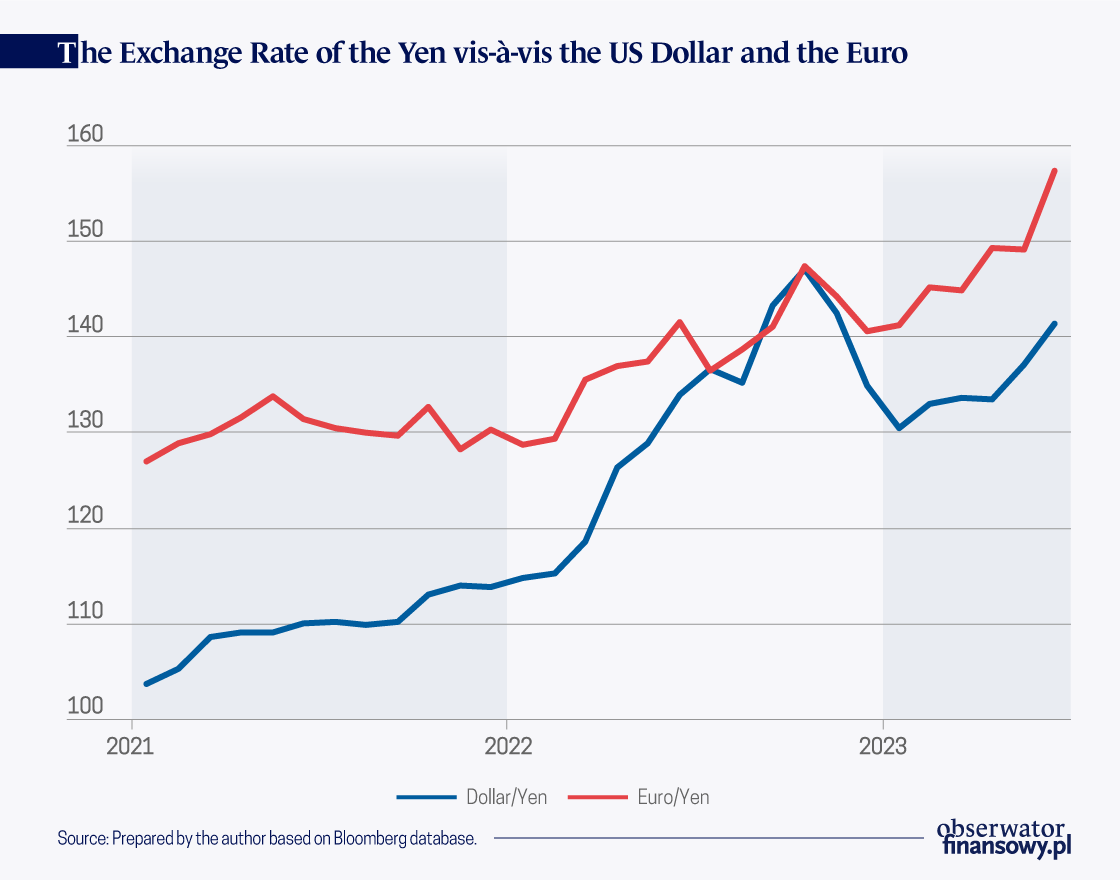

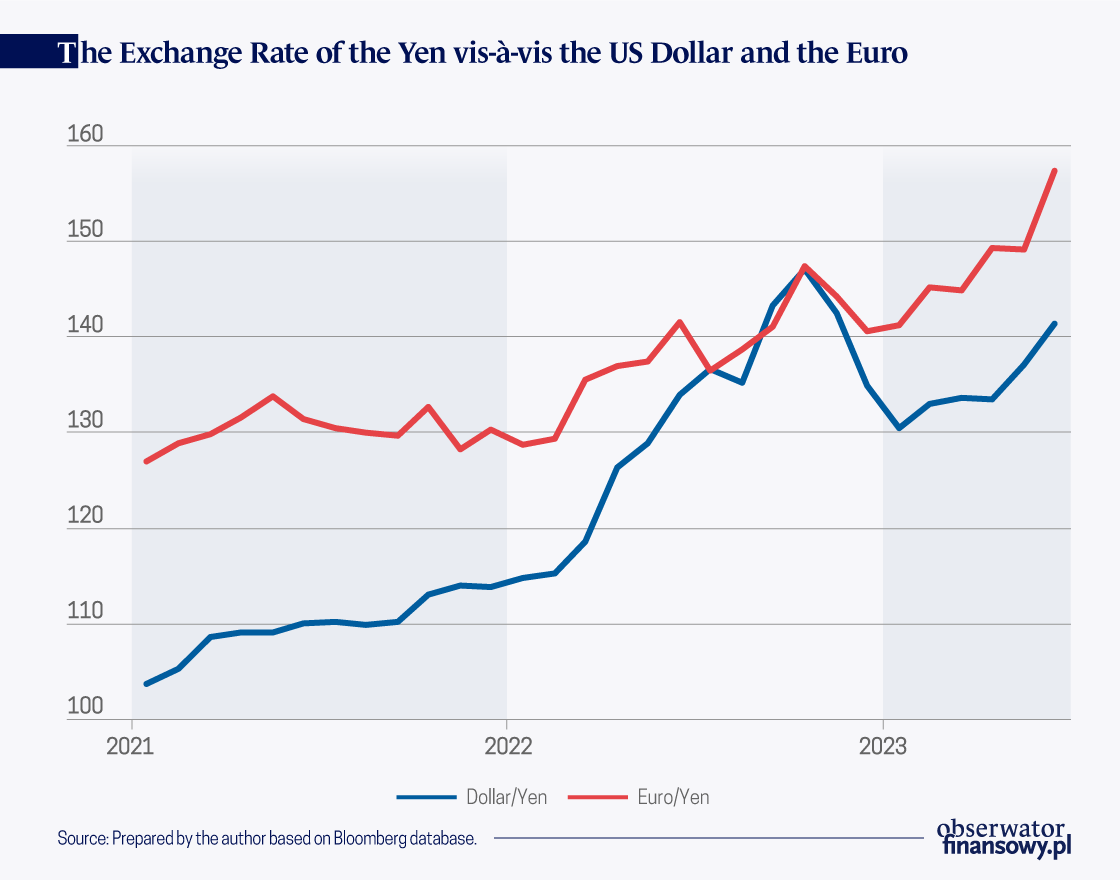

Furthermore, the significant undervaluation of the yen has prompted calls for a policy shift to reduce upward pressures on inflation. This undervaluation reflects the divergent monetary policy stances between the hawkish Federal Reserve and the European Central Bank on one hand, and the dovish Bank of Japan (BOJ) on the other. From early 2022 to late October 2022, the yen experienced a sharp depreciation of 30% against the US dollar, reaching around 150 yen, and a 13% depreciation to 147 yen against the euro (Figure 2). These exchange rates more or less stabilized at around 130-140 yen and 140-145 yen, respectively, from November 2022 to mid-April 2023. However, since late April, the yen has resumed a depreciation trend, with exchange rates reaching 145 yen against the US dollar and 157 yen against the euro in early July. This shift in the yen’s value is driven by the need for the Federal Reserve and the ECB to continue raising interest rates in response to persistently high core inflation, in sharp contrast to the BOJ’s monetary easing stance.

Policy Options and Sequence

The policy shift expected by market participants focuses on the 10-year yield control with the options including (1) an expansion of the 10-year target range to ±0.75% or ±1%, (2) shortening of the maturity from 10 years to 5 years, or (3) a complete removal of the 10-year yield control.

When considering policy adjustments for 10-year yields, there are some opinions that neither expanding the fluctuation range to ±1% nor completely abolishing the 10-year target and fluctuation range would result in significant issues. Widening the range to approximately 1% is viewed as aligning the bond yield with its fair value, thus reducing the likelihood of speculative attacks and promoting stability. In the event of a complete removal, long-term interest rates could also remain within 1% based on fair value considerations.

In both scenarios, the fair value assumption plays a crucial role. The International Monetary Fund (IMF) estimated Japan’s natural interest rate to be around -0.5%. Currently, the 10-year inflation expectation derived from government bond trading and market data is slightly below 1%. Hence, there is a possibility that the 10-year yield would remain below 1% without the implementation of 10-year yield control. However, the fair value calculation assumes the maintenance of short-term interest rates (such as the current account deposit rate at -0.1%) and the continuation of the BOJ’s holdings at the current level of approximately 580 trillion yen of long-term JGBs. Nevertheless, the absence of a target or fluctuation range for the 10-year yield would likely result in increased interest rate volatility. As the outstanding government bond amount continues to grow, the market would become more sensitive to supply-side factors. Additionally, there is uncertainty about BOJ’ plan to purchase additional JGBs beyond the current 580 trillion yen balance, following policy adjustments, which could significantly influence the movement of long-term interest rates. Thus, expanding the 10-year yield target range may be a more suitable option than abolishing the 10-year yield control in terms of containing excessive volatility.

A more challenging scenario would be when the BOJ raises short-term interest rates, as there is no effective lower bound binding with regards to short-term interest rates in this situation. As a result, long-term interest rates would be more susceptible to upward swings and would become more responsive to supply-side issuance factors. Therefore, it is natural to expect that the increase in short-term interest rates by the BOJ should occur after the adjustment of the 10-year yield.

To enhance the functionality of the bond market centering 10-year yields, there is support for shifting the target from the 10-year yield to the 5-year yield. However, some market participants consider fixing the 5-year JGBs undesirable due to traditionally lower liquidity compared to the 10-year JGBs, which could introduce uncertainties in interpreting the implications of the 10-year yield. Furthermore, shifting the target to the 5-year yield would result in a steeper yield curve, serving as a clear indication of monetary tightening. This raises consistency problems for the BOJ about whether it aligns with the commitment to maintaining monetary easing until achieving a stable 2% inflation rate.

Conclusions

The commitment to achieving the 2% price stability target remains the BOJ’s top priority. However, there are high expectations among market participants regarding new Governor Ueda, hoping for a normalization of the 10-year yield curve control and a shift towards more traditional monetary easing based on adjustments in short-term interest rates. The BOJ also needs to carefully consider the implications of mounting structural issues such as population decline, aging, low productivity, potential growth rate, labor shortages stemming from a declining workforce (in the face of sluggish domestic demand), as well as recent cost-push inflation and the substantial undervaluation of the yen. Furthermore, the escalating tensions between the US and China are expected to contribute to higher inflation. The restructuring of global supply chain networks away from China and restrictions on trade, particularly concerning advanced semiconductor and other high-technology products, are likely to result in reduced efficiency and increased production costs. These factors introduce a significant amount of uncertainty surrounding the direction of the BOJ’s policy.

Data presented in the article current as of 7th of July, 2023.

Sayuri Shirai is a professor of the Faculty of Policy Management, Keio University and a former Bank of Japan board member (2011–2016)