Bank of Slovenia, Ljubljana (Fred Romero, CC BY 2.0)

Only in April 2020 the current account showed a surplus in the amount EUR230m, however, it is EUR33m less than in April of the previous year. Taken yearly, the current account surplus was EUR3.3bn in the last 12 months. Further development is conditioned by the general economic situation in the Eurozone, which economy, according to EBC data, will decrease by 8.7 per cent this year, while the unemployment will increase to 9.8 per cent. These brings bad news to the Slovenian economy, which exports 75 per cent and imports 71 per cent of goods and services from the EU (mostly Germany, Italy and Austria).

Trade of goods

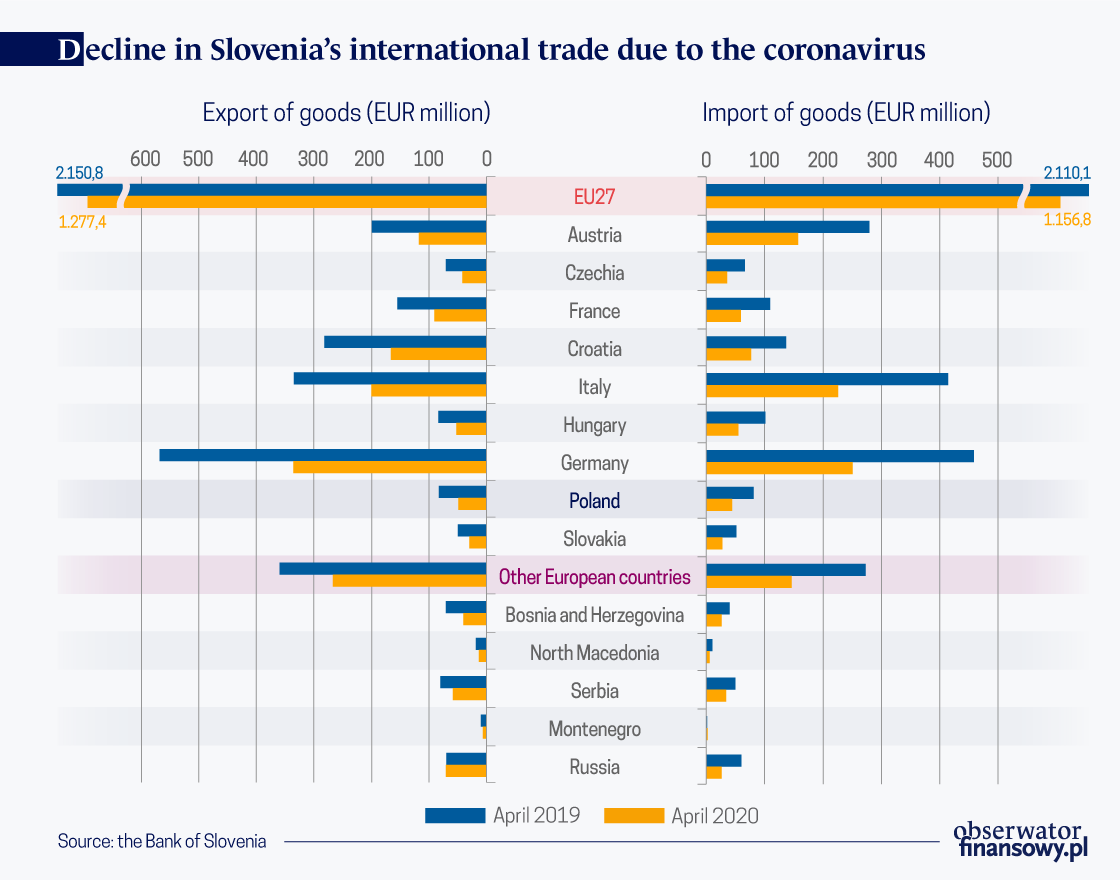

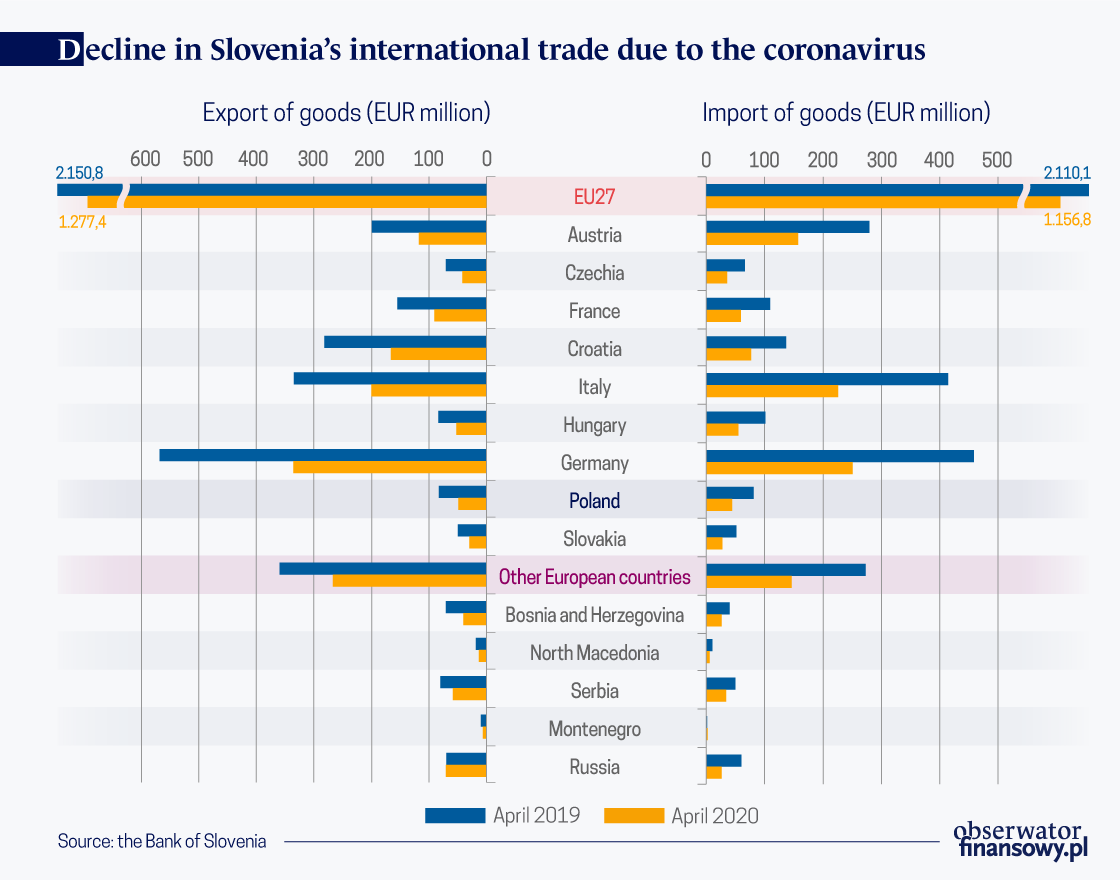

Provoked by COVID-19 uncertainty, general lockdown, as well as decline in foreign demand, have had effect on trade in Slovenia, resulting in closing some businesses and decline in manufacturing production. In Q1’20 the surplus in trade in goods amounted to EUR718m and as such was EUR260m higher than during the Q1’19. The exports decreased by 11.1 per cent y/y (in April by 40 per cent m/m) and imports by 14.1 per cent. Between May 2019 and April 2020, trade in goods and services together achieved a surplus in the amount EUR312m, of which the trade balance represented a 60 per cent surplus.

The coverage of imports by exports amounted to 108.1 per cent. Exports to the EU Member States accounted for 74.9 per cent of total exports in Q1’20. Comparing to the same period of the previous year it decreased by 14.0 per cent, or EUR1.2bn. The largest decrease was in exports to Italy and Germany (56 per cent of the of the overall reduction). Imports from the EU Member States accounted for 76 per cent of total imports and decreased by 15.4 per cent (EUR1.2bn). Imports from Austria, Germany and Italy decreased the most (63 per cent of overall imports from the EU). Most importantly, export to the EU has been hit much harder than to other European or non-European states.

In April 2020, the level of trade in goods fell sharply compared to the same month last year. The trade balance otherwise reached a surplus of EUR188m, which is EUR147m more than in April 2019, but only due to a larger reduction of imports (by 41.4 per cent) than exports (by 35.5 per cent).

Trade of services

The surplus in the current account would be even bigger if not sharp decrease in trade in services which during the Q1’20 fell by EUR166m. Exports of all services in the first four months of 2020 decreased by 13.0 per cent compared to the same period in 2019, while imports decreased by 10.0 per cent. In April 2020, the surplus in trade in services amounted to EUR124m, which is EUR176m less than in April 2019.

From March 2020 onwards exports and imports of tourism (along its value chain components: travel planning, transport, accommodation, food and shopping, local travel and tourist sites) decreased the most. Tourism and transportation was the most affected by the lockdown. Especially harmful is absence of tourists from Germany, Italy and Austria, countries that are the largest net importers of tourism services from Slovenia. Tourism as one of the most important components of trade in services (accommodation, food, transport services, along retail constitute over 20 per cent of Slovenian economy) decreased by 96 per cent in both exports and imports compared to April 2019 (exports in April 2020 amounted only to EUR9m and imports to EUR4m).

During the Q1’20 surplus in the trade in services amounted to EUR719m, which is EUR166m less than in the same period of 2019. The highest positive (EUR423m) balance was achieved by transport services. Compared to the 1Q’19 however they were also lower by EUR36m.

Primary and secondary income

This rather overall pessimistic picture is deepen by figures showing primary income that decreased by EUR16m during Q1’20 (EUR48m during the 12 months of May 2019-April 2020) when compared to the last year, and the secondary income where deficit increased by EUR64m (EUR34m in the past 12 month).

The deficit of primary incomes in the Q1’20 amounted to EUR157m, which is EUR16m less y/y. The lower deficit is mainly due to a larger reduction in expenditure (by EUR 44 million), mostly from capital (by EUR 19 million). In April 2020, primary incomes showed a deficit of EUR48m, which is EUR5m less as of April 2019. Both income and expenditure saw a sharp decline in income from work due to the closure of borders. Deficit of secondary income in the 1Q’20 amounted to EUR176m and was EUR64m lower than in the same period of the year 2019. In April 2020, secondary income recorded a deficit of EUR34m, which is EUR9m more than in April 2019.

Further expectations

The surplus in current account might be the only good news for Slovenian economy in 2020. The Slovenian Institute of Macroeconomic Analysis and Development predicts further decrease in food and accommodation services. General economic decline in Slovenia has been already preceded by almost 20 per cent lower consumption of electricity consumption. Similar trends have been observed in the EU, which in turn will negatively affect Slovenian economy. As a member of the Eurozone Slovenia enjoys relatively stable protective umbrella provided by the European Central Bank. Yet, as a new member state with small economy oriented towards a few neighboring countries faces a little alternative in economic development. Potential markets in the Western Balkans, UAE or Russia will not be able to absorb Slovenian exports in goods or services nor provide investments.