Tydzień w gospodarce

Category: Raporty

Wrocław, Poland (Neo[EZN], CC BY-SA)

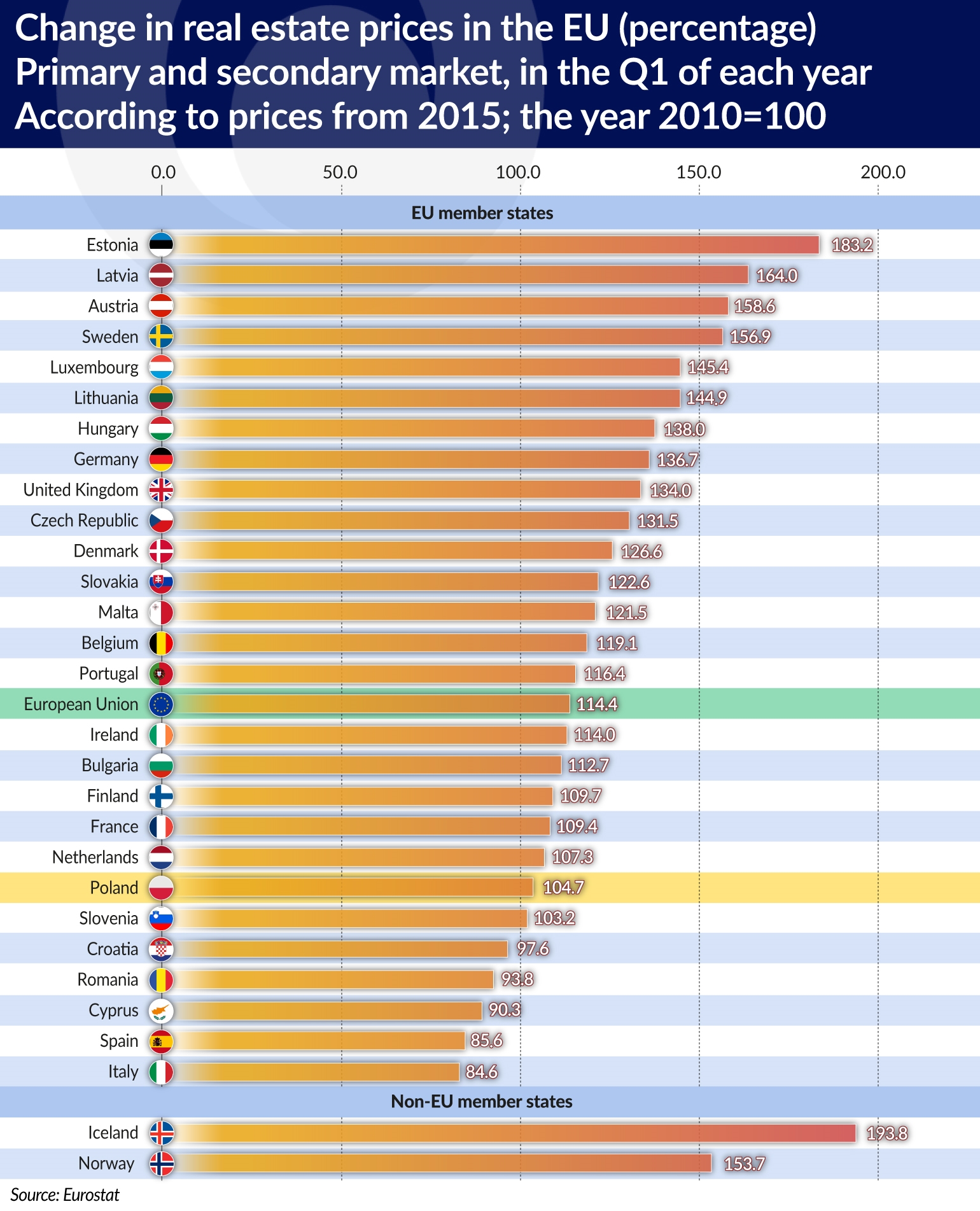

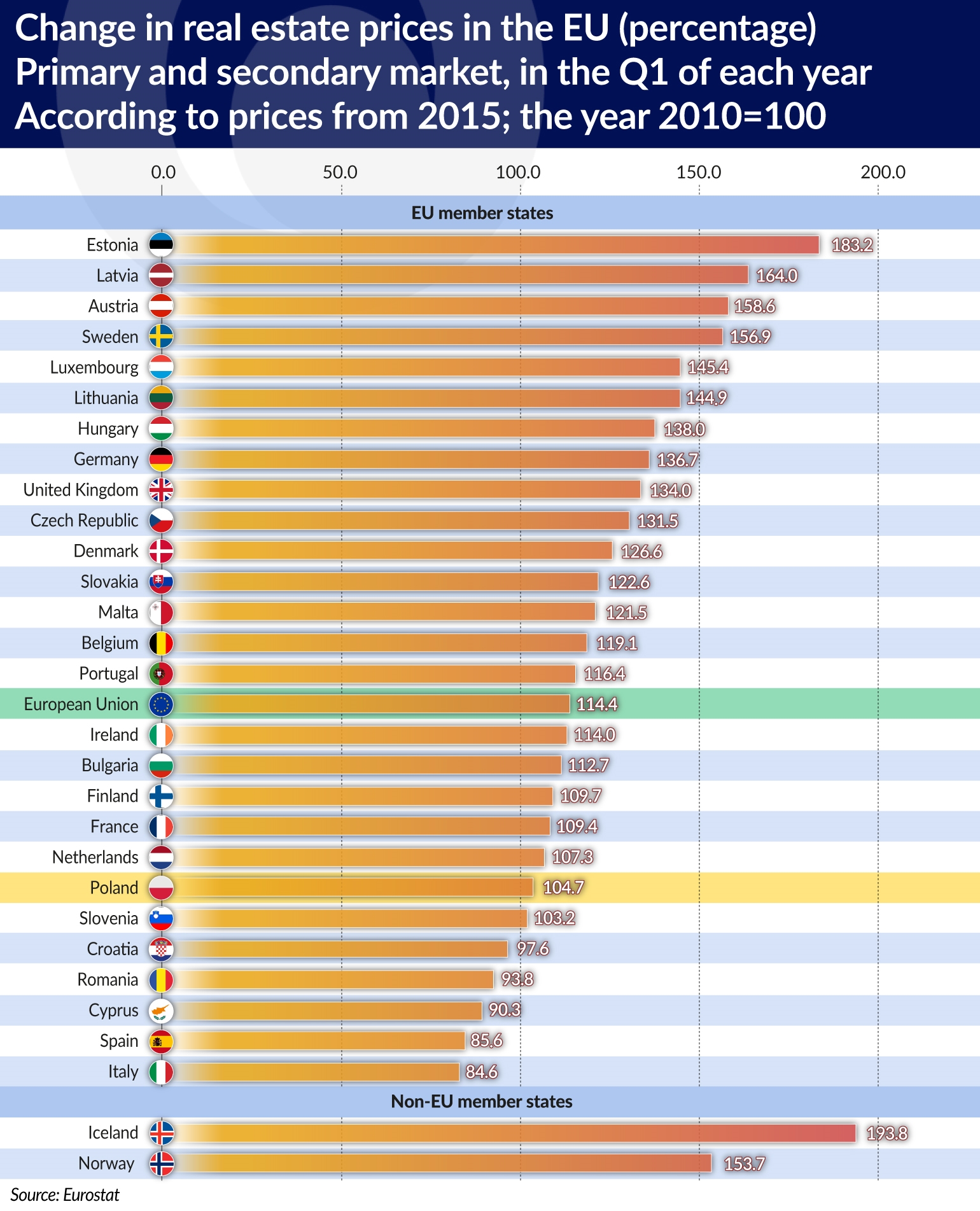

According to data collected by the Eurostat, in the Q1’18 the prices of houses in the European Union were 4.7 per cent higher on average than in the Q1’17. These are aggregate data covering both newly built housing, as well as prices on the secondary market. Over the past year (all further comparisons relate to the Q1s of each year), the strongest rate of growth was recorded in Latvia (13.7 per cent) and in Slovenia (13.4 per cent), as well as in Ireland (12.3 percent) and in Portugal (12.2 per cent).

Housing prices rose in almost all the EU member states, with the exception of slight drops in Finland (-0.1 per cent), as well as Sweden and Italy (-0.4 per cent in both cases). The prices of houses in Poland are clearly increasing but the rate of growth was slower than in Latvia or Slovenia. An overall increase of 6.0 per cent was recorded. The pace of price increase was faster in the secondary market (an increase of 6.4 per cent according to Eurostat data) than in the case of new dwellings (an increase of 5.4 per cent).

The Eurostat statistics cover flats and detached houses, and the reference point for the calculation of price change indices in individual countries are the prices from 2015. The multi-annual data allow an approximate assessment (as the prices from 2015 are still the point of reference) of long-term price trends.

This is important not only for potential customers on the real estate market, but also for researchers looking for potential imbalances in the financial markets. As the “overheating” of prices on the housing market contributed to the last financial crisis. It first affected the mortgage market and later also the public finances, due to the necessity of using budgetary funds to rescue banks with excessively large portfolios of NPLs. The central banks ultimately had to join the rescue operations in order to save the public finances using, among other things, unconventional monetary policy measures. The world of finance has only recently emerged from that crisis and is cautious about a possible repetition of the same scenario.

Notwithstanding the above reservations, it is worth noting that the prices of flats (including both the primary and secondary market) in the European Union member states exceeded the levels from 2007 — i.e. the last year before the outbreak of the crisis — already in 2016. In the Q1’18, house prices were already 13.2 per cent higher than in 2007. At that time the highest rate of increase (by 82.7 per cent) was recorded in Sweden. It is not surprising that the example of Sweden has frequently appeared in analyses concerning the potential “overheating” of real estate prices and the risk that this could create for the country’s public finances.

In addition to Sweden, real estate prices have already significantly exceeded the 2007 levels also in Luxembourg (by 60.3 per cent), Germany (by 41.9 per cent) and Slovakia (by 36.8 per cent). Very high housing price growth is also recorded in two Nordic countries that do not belong to the European Union: in Norway the prices increased by 67.2 per cent, and in Iceland they rose by as much as 91.5 per cent. The prices in countries that have been most affected by the downturn — Latvia, Cyprus, Spain and Ireland — still remain below the pre-crisis peaks.

Eurostat data concerning Poland only begin with the indication of growth in 2011, so for the purpose of comparisons with other countries it is better to adopt the year 2010. In the first part of this period, housing prices were decreasing (in 2014 they were 7.1 per cent lower than in 2010), and then they started rising again. On the secondary market the lowest price levels (8.6 per cent below the 2010 prices) were recorded in 2013. In 2018, for the first time the average prices of all properties offered on the market have exceeded the 2010 prices levels. The prices of new dwellings have already exceeded the 2010 levels in 2017, and in 2018 the secondary market has also clearly started following the increases recorded in the primary market.