Tydzień w gospodarce

Category: Trendy gospodarcze

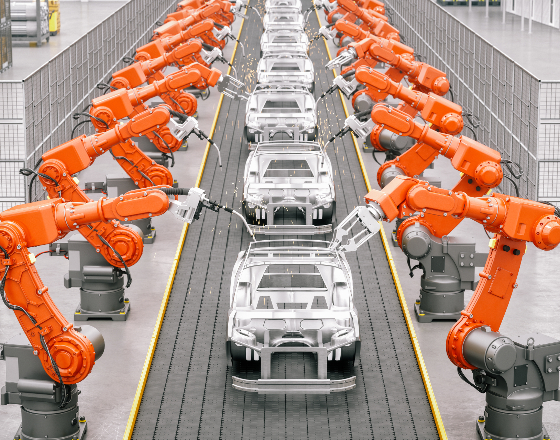

©GettyImages

„’We spent our last penny on countless attempts at a two-stroke and poverty stood at the door. I had already tried so many times to start the engine, which with its silence cheated our dream, already strained to its last limits. After dinner, my wife said: we must try our luck again,’ Karl Benz noted in his diary on the last day of 1878. ’My heart was beating hard. I turned the flywheel and the motorcycle responded with a quiet tit, tit, tit and began to sing the song of our dreams in a beautiful regular rhythm,’ he continued with triumph.”

The above text is a description of the creation of the two-stroke engine from a newly published book on oil written by Andrzej Krajewski. The German designer Benz patented his three-wheeled automobile in 1886, thus going down in history as the father of the automobile industry. „By building a global infrastructure consisting of automobile factories, suppliers, training centers, engineering courses and dealers, a core of prosperity emerged around which other markets could emerge,” reads Focus about Germany. Over time, German automobiles have become the hallmark of our western neighbor, and the good quality associated with the slogan „Made in Germany” most often refers specifically to cars.

Particular growth has occurred in the last 30 years. In 2022 (according to Statista), the German automotive industry generated revenues of about 506 billion euros (with turnover in foreign markets of more than 274 billion euros). Today, the automotive industry is responsible for as much as 24% of Germany’s total industry and directly employs some 800,000 people. In no other country among the world’s most developed economies does the automotive industry play such an important role as in the most populated country in the European Union. The industry is responsible for about 5% of the country’s total economy (not including subcontractors). In addition, it is worth mentioning spending on scientific activities (R&D). According to the Federal Agency for Foreign Trade, „no other industry invests so much in R&D – almost 28.3 billion euros in 2021 alone. As a result, Germany’s automotive industry accounts for more than a third of the country’s total R&D spending.”

More

Meanwhile, German car production and exports are falling. According to Handelsblatt, major companies like Volkswagen, BMW and Mercedes-Benz produced half a million fewer cars in January-May 2023 than in the same period in 2019, a decline of 20%.

In 2022. China exported more cars than Germany for the first time: about 3 million vs. 2.6 million vehicles, respectively. According to the Financial Times (citing Moody’s data), the Middle Kingdom is on track to surpass Japan’s first in this statistic in many years later this year.

Electrics

As Automobility’s data shows, Chinese car exports were primarily directed to emerging markets in Europe and Asia, mainly to sanctioned Russia. However, when it comes to Europe, the increasing import of Chinese vehicles is responsible for the progressive electrification of cars. Europe is the only area where imports from the Middle Kingdom are higher for electric cars than for traditional ones.

On the other hand, China itself has seen a surge in sales of electrics in the past four years. Historically, Europe has exported far more vehicles to China than it has imported. However, the shift toward electric cars has caused a change in purchasing patterns. Consumer preferences have shifted toward domestic brands, which account for 80 per cent of newly registered electric cars in China, notes the Financial Times. For proof, cite data on China’s best-selling vehicles in 2022. The only European model in the top 20 is the VW ID.4, only in 16th place.

Overall growth in sales of full electrics, or BEVs (battery electric vehicles) and hybrids, or PHEVs (plug-in hybrid electric vehicles) in Europe slowed in 2022 to 15% y/y as a result of a generally weak vehicle market, continued parts shortages and the war in Ukraine. In the U.S. and Canada, growth was 48%, and in China, it was as high as 82%. Looking at individual brand sales, the first thing that catches the eye is China’s BYD, which tripled its sales in the last year with more than 1.8 million. In second place was Tesla with 1.3 million vehicles and a 40% year-on-year increase. Germany’s largest manufacturer, the VW Group, sold about 0.9 million EVs with a slight increase of 10%.

More

The most important component of electric cars is, of course, the batteries. And here the Chinese dominance is particularly evident. Taking the lithium-ion battery makers, one can see that the list of the 10 largest such companies does not include any European or American ones. The leader is (considering the most recent January-August 2023 data) China’s CATL with a 36.9% market share, 15.9% has BYD from the same country, followed by Korea’s LG (14.2%) and Japan’s Panasonic (7.1%).

Batteries, in turn, primarily require lithium and cobalt, of which China is a major processor.

In addition, the Middle Kingdom is not only a major processor but also miner of rare metals (according to the „Risk Outlook 2024” report, EIU), which in turn are necessary for the magnets that make up the main drive motors. Access to these raw materials is undoubtedly an important advantage for the Asian tiger over the German automotive giant. On top of that, there are definitely lower labour costs, which are undoubtedly an important cost component of the value of the car sold.

But what is most important is the policy of the state itself towards electromobility. Over the past decade, the Chinese government has provided solid support to the country’s electric vehicle industry through the New Energy Vehicle Industry Development Plan (2021-2035). As Reuters reports, $57 billion has been allocated for this purpose between 2016 and 2022. According to Jato Dynamics data, the average retail price of electric cars available in China was 37% and 26% higher than in Europe and the US in 2015. However, the situation has reversed, the average retail price of an electric car available in China is now more than half the price observed in Europe and the US. In the first half of 2023, an electric car cost €31,165 in China, €66,864 in Europe and €68,023 in the US.

However, China is not just competing on price, but also on quality, says the automotive market research firm just mentioned. Jato says that Chinese companies are easily producing cars with 200-300 horsepower (hp). For example, the Chinese Seal from BYD, which costs about $25,000, has 204 hp, while the closest-priced European rival is the Renault Twingo Equilibre, which has only 84 hp. A good summary of the path that Chinese electrics have taken may be the words of the head of Tesla. Elon Musk in 2011, when asked in an interview about competitor BYD, laughed and asked an editor if she had seen their cars. In May of this year, he referred to the conversation and wrote on Twitter: „That was many years ago. Their cars are now very competitive.”

Short-sightedness

We know that Chinese companies are getting better and growing stronger at the expense of European companies. A good business environment for electromobility, cheap labour and specialization in battery production are undoubtedly part of the explanation for the changes taking place in the market. In the search for further reasons for Germany’s declining position in the automotive world, we can return to the text by Gabor Steingart, who puts the mismanagement of CEOs of large companies first. He argues that German car managers, from VW to Mercedes, have missed the beginning of the electric era. Already almost 4 years ago, at the beginning of 2020, VW boss Herbert Diess, in a speech to employees, accurately diagnosed the situation by talking about 2 basic trends relevant to his company. The first is climate change and the associated pressure to innovate toward zero-emission driving. Second is digitization, which is fundamentally changing the automotive product. Diess said: „What we lack above all is the speed and courage to make powerful, if necessary, radical changes.” However, as we are finding out, diagnosis alone is not enough.

Steingart writes quite emphatically about the short-sightedness of German company managers, writing „The alphabet of automotive decline in Germany begins with the letter A – A standing for arrogance.” Just as Musk once mocked BYD, much earlier Musk was mocked by others, such as former VW chief Martin Winterkorn, who summed it up after a Tesla test accident with the words „Our cars run and don’t burn.” Now, on the other hand, what may be burning is at most the ground under the feet of the heads of the big European automotive companies.

What to do?

Given the importance of the automotive industry in Europe and the main contender to grab a significant share of the profits, the European Union has launched an investigation into Chinese subsidies for electric vehicles. It is also true that when it comes to importing cars from the Middle Kingdom, Europe has a fairly liberal policy with a duty level of 10%, while the US, for example, is 27.5%.

More

However, raising tariffs is a rather risky and short-term strategy. As written earlier, the Chinese control many of the metals necessary for the production of modern autos. China may expand its export controls on rare earth metals. In addition, Germany is opposed to a strong EU reaction on the issue, because it fears possible retaliation, which could do more harm than good to German industry. Recently addressing the issue, German Chancellor Olaf Scholz said: „I still remember the great debates that started when Japanese cars came to Germany. Now they are part of the market – there are German cars in Japan and Japanese cars in Germany. What’s the problem?” Moreover, stronger protectionist policies, i.e., higher tariffs, are a short-term measure. In the long term, Chinese vehicles could simply become cheaper.

The price of a car is still the most important criterion for buyers in all markets. So production costs are an important determinant of sales success. In this area, Europe stands apart from Asian companies. VW’s current chief executive Thomas Schäfer, who is aware of this, said in his speech to 2,000 managers earlier this year, „We are letting costs get too high in many places.”

According to the McKinsey study, in order to reduce costs, „European OEMs (Original Equipment Manufacturers) could close up to 20 percentage points of the cost gap by adopting product design, vertically integrating battery production, scaling EV production and improving productivity.”

Additionally, European manufacturers have long product development cycles compared to their competitors. Therefore, process redesign is being advocated to accelerate innovation and development. According to the consulting firm mentioned in the previous paragraph, „The product design process could be accelerated through iterative styling methods. Subsequent product development could be optimized by decoupling hardware and software development and by applying agile principles to software development.”

An important aspect for European companies should be winning the competition in China. The head of the aforementioned BYD company, Wang Chuanfu, in an interview with Forbes, predicts that by 2030 sales of new electric vehicles will account for 70 per cent of the market there. To do that, you don’t just need competitively priced products, but also an in-depth understanding of the market and different buying preferences. The average customer in China is 34 years old, compared to 58 in Europe, making more modern technology systems extremely important to Chinese buyers.

More

In the study, „A road map for Europe’s automotive industry,” the authors write about what they believe are the most important steps Europe should take. They call for greater cooperation in the industry, on 3 levels. First, horizontal partnerships between players in the same parts of the value chain (different automakers). Second, vertical partnerships between players in different parts of the value chain (e.g., an automaker and a technology company). Third and finally, inter-industry partnerships (between manufacturers and utilities).

The future

Is it really so bad for German automotive companies that the topic has become so popular? Of course, no apocalypse is imminent, but the heads of European companies themselves are making emphatic statements. Terms like „last wake-up call” or „the roof is on fire” or „our automotive business is sick” testify to a not-insignificant moment for the German automotive industry.

Steingart’s phrase „If the auto industry collapses, Germany will collapse,” recalled at the outset, has its complement in the words „At least Germany as we have known it until now.” And more than that, even without a strong auto industry, neither Germany nor Europe will cease to exist. However, as the authors of the „Good Times Bad Times Poland” YouTube channel put it: „If the catarrh of German industry does not pass, but turns into a chronic disease, the Czech Republic, Slovakia and Hungary will also face serious perturbations. Poland and Spain could also be seriously hurt.”

The first four-wheeled automobile developed by Benz was – as it later turned out, prophetically – named „Victoria.” Will we be talking about victory in the context of European automotive in 20 years? How will the German automotive industry cope in the face of the greatest challenge since the invention of the internal combustion engine? These are critical questions worth debating.