Due to the Eurozone’s high share in Polish exports, the economic situation in that group of countries has a significant impact on export growth. According to data from CPB (Netherlands Bureau for Economic Policy Analysis), in early 2019 the growth rate of trade in the Eurozone was lower than in the Q1’18. However, the annual growth rate of the trade turnover was higher in the Q1’19 than in the Q4’18. Imports increased by 1.1 per cent y/y (compared to a zero growth rate of zero in the Q4’18), while exports increased by 0.7 per cent (compared with a decline of 0.5 per cent in the Q4’18). The pickup in imports in the Eurozone was to a large extent due to an increase in German demand. According to the national statistics, in the Q1’19 imports of goods in Germany increased by 4.8 per cent, which was a higher growth rate than in the previous two quarters.

In the Q1’19 trade volumes in the Eurozone grew at a faster rate than the global average. This could indicate some improvement primarily in the mutual trade between the EU member states. However, the continuing slowdown in world trade is inhibiting the growth of the Eurozone’s exports. CPB estimates that in the Q1’19 the rate of growth of global trade fell to just 0.5 per cent y/y, which is the lowest level recorded since 2009. This was mainly due to a decrease in imports in the developing economies of Asia.

Poland exported the most lithium-ion batteries in the EU

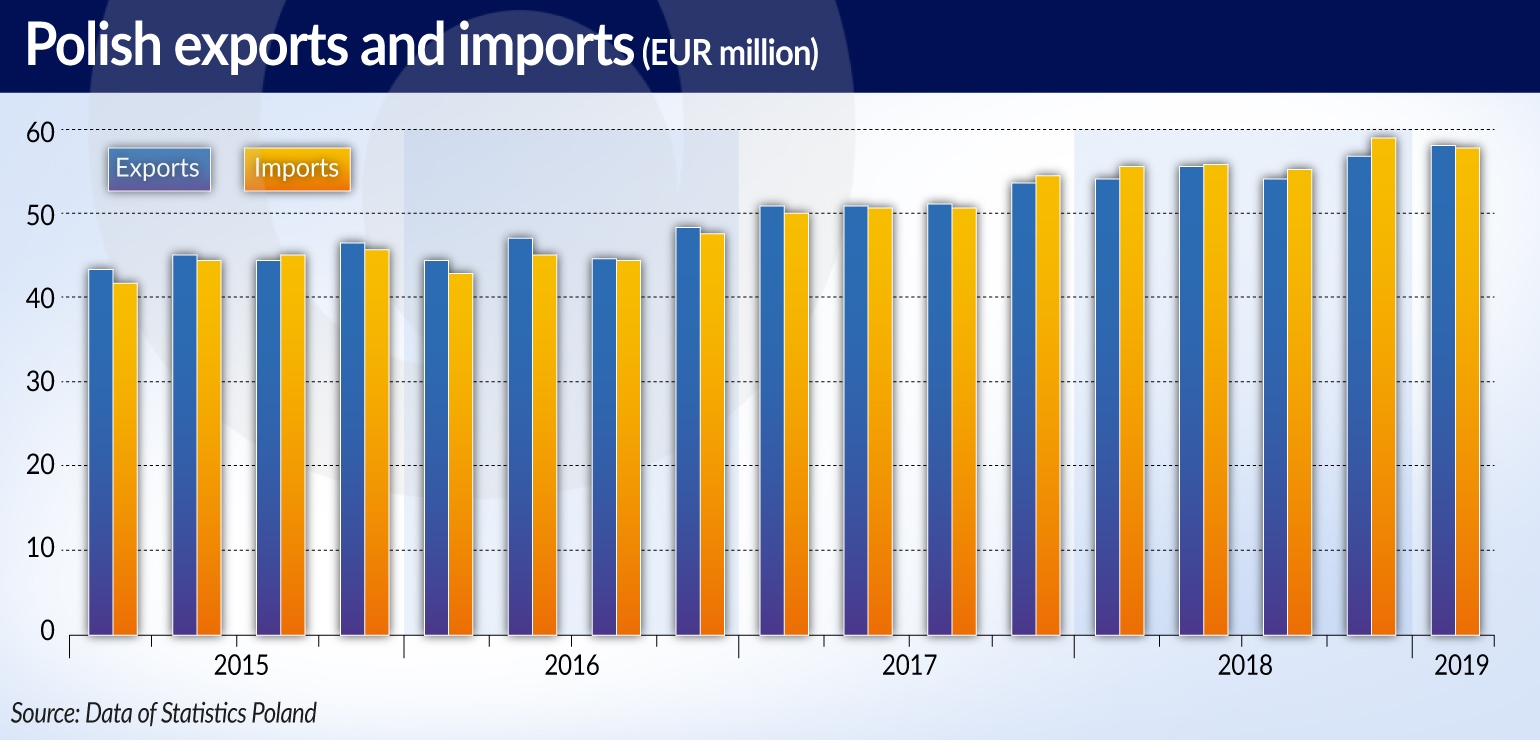

In the Q1’19, the value of Polish exports of goods increased to EUR58bn, i.e. by 7.0 per cent y/y. This means that the rate of growth in exports was higher than in the previous two quarters, and the same as in 2018 on average. Such a growth was mainly driven by an increase in the volume. According to Eurostat data, the volume increased by 5.8 per cent y/y, more than in the previous two quarters. This acceleration was partly due to the low base effect, as the real rate of growth in exports in the Q1’18 was much lower than in the remaining quarters of 2018.

In the conditions of slower exports growth in the majority of EU member states at the beginning of 2019, the real rate of growth in Polish exports turned out to be more than twice as high as the average in the EU. In addition, the impact of the increase in export prices on the growth in the value of foreign sales was positive and greater than in the previous quarters.

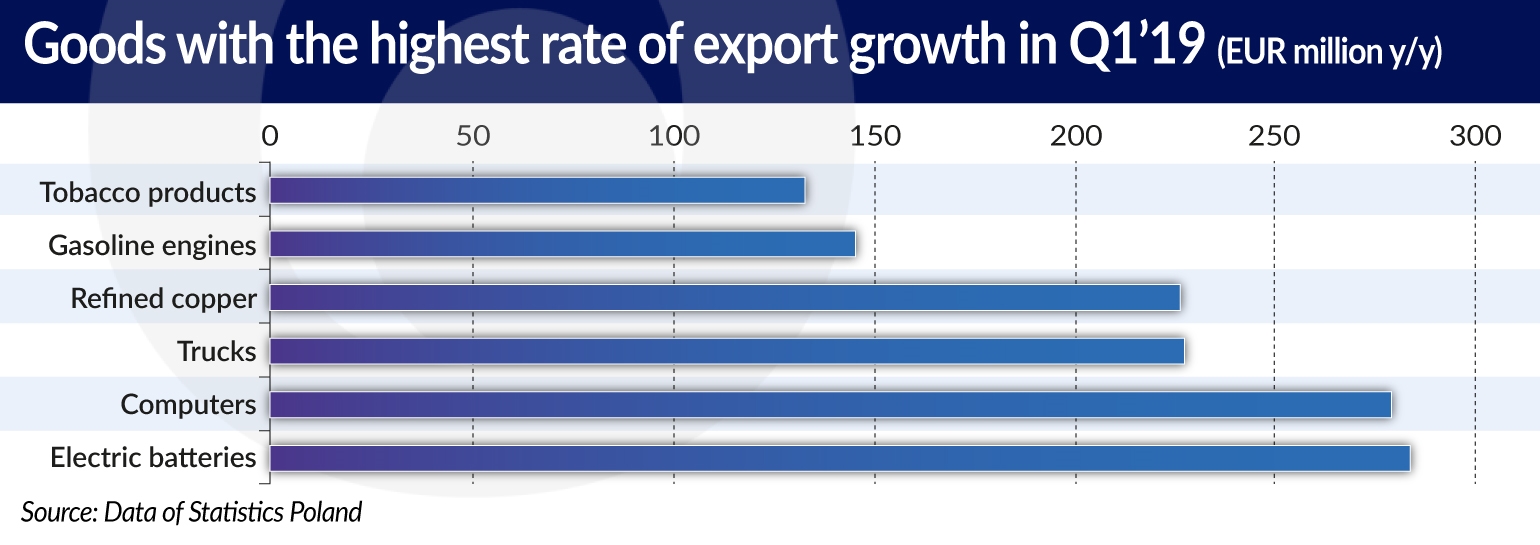

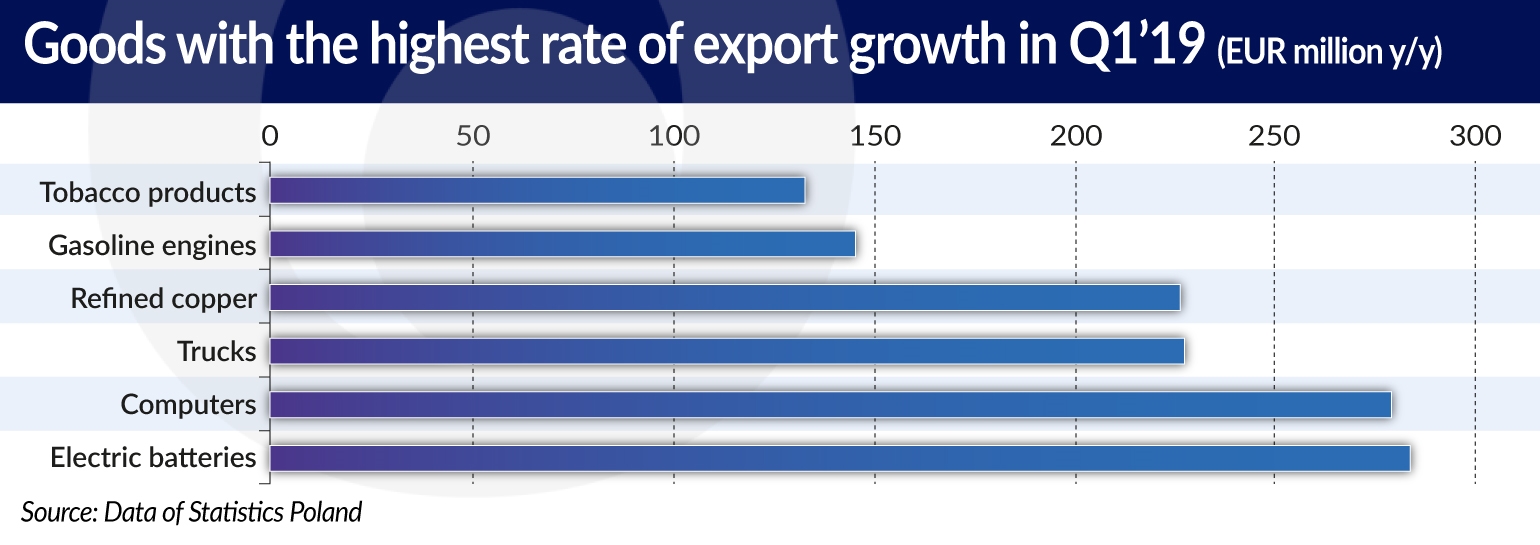

Such good results were primarily driven by products that were previously of a minor importance in Poland’s exports. This includes lithium-ion batteries used in electric cars, as well as the new generation gasoline engines and engines for hybrid vehicles. Poland became the largest exporter of lithium-ion batteries among all the EU member states.

These developments may indicate a strengthening of the production capacities in the export sector as a result of previous foreign investment activity. This has largely mitigated the effects of weaker demand in economies that are Poland’s major trading partners.

The concerns over the consequences of Brexit for trade had a positive impact on the growth rate of Polish exports. The looming Brexit deadline, which was originally scheduled for March 2019, led to a steep increase in the UK imports. According to Eurostat data, imports increased by 13.4 per cent in real terms, compared with a decline of 0.6 per cent in 2018. The increase was reflected in the double-digit growth of Polish exports to the British market, and it concerned a very broad group of goods.

The rate of growth of Polish exports to the Eurozone stayed at a relatively high level. In the Q1’19 the value of Polish exports expressed in the EUR increased by 6.5 per cent, which was a higher rate of growth than in the Q4’18, but slightly lower than the average in 2018 (8.1 per cent). The worse growth in exports resulted from the lower growth in sales to Germany. Meanwhile, exports to other countries, including France, the Netherlands and Austria, accelerated. The exports to Germany were concentrated in categories covering industrial means of transport (primarily an increase in the export of trucks from the Volkswagen factory in Września, western Poland), processed industry supplies and investment goods. Meanwhile, the export of consumer goods and food products was lower than in 2018. At the same time the ongoing crisis in the German automotive sector led to large drops in the export of components for means of transport.

According to mirror statistics (i.e. data analysed from the point of view of Germany), in early 2019, German imports from Poland grew faster than the overall imports. This resulted in a further increase of Poland’s share in imports to Germany (to 5.5 per cent). For the first time, Poland became the fifth largest exporter to Germany (after the Netherlands, China, France and Belgium). In the Q1’19, for the first time in history, the value of Germany’s imports from Poland was higher than the value of imports from Italy.

Sales to countries outside the European Union clearly accelerated and the value of exports increased by 7.9 per cent, as compared to an increase of 2.7 per cent y/y. The strongest increase was recorded in sales to non-European developing economies (by almost 12 per cent y/y). High growth was recorded in exports to China and South Korea. The exports to China was driven by growing sales of copper, computer parts and poultry, while sales of copper and precious metals contributed to the increase in exports to South Korea.

Weaker imports of fuel and passenger cars

Unlike in the case of exports, the growth rate of Polish imports was lower than the average for 2018. In the Q1’19, the value of imports of goods to Poland increased to EUR 57.9 billion, i.e. by 4.1 per cent compared with the same period of the previous year. This was due to a lower real rate of growth in imports (by 4.4 per cent, compared with 7.1 per cent in 2018), as well the lower rate of growth in the prices of goods imported to Poland.

The increase in the volume of imports was reduced by the weaker growth rate of the fuel supply and passenger cars. Meanwhile, the lower prices of imports were primarily due to the stabilization of commodity prices, including oil. The changes in the geographical structure of trade could also have some effect, with China and other Asian developing economies accounting for a growing share of Polish imports.

In the Q1’19 Poland imported less fuel — 46.7 million barrels of oil, which is nearly 9 per cent less y/y. The new agreement between PKN Orlen and the Russian company Rosneft contributed to the decrease in the supply of crude oil. Pursuant to the new contract, the amount of Russian oil was reduced starting from February 2019. So the oil imports from Russia were 17 per cent y/y lower. Meanwhile, oil supplies from Saudi Arabia, Kazakhstan and Norway increased. For the first time, Angola appeared among the countries supplying oil to Poland

The imports of coal stabilized and grew by 4.7 per cent y/y compared with growth of over 50 per cent in all of 2018. Imports of coal from Russia and Australia increased, while imports from the United States and Colombia decreased.

After large fluctuations in 2018, the domestic demand for passenger cars also stabilized, as confirmed by vehicle registration data. The number of registered new passenger cars reached 139,800 and remained virtually unchanged compared with early 2018 (when it increased by 11.1 per cent y/y). Meanwhile, the slight increase in the value of imports of new cars may have been due to an increase in the imports of cars from the premium+ segment (of 8.8 per cent y/y). At the same time there was a slight decrease in the registrations of used cars imported from abroad, the number of such vehicles decreased by 0.6 per cent y/y.

Imports of investment goods had the highest growth rate, primarily due to an increase in imports of computers, telephones, and tractors and trucks.

Imports of parts, including primarily automotive components, grew faster than the average imports growth, which resulted from an increase in exports of both trucks and car parts. At the same time, among consumer goods, the highest rate of growth was recorded in imports of television sets.

Poland once again recorded a surplus in trade in goods

After five consecutive quarters, when the value of imports of goods was higher than the value of exports, in the Q1’19 the balance of goods trade was positive. The surplus amounted to EUR150mn, so Poland’s improved its trade balance by EUR1.5bn y/y.

In terms of product groups, the improvement was mainly driven by the expansion of the trade in consumer goods and the reduction of the negative balance in the trade in intermediate and investment goods. The deficit in the category covering raw materials and fuels remained at a level similar to the one recorded in the Q1’18. Among the major categories of goods, the size of the deficit only increased in passenger cars.

In terms of the geographical structure of Poland’s international trade there was a further increase in in trade with the European Union (up to EUR12.9bn, i.e. by EUR2.2bn y/y). Additionally, the negative balance in trade with Russia decreased by more than EUR500m due to the decline in the oil imports. At the same time, there was a continued trend of a deepening deficit in trade with non-European economies — in the Q1’19 the negative balance amounted to EUR12.7bn and was EUR650m higher y/y. It was mainly worsened by the exchange with China.