Tydzień w gospodarce

Category: Raporty

In the case of Poland there are certain conditions that could lead to a moderate increase in producer prices and the prices of consumer goods and services.

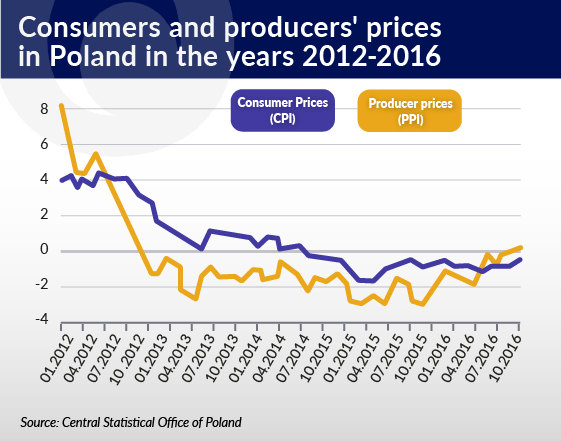

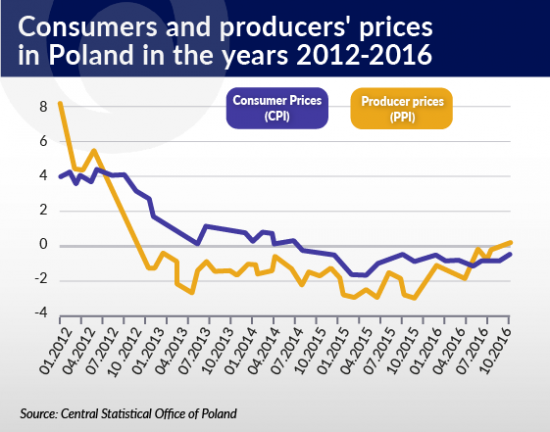

The deflation recorded in the years 2013-2016 applied to all price categories. The decline in producer prices was followed by a decrease in the prices of consumer goods and services, which occurred with a delay of more than a year and a half.

A delayed response of consumer prices (CPI) in relation to changes in the prices of goods intended for further production (PPI) is a relatively common phenomenon.

Firstly, the prices of consumer goods and services only partially depend on the changes in producer prices. Not every change in the prices of commodities has to be reflected in a change in consumer prices. Sometimes entrepreneurs cover the increase in production costs resulting from rising commodity prices from their own margin. Only a more persistent trend of increases in producer prices causes an increase in consumer prices.

Secondly, in the conditions of deflation entrepreneurs are usually not in a hurry to reduce prices, thus rescuing the dwindling sales revenues. During deflation the decrease in sales revenues results from the fact that at the time of sale, the prices dictated by the market are lower than the prices assumed at the time of their calculation.

Commodities, transport, storage and labor force were contracted in advance, at a price higher than that the price applicable at the time of sale of the product. This in turn is a threat to the achievement of the previously planned margin.

A similar mechanism of changes in prices of consumer goods delayed in relation to changes in the prices of commodities and consumables occurs amid inflation. Despite the increasing producer prices, companies manufacturing consumer goods try to keep prices at a stable level as long as the demand allows them to do so, even at the expense of losing a part of the unit margin. As a result they obtain higher price competitiveness, which, as they believe, will result in increased sales and higher revenues.

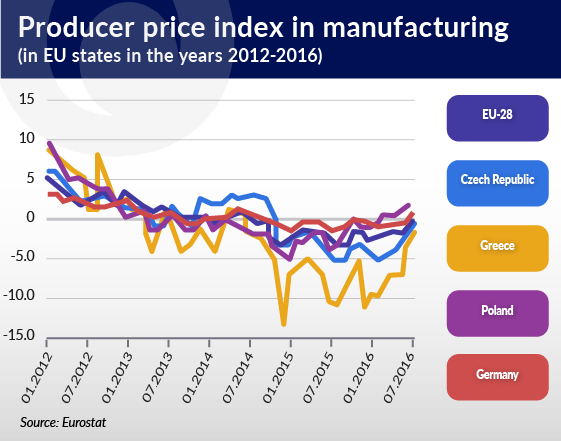

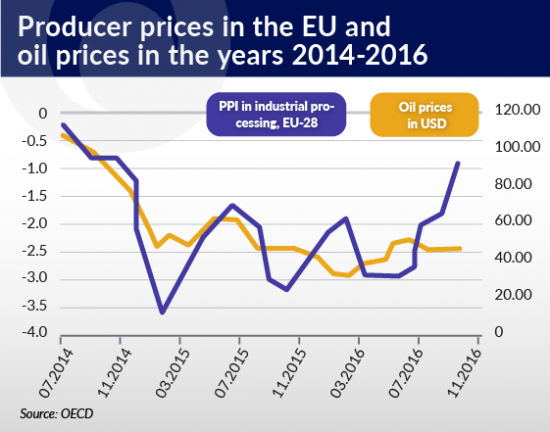

In recent years, deflation has spread almost all over the world, and in Europe it has affected all the countries of the EU.

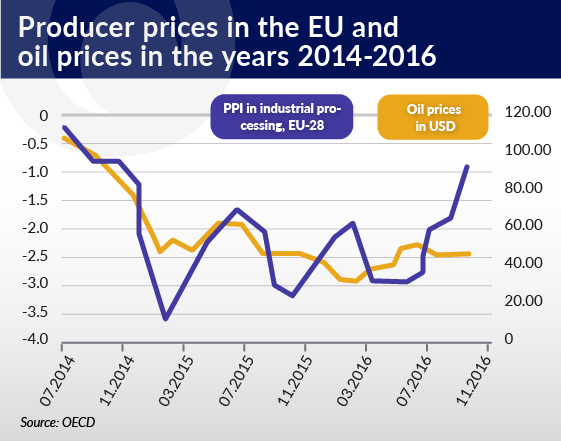

Initially, in 2013 and the first half of 2014 it was a direct consequence of yet another wave of recession or weak growth, which was associated with a widespread decrease in trust, reduction in investment and weak demand. Later on, the rapidly falling oil prices were of essential importance for the deepening of deflation.

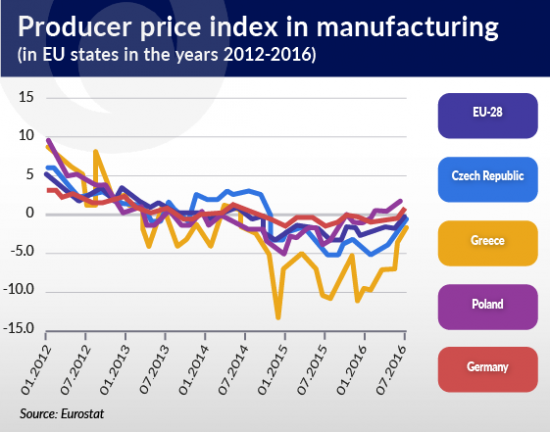

The most severe period of deflation was 2015. However, individual economies experienced the price collapse with varying intensity. Generally speaking, the weaker the economy and the lower the growth rate, the deeper the price decreases. Deflation and recession form a certain kind of a feedback loop: a slower rate of growth of the economy reduces demand and intensifies the price decrease.

Falling prices halt expenditure on both investment and consumption, the value of the contracted debts increases, which further limits economic growth or deepens the already existing recession.

During the period of the most severe deflation, at the beginning of 2015, Greece recorded a decrease in PPI prices exceeding 11 per cent, whereas in the economy of Germany the deepest deflation of producer prices did not exceed 2 per cent. In Poland, deflation was not particularly severe or long-lasting. Producer prices decreased at the fastest pace in early 2015 (at the rate of nearly 5 per cent annually), but since August 2015 deflation has been gradually subsiding.

The producer prices in the Czech Republic, Hungary or the United Kingdom behaved in a similar way as in Poland.

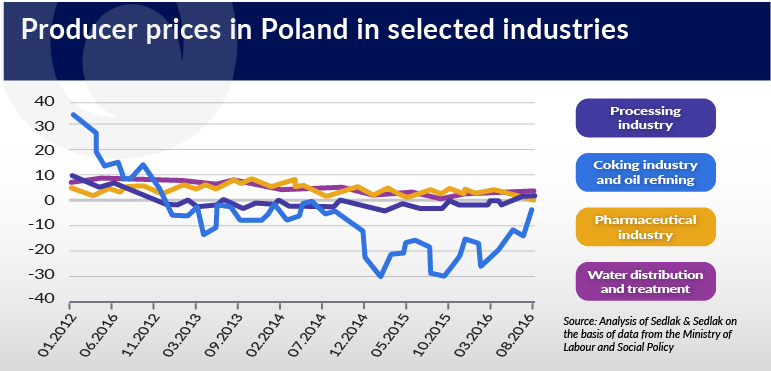

The producer price index PPI reflects the production structure of a given economy (just like the consumer price index reflects the structure of expenditure of “Joe Bloggs”). Hence the structure of the PPI index includes prices of products from various sectors and industries. Not all products become cheaper and more expensive at the same rate. There are industries more and less sensitive to supply side shocks associated with changes in the prices of commodities and especially oil prices.

In the case of importers of commodities, where settlements are made in foreign currencies, there is the added importance of the exchange rate, which can alleviate the increase or decrease in the price of commodities or intensify that increase or decrease. Finally, there are industries that are characterized by considerable rigidity of demand and industries where prices are not entirely free, but are to a large extent regulated by the state.

All these particular characteristics of individual production activities lead to varied price reactions both amid deflation and inflation. This phenomenon could also be observed in the years 2013-2016 in the Polish economy. For example, the pharmaceutical industry, characterized by relatively rigid, and even growing demand, did not experience deflation.

A similarly positive rate of price growth was maintained among companies operating in the sector of water distribution and treatment, where prices are not entirely shaped by the free market. In both cases, the rate of price increases was reduced only slightly. On the other hand, the oil processing industry was characterized by the deepest deflation, which was directly associated with the long-lasting decrease in the prices of this commodity.

The crossing of the boundary between deflation and inflation of producer prices raises questions about further trends. Commodity markets analysts are not expecting any extraordinary increases of oil prices in 2017. High stocks and low economic growth of the world’s leading economies raise doubts whether an OPEC agreement to cut oil production will be kept.

However, in the case of Poland there are certain local conditions that could lead to a moderate increase in both producer prices and the prices of consumer goods and services. This could be decided by the rising costs of production.

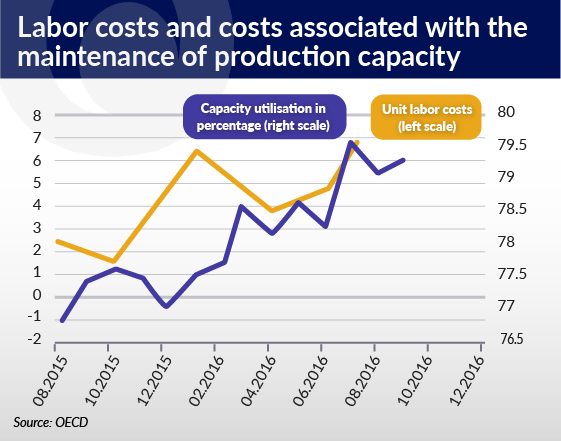

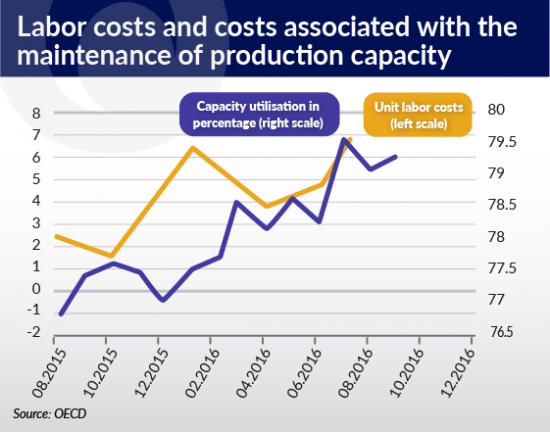

Since the middle of last year there has been an increase in unit labor costs (exceeding 7 per cent annually), which is a direct consequence of an increase in salaries amid simultaneous moderate growth of sales of industrial production. The costs of maintaining production capacities in companies have also been growing for a long time.

The costs associated with the operation, repair and renovation of machinery usually vary proportionally to the degree of its utilization in the production process. Over the last year, the rate of capacity utilization in enterprises increased from about 77 per cent to nearly 80 per cent.

It should be added that for the Polish economy this is a very high rate of utilization of machinery and equipment. At this rate companies typically begin to invest in the renewal and development of the machinery. The fact that they are not currently doing so results from the high uncertainty widespread among Polish entrepreneurs.

However, such a high rate of utilization of production capacities leads to an increase in expenditure associated with their renovation, repairs and spare parts. This means that we are dealing with an increase in production costs resulting from the increasing wages and the high maintenance cost of machinery. Therefore, from the point of view of companies and their financial results, there are strong grounds to increase prices. Companies will surely do so if the size of the demand or their market position permits them.

Maria Drozdowicz-Bieć, PhD, is a professor at the Warsaw School of Economics. She also cooperates with Institut für Wirtschaftsforschung (IFO) in Munich, Conference Board and Foundation for International Business and Economic Research (FIBER) in New York, and Centre for International Research on Economic Tendency Survey (CIRET) in Zurich.