Almost every second respondent declares that they save for retirement – these are the conclusions of Deutsche Bank’s report entitled „Liberal professions in Poland. The portrait of a professional in 2017”.

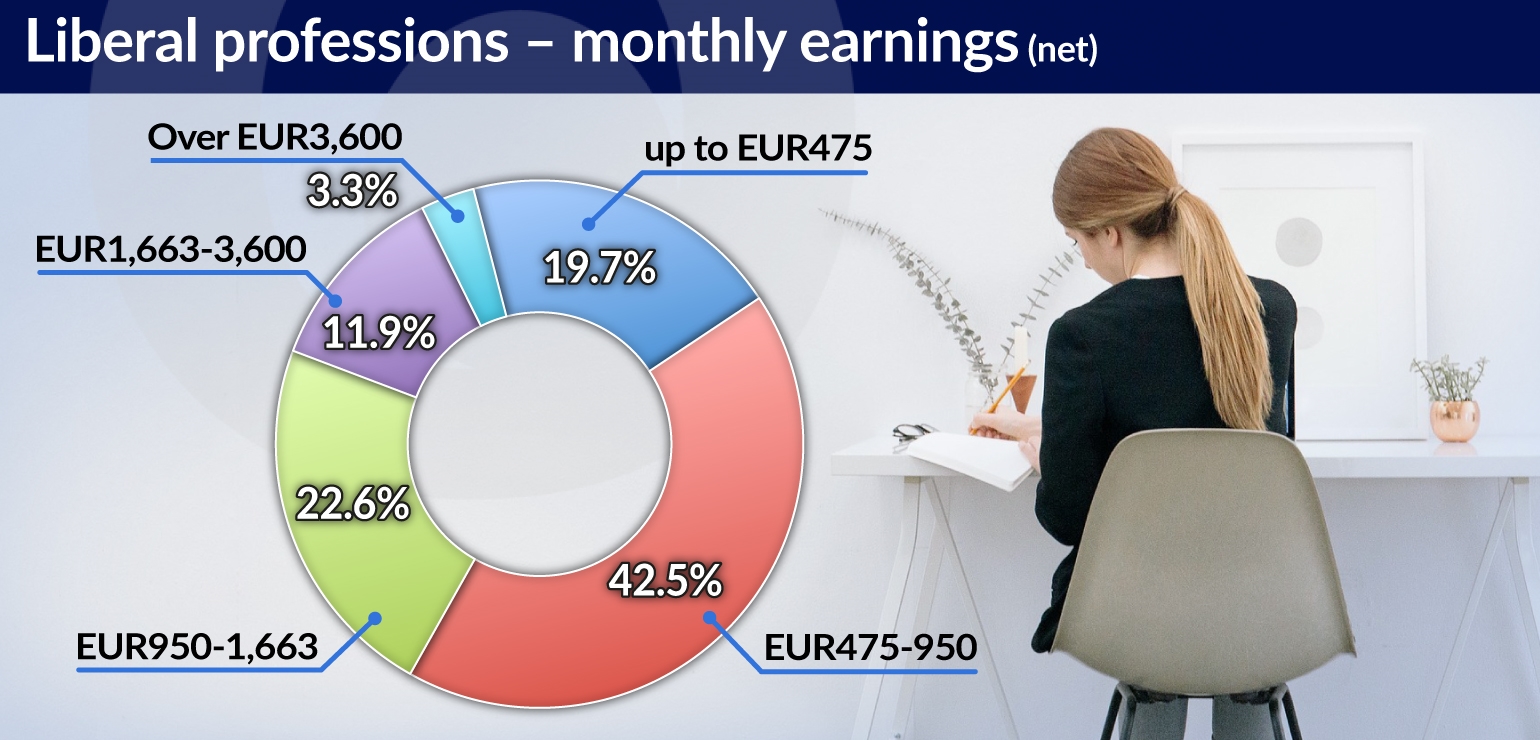

The group presented in the report comprises the representatives of various professions. These are i.a. physicians with an independent practice, veterinarians, attorneys, notaries, accountants, psychologists and architects. Their income levels can vary significantly. Only 3.3 per cent of them earn more than EUR3,600 net per month. More than 42 per cent obtain net earnings between EUR475-950, and close to 12 per cent between EUR1,663-3,600. The persons running a sole proprietorship earn more, on average, than those working pursuant to other legal basis.

Interestingly enough, the above-average incomes are not considered to be an important advantage of liberal professions. The possibility of developing and receiving training at an industry organization, as well as conducting one’s own business activity are seen as more important (13.3 per cent and 10.2 per cent respectively).

“The representatives of liberal professions are a very attractive group of customers for banks. Some of them already meet the criteria for belonging to the premium segment. Others will probably join this group in the near future along with the development of their career or business activity,” predicts Monika Szlosek, Director of Retail and Investment Banking at Deutsche Bank.

Competition breathing down one’s neck

A year ago the growing costs of conducting a business activity affected almost every other representative of the liberal professions. This was the second most frequently indicated challenge at that time. Currently only every fifth respondent is affected by this issue. Professionals look to the future with optimism. Almost every fifth responded believes that the scale of their business activity will definitely increase in the next five years. More than half (52.4 per cent) expect that it will remain similar to the present level. The key aspects for development indicated by the respondents include the acquisition of new markets, good location, improving the equipment of the office, and broadening the scope of the provided services.

The biggest challenge in the past two years has consistently been the high competition within the particular industries. It is indicated by nearly half (48.5 per cent) of the people working in a liberal profession. The need to ensure regular income is a source of uncertainty for almost 43 per cent of the respondents, while fewer than 39 per cent point to the difficulties in acquiring new orders. A similar proportion is aware of the risk of losing financial liquidity. The legal liability for the performed work is a challenge for more than 43 per cent of the respondents.

Development is difficult without investments

Professionals see opening themselves to new markets and sources of orders as a chance to access new customer segments. They are also aware of the need to constantly develop their competences and their offer.

“This is the key to meeting the needs of the customers and withstanding the pressure of the competition. Smart investments are necessary in order to obtain a competitive advantage. Every third professional plans to make such investments within the next half a year. These will primarily include investments in infrastructure and offices,” emphasizes Waldemar Jarek, responsible for the development of the credit offer for individual clients and micro-enterprises at Deutsche Bank.

Greater openness to loans

Just a year ago, two-thirds of the representatives of liberal professions planned to finance potential investments with their own funds. In the latest edition of the survey, more than half of them (56 per cent) indicated this source of financing.

“Due to favorable economic conditions entrepreneurs are not worried about the sources of future income. As a result, they are more likely to take out loans. An additional argument for that is the availability and low price of such forms of financing,” Mr. Jarek.

Economically active professionals appreciate banking solutions that are functional, modern and customer friendly. Almost every third professional expects a comprehensive look at their finances – covering both personal and business finances. They also put emphasis on the functionality of the tools provided by the bank. The high quality of electronic banking solutions ranked first among the expectations towards financial institutions. The importance attributed to the availability of mobile solutions also increased compared to last year (they are important for 41 per cent of the representatives of liberal professions).

Retirement – professionals are aware of the risks

Almost half (47 per cent) of the surveyed professionals declare that they are saving for retirement. Compared with the previous edition of the survey, the proportion of professionals saving for retirement increased by almost 6 percentage points.

“This is a very good result compared with the society in general. Studies conducted on the general population indicate that the average Polish citizen is significantly less likely to save for this purpose,” comments Professor Małgorzata Bombol from the Warsaw School of Economics.

The inclination to engage in long-term savings increases with age. Only one in five professionals below 24 years of age saves for retirement. People aged 55-64 attach the greatest importance to retirement savings. The professionals with above-average earnings (over EUR2,379) exhibit particular foresight. In this group the percentage of people building their retirement capital exceeds 60 per cent.

“If we take into account that the vast majority of Polish representatives of liberal professions run a sole-proprietorship business activity, these data should not come as a surprise. The vast majority of them decide to pay the lowest possible mandatory pension contributions. As a result the capital that they collect in their Social Insurance Institution accounts is much lower than in the case of persons employed on the basis of an employment contract. The additional savings are therefore necessary to ensure an appropriate quality of life during retirement,” says Monika Szlosek.

The nationwide survey was conducted on behalf of Deutsche Bank by the Market and Social Research Institute (Instytut Badań Rynkowych i Społecznych) on a random sample of 1,000 people constituting a statistical representation of the demographic characteristics for the overall group of people working in liberal professions, and it takes into account territorial distributions (data according to the Poland’s Central Statistical Office).