German automotive industry at a crossroads

Category: Business

Były radca ministra w Ministerstwie Gospodarki i Ministerstwie Rozwoju

more publications of the author Jerzy Rutkowski

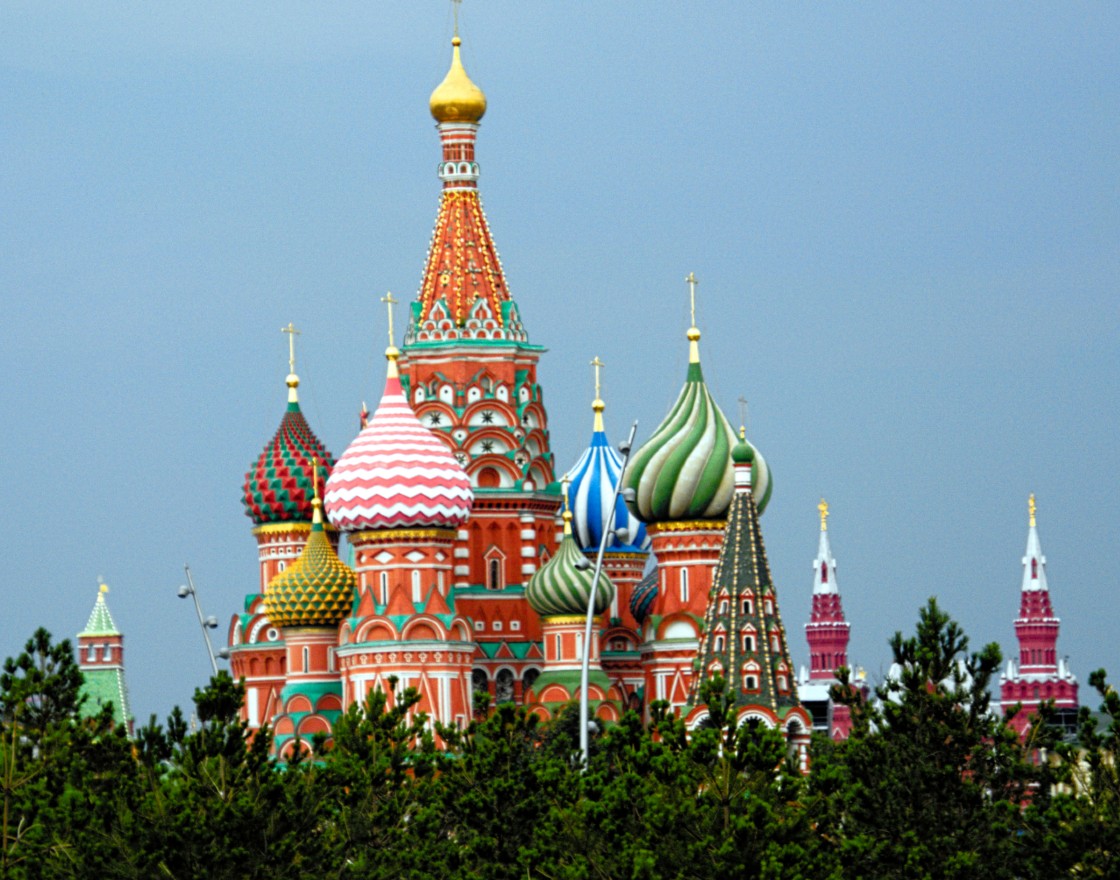

Moscow, Russia (Deep Goswami, CC BY-NC-ND 2.0)

The optimism of the authorities, which are assuming that the rate of GDP growth will significantly accelerate — to more than 3 per cent per year starting from 2021 — is not justified in any way. The launch of the highly publicized national economic development programs (“national projects”) financed from the state budget cannot provide the expected growth impulse without significant structural reforms covering the foundations of the country’s social and economic life.

The last decade in Russia was a time of economic stagnation, with the average annual rate of GDP growth only reaching 0.8 per cent. There is increasing cause for concern, because the negative trends are now deepening. In the last five years, in conditions of continued anti-Russian sanctions associated with the annexation of Ukrainian Crimea, the average annual rate of GDP growth has dropped to just 0.4 per cent.

Both Russian and international think tanks agree that the Russian economy has found itself in a deep crisis. According to the initial estimates, the rate of GDP growth in 2019 amounted to 1.3 per cent. The predictions for 2020 are not overly optimistic either.

Meanwhile, the Russian authorities do not share these far-reaching negative opinions. They indicate that while economic growth is indeed modest and lower than the expectations, the economy is expanding. According to the authorities, this expansion provides macroeconomic stability and enables Russia to become independent of external shocks, including, in particular, the sanctions.

In this context the authorities have been boasting about Russia’s “safety cushion” in the form increased foreign exchange reserves, financed from budget surpluses, as well as the low level of inflation (3.0 per cent in 2019), which is below the inflation target of 4.0 per cent. This cushion is supposed to protect Russia in the event the sanctions are further tightened.

At the end of 2019, Russia’s foreign exchange reserves reached USD554.4bn, which is the highest level since early August 2008 (on 8 August 2008 Russia’s foreign reserves reached USD598.1bn). However, according to analysts, if the sanctions are tightened, even such a significant level of foreign reserves will only secure the smooth functioning of the Russian economy for a period of no more than two years.

After years of budget deficits in the period 2012-2017, in 2019 for the second year in a row Russia recorded a budget surplus reaching 1.8 per cent of GDP (in 2018 the surplus reached 2.6 per cent).

However, analysts are pointing out that the country’s restrictive budgetary policy is a factor weakening economic growth. The increase in the VAT rate from 18 to 20 per cent means an additional weakening of consumer demand, especially in a situation where the real incomes of the population have declined by more than 10 per cent.

Meanwhile, by using the budget surplus to purchase foreign currencies — in order to strengthen the country’s foreign exchange reserves — the Russian authorities are depriving the market of significant financial resources which could otherwise be invested in the real economy. It is no coincidence that the budgets adopted by the Russian parliament in recent years are not seen in line with the government’s preferred narrative, that is, as a tool for building strong foundations of macroeconomic stability, but rather as a factor that is “stabilizing the stagnation” and, as such, also consolidating “Russia’s stable weakness”.

Such opinions are widely shared in Russia’s business circles. In December 2019, the participants of a discussion held at a financial forum organized by the Vedomosti newspaper were asked to assess the economic situation in the country. Some 35.6 per cent of the respondents indicated that the country’s economy was in stagnation, 33.3 per cent pointed out that Russia was experiencing the beginning of a crisis, and 24.4 per cent described the condition of the economy as uncertain.

Herman Gref, a former minister and the current president of Russia’s largest bank Sberbank, has been particularly critical of the economic situation in Russia. In one of his public appearances at a financial forum in September 2019, he stated that “there is no business model to spur the country’s economic growth. We don’t have a consensus on what needs to be done. And if there is no consensus on what needs to be done, then the question of how things should be done is not on the agenda at all”.

At the same financial forum, Mr. Gref and Russia’s then-Deputy Finance Minister Anton Siluanov engaged in an interesting exchange of opinions. Mr. Siluanov disagreed with Mr. Gref’s assessment and indicated that the government had clear goals and objectives. “There are goals, there are resources, and there are also people who will pursue these goals. We didn’t have all that at earlier times,” said Mr. Siluanov. In response, Mr. Gref stated bluntly: “The car has wheels, it has a steering wheel, everything seems to be in place, but it is not going anywhere”.

Recent years, and especially 2019, have shown that the Russian government’s economic policy is ineffective. People’s incomes are falling, and the subsequent changes in the methodology used to calculate them are leading to a stagnation of the indicators in this area. The modest rate of economic growth is far below the expectations, while investment growth is practically non-existent.

It is therefore not surprising that the above mentioned factors, combined with the increase in the retirement age (between 2019 and 2028 the retirement age will rise from 55 to 60 years for women and from 60 to 65 years for men), as well as the increase in the VAT rate, have resulted in a significant decline in people’s confidence in the authorities and their trust in the effectiveness of the pursued economic policy. This applies both to the general public, who have been forced to reduce their consumption, as well as the business circles, which have reduced their investment activity.

Will the attempt to escape the current situation through a change of government prove effective? The opinions are divided, although negative assessments far outweigh the positive ones.

Already at the first meeting of the new cabinet, the Russian Prime Minister Mikhail Mishustin informed that the main directions of his activity would involve changes in the social sphere, leading to an increase in the real incomes, wealth and living standards of the population, as well as the implementation of the national projects.

Such announcements are hardly encouraging. The social sphere is the favorite area of activity for the authorities when their popularity is declining, and when they have no significant achievements in other fields. In the prosperous period of 2001-2008, all critical opinions could be effectively placated by “throwing the RUB at any signs of social discontent”. Increases in retirement pensions, disability pensions, educational scholarships, salaries in the public sector, and many other benefits financed from the public budget, are the main tools used for the implementation of these “ambitious” objectives.

Now, however, the situation has changed significantly. The media coverage indicates that the Russian public is tired of promises. The people no longer want one-off interventions. Instead, they want systemic changes that will ensure stable and faster economic growth providing a real improvement in the residents’ standard of living and level of wealth.

The currently presented ideas are just a repetition of the previously pursued policies, which — as has been demonstrated in recent years — do not provide any reason to expect a reversal of the negative trends in the rate of economic growth.

In its January forecast, Russia’s Ministry of Economic Development predicted that GDP growth rate will accelerate to 1.9 per cent in 2020. The Ministry has also left unchanged the previous high forecasts for the years 2021-2024, which predict GDP growth rates of 3.1 per cent in 2021, 3.2 per cent in 2022, and 3.3 per cent in the years 2023-2024. The presented projections have been met with widespread criticism, which has been especially targeted at the “growth spurt” forecasted for the years 2021-2024.

The growth forecasts of the Russian government have been criticized by Alexei Kudrin, the chairman of the Accounts Chamber of the Russian Federation and Russia’s former long-time finance minister. Mr. Kudrin believes that there are no factors in the economy that would justify the expectation of 1.7 per cent GDP growth in 2020 (in line with the September forecast of the Ministry of Economic Development), not to even mention growth of 1.9 per cent, or growth exceeding 2 per cent, as the Ministry now projects.

The lack of persistent, clearly upward growth trends in the industry is a worrying signal. In 2019, growth in this area varied in the individual months from 0.3 to 4.6 per cent. A low rate of growth is also recorded in the case of investment activities. After three quarters of 2019 investments only increased by 0.7 per cent.

The postponed, negative production effects associated with the low rate of investment will become visible in 2020 and in the following years. A significant decline in the rate of growth in the construction sector, from 6.3 per cent in 2018 to 0.6 per cent in 2019, is also noteworthy.

The external conditions for economic growth are also deeply unfavorable for Russia. It is estimated that the rate of GDP growth in Russia could decrease by up to 0.2 percentage points due to the coronavirus epidemic.

A cumulative negative effect of the falling prices and export volumes of crude oil and, likely, also natural gas, is to be expected. Already in 2019, the value of net exports dropped below 10 per cent and more of GDP for the first time in 10 years (reaching 7.7 per cent of GDP) as a result of a decline in exports by 5.5 per cent and a simultaneous increase in imports by 2.2 per cent. It seems very likely that this trend will continue to deepen.

The Ministry of Economic Development still hopes that the rate of economic growth could increase as a result of significant acceleration in retail sales (due to an increase in consumer demand) from the previously assumed level of 0.6 per cent to 1.3 per cent. Such an increase should occur following the implementation of the social spending program announced by President Putin.

However, after comparing the anticipated expenditures allocated to that program — reaching the RUB 300-400bn in 2020, and the RUB700bn in 2021 — with the overall volume of retail sales, which exceed the RUB32 trillion per year, it becomes clear that the expectations of significant pro-growth effects in this area are not substantiated.

In their report the analysts from the Central Bank of Russia emphasize that households will allocate most of the funds obtained from the new social spending program on consumption, which — based on previous experience — will likely boost imports. This, in turn, will diminish net exports, limiting the pro-growth effects on this account.

The issue that arouses the most controversy are the official assumptions and projections for the years 2021-2024, which predict an acceleration of GDP growth to 3.1-3.3 per cent. The Ministry of Economic Development expects that the rate of economic growth will more than double due to the implementation of 13 national projects, covering three areas: human capital (4 programs), living conditions (3 programs) and economic growth (6 programs). The implementation period of these projects is scheduled from October 2018 to December 2024. The government plans to spend the RUB25.7 trillion (USD403.5bn) on the financing of the programs over six years.

According to both international as well as Russian analysts — also including those closely linked to government circles — the optimism of the authorities is entirely unsubstantiated, and the forecasts of a significant acceleration in the rate of economic growth — exceeding 3 per cent annually — are detached from economic reality.

According to the Centre of Development Institute of the Higher School of Economics in Moscow, the consensus forecast (27 institutions, including 16 from Russia) points to a GDP growth rate of 1.8 per cent in 2021, as well as 1.9 per cent in the years 2022-2024. Similar forecasts of future economic growth are presented by FocusEconomics (46 institutions, including 6 from Russia) and S&P.

The possible effects of the national projects on the acceleration of economic growth are also expected to be rather limited. According to the experts participating in the Gaidar Forum held in January, these programs could boost GDP growth in Russia by a maximum of 0.5 percentage points.

The analysts at Oxford Economics expect that the programs could raise annual GDP growth by 0.1-0.2 percentage points in the next five years. They emphasize that even if all the allocated funds are actually spent — and the experience of 2019 shows how difficult that could be (in more than half of the programs less than 20 per cent of the financing was disbursed) — and if maximum effectiveness is ensured in all the implemented projects, the pro-growth effects will not exceed 0.5 percentage points anyway. The estimates of these effects presented by the World Bank are equally modest: 0.1 percentage points in 2020 and 0.2-0.3 percentage points in 2021.

The efficient spending of the budgetary resources is the weakest part of the national programs. Previous experience has shown that the state is not an overly demanding investor. As a result, the rate of disbursement of funds is usually significantly faster than the progress in the implementation of the funded projects.

The authorities attempted to solve this problem in 2019, by linking the disbursement of funds with the progress in the implementation of the projects, that is, by moving away from advance payments. As a result of this approach, planned budget expenditures amounting to more than RUB1 trillion were not realized.

While in the past, in spite of the existing structural weaknesses of the Russian economy, the main harbinger and the direct cause of crises was usually a drop in oil prices, the causes of the current economic collapse are entirely internal.

For this reason, possible increases in the prices of raw materials, and, in particular, the prices of oil, will not be enough to come out of the current slump, which has been described by analysts as a “crisis made in Russia”.

Mr. Gref has been emphasizing for many years, and with particular intensity in the recent period, that Russia’s main problem and the biggest obstacle to faster economic growth is the inefficiency of the Russian system of public administration, whose roots date back to the days of the Soviet Union.

Both Mr. Gref and the participants of the previously mentioned Gaidar Forum believe that one particularly pressing issue is the necessary reform of the Russian judicial system. This is consistent with the widespread opinion among businessmen and experts, including foreigners, that the main barrier to the development of the Russian economy is the weakness of its institutions and the resulting lack of respect and lack of legal guarantees for the protection of property rights, which is also correlated with high levels of corruption.

Is Russia ready to go in this direction? The authorities certainly aren’t, but in the event of a prolonged stagnation, they may lose control over the further development of the situation.

An apt characterization and assessment of the country’s economic situation was provided by the title of a panel discussion devoted to Russia at the World Economic Forum held in January in Davos: “Russia is expanding its geopolitical reach and influence, yet its economy is stagnating, with GDP growth averaging 0.4 per cent annually in the past four years. What are the strategic priorities for Russia in 2020?”. The participants of the seminar did not receive a clear answer to this question.