Tydzień w gospodarce

Category: Raporty

(graph. by D.Gąszczyk/CC BY-SA Salim Virji)

Few still remember the record contract, which lies at the foundation of the present problems in the construction industry, namely the S8 express road contract of the General Directorate for National Roads and Highways for the construction of the road section between the Konotopa and the Powązkowska interchanges in Warsaw in December 2007. The construction giants – Budimex, Mostostal Warszawa, Strabag and Warbud – formed a consortium and divided the contract among themselves, establishing the price of PLN 2.1 billion for the tender.

This move made the S8 the most expensive road constructed in Europe at the time. The express road cost PLN 218 million per kilometre, while the EU average was PLN 40 million. Even if the high price of the S8 express road can be partially justified by the construction taking place in a dense urban area, the need to trench the express road on a several hundred metre stretch and high standard of finish, the value of the contract has remained controversial to this day. Public prosecutor’s office even investigated price fixing allegations but the proceedings were discontinued.

It were the circumstances of that tender coupled with the starting preparations for the organisation of Euro 2012 that laid the foundations for the opening of the market to new contractors, and thus to increasing competition.

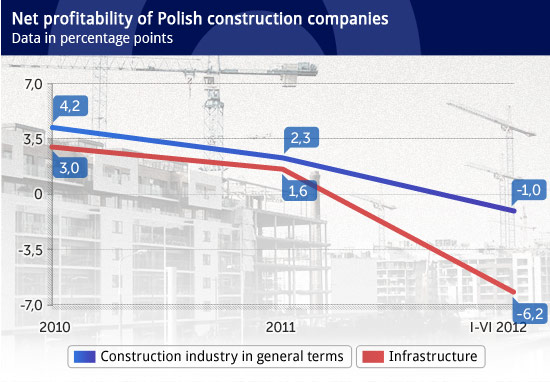

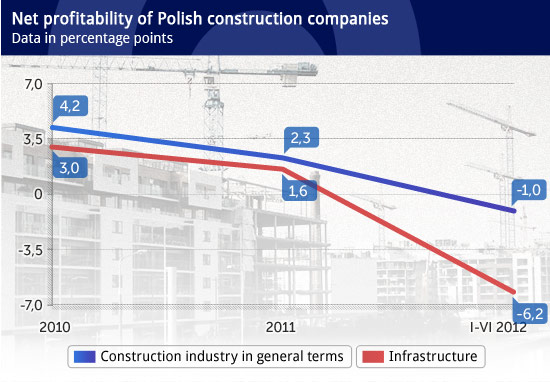

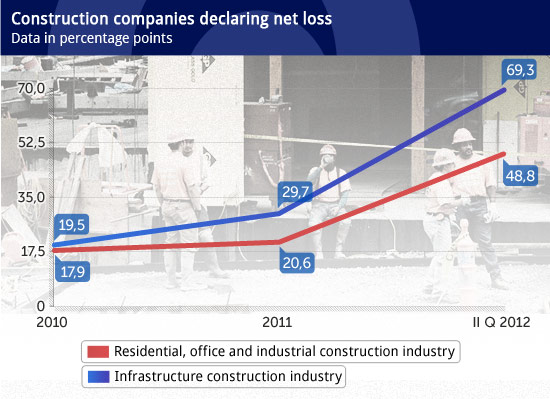

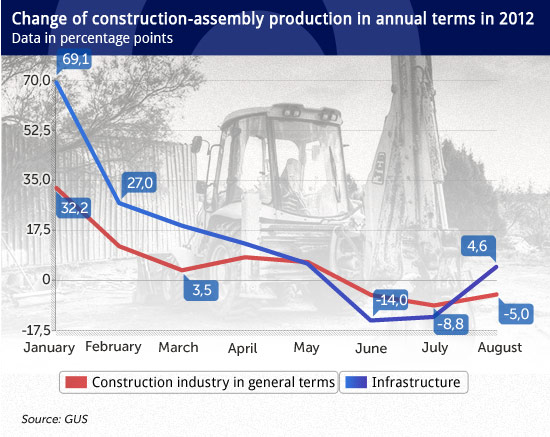

The direct reason for the search for new contractors was that in 2008-2012 the GDDKiA was supposed to build over 2 thousand km of roads contracted in 140 tenders of joint value of PLN 74 billion. At the same time, it decided to establish the price as the basic parameter for the choice of contractors. In order to beat the competition and win a contract, companies bid aggressively. Furthermore, the accumulation of road construction tasks drove material prices up. As a result, a few years later it turns out that the majority of contracts have been carried out with gigantic losses.

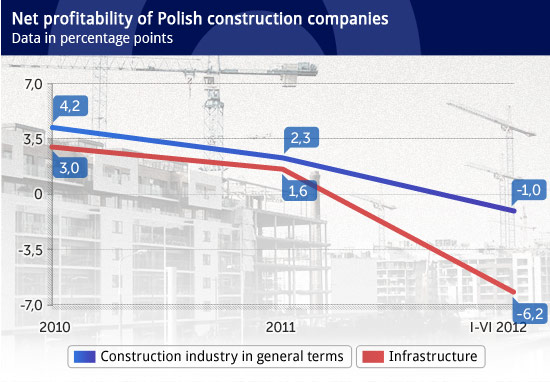

Sentiment in the construction industry is bleak. According to Euler Hermes, since the beginning of the year over 200 construction companies have gone bankrupt. The Polish Association of Construction Industry Employers has announced that till end-2013, from 100 to 150 thousand people will lose their jobs in the construction industry, a sector which generates 7 per cent of GDP.

The sentiment has been temporarily improved by the expose of Polish Prime Minister, Donald Tusk, announcing the allocation of PLN 43 billion for the continuation of the road construction programme and PLN 30 billion to railway investments in 2012-2015. This constitutes an opportunity for construction companies, since construction financed via the BGK bank and the Inwestycje Polskie agency will help them survive till the new EU budget of 2014-2020, and Poland has a chance to receive more than EUR 70 billion from that budget. However, sceptical opinions were quick to appear, as well.

– Simultaneously with launching new investments, there is an urgent need for systemic changes which will improve the relationships between investors and contractors. Pending those changes we will continue to witness abandonments of construction sites and bankruptcies. Ever more punitive legal regulations and the expanding catalogue of penalties imposed upon contractors are the reasons for the crisis of the Polish construction industry. These factors adversely affected road and railway investments, and bode badly for the energy industry – claims Wojciech Malusi, the chairman of the All-Polish Economic Chamber of Road Building.

>>The suggestion of creating an off-budget vehicle at the BGK

Representatives of several dozen biggest companies from the design and contracting sector have been preparing a black list of barriers hindering the development of infrastructure ( included at the end of this text). Ongoing works are coordinated by the Polish Association of Construction Industry Employers, SIDiR (Association of Consulting Engineers) and the Association of Employers of the Engineering Services Industry. At the end of 2012 and beginning of 2013 the document is going to be presented to policy-makers at the country and EU level. Let us have a look at the suggested solutions. Some of these proposals constitute a totally new approach.

The basic blame has been formulated time and time again for months: contracts are settled on the basis of price alone, a practice which coupled with tight competition leads to bids being placed below real costs. The government agency replies that contractors have been sawing off the branch they sit on, offering dumping prices in tenders. The bids placed by the Chinese COVEC company for the construction of two sections of the A2 Lodz-Warsaw motorway were almost 40 per cent cheaper than GDDKiA cost estimates, while the PKP Polskie Linie Kolejowe railway company received an investment supervision bid amounting to 16 per cent of investor’s cost estimate. The first deal ended in a scandal, the second was cancelled.

– The management of construction companies acted in a short-sighted manner. Now they are trying to offload blame for their situation onto investors. Participating in tenders they totally failed to assess the risk of a price rise. If someone with market experience is surprised that asphalt prices increased in the period of an unprecedented accumulation of road investments taking place in Poland, then I find it really astonishing – says Lech Witecki, the director of the GDDKiA.

The government road construction agency maintains that the parameter of price is decisive for most infrastructural tenders in Europe. According to the GDDKiA, the price constitutes the final and most objective criterion in the case of construction works, if coupled with precisely established requirements concerning contractor’s experience and staff qualification as well as its financial and technical capabilities.

A more flexible approach to the price criterion is taken by PKP Polskie Linie Kolejowe. Maciej Dutkiewicz of the PKP PLK declares that the scheduled infrastructural tenders will account for other factors apart from the price, such as: project completion date, guarantee duration and the scale of inconvenience for the passengers during the track works. Railway companies will have to introduce changes because unprofitable contracts concluded by contractors mean that investors will have problems spending their funds until 2015, which is the deadline for settling EU subsidies from the 2007-2013 EU perspective.

The construction industry calls for the ordering parties to verify if the price is real and whether the contractor is able to carry out the contract for the price offered. This is another item on the black list. Construction industry representatives suggest multiple-stage tenders (with a pre-qualification stage) and excluding contractors placing grossly underpriced bids. It seems quite likely that these demands will be accommodated by the government agencies.

Investors in most major tenders from the road, railway and energy industries already use pre-qualifications. The only problem is the strictness of criteria to eliminate unreliable contractors, e.g. in a billion-worth tender for the reconstruction of the Grot-Rowecki bridge in Warsaw the GDDKiA left out only 2 out of 22 bidders: Alpine Bau and NDI. Both had been excluded earlier from road construction tenders under the Public Procurement Law. The Public Procurement Office is working on the definition of grossly undervalued price. As the spokesperson for this office, Anita Wichniak-Olczak, says it is currently at the stage of public and interministerial consultations.

Thirdly, contractors wish to include indexation made on the basis of GUS indices into contracts. This mechanism would offset losses produced by unexpected increases in material prices, e.g. asphalt (during the construction boom prior to Euro 2012 its price went up by 42 per cent). There are first signs of changing attitudes in this respect. The GDDKiA started putting market review clauses in contracts but with a restriction: extra payments cannot exceed 1 per cent of the contract value. Construction companies suggest lifting this restriction, but the government side disagrees.

Fourthly, contractors claim that investors offload most of risk onto them, e.g. in tenders for the completion of the A4 motorway near Rzeszów, the GDDKiA asked the contractor to assume responsibility for possible project changes, supplementing documentation, land repossession, etc. refusing him the right to make claims for the change of contract schedule or value on those grounds. There was a several-week long dispute before the National Chamber of Appeals between the agency and contractors, till the Chamber ordered the investor to introduce changes into the tender specification sheet.

The main focus for the lobbying efforts, pursued by the construction industry during the preparation of the black list, is on a more favourable settlement of claims for the increase of the value of contracts on account of additional works. The total amount of claims has exceeded PLN 5.2 billion, of which the GDDKiA has positively examined appeals of joint value of PLN 75 million.

– The director of the GDDKiA does not act in this case as a partner but as a watchdog for public funds. Such policy resulted in companies declaring bankruptcy and abandoning construction sites. The public finance system operates like a system of communicating tubes. Money saved on claims filed by contractors will have to be spent on social assistance due to job losses – asserts Anna Maria Pukszto, a partner in the Salans law firm, vice-president of the Polish Association of Restructuring Professionals.

The GDDKiA, acting as an investor, is not persuaded by this argument. According to Lech Witecki, the majority of contractors’ claims are ill-founded and if he were to start accepting them this would trigger an avalanche of claims from other contractors. In his opinion, the escalation of claims for damages is due to managers of construction companies trying to divert attention from evident project mismanagement errors.

The list of obstacles includes a new item – guarantee calls, whose legality is put in doubt by construction companies. What is it all about? The GDDKiA demands the contractor to produce guarantee insurance (or security deposit) for each construction contract, which is supposed to warrant due performance. What is at stake is that all defects and mistakes made in the construction process could be removed at the expense of the contractor.

Lawyers representing companies believe that GDDKiA abuses this instrument treating guarantees as easy money to pay off subcontractors. For prime contractors this is dangerous, since following the seizure of guarantees, insurance companies or banks file recourse claims against them. The issue is under legal dispute, with cases of courts withholding the payment of guarantees to the GDDKiA – e.g. in the breached contract with PBG SIAC concerning the A4 Tarnów-Dębica motorway.

Another new type of investment barrier brought to public attention by the black list is the request for investors to stop tolerating the mechanism of abuse of the reference system. According to Cezary Saganowski, CEO of the Egis Poland design company, references related to design services for the sake of PKP PLK may come from exotic companies, which do not necessarily have to participate in a project in Poland (the investor does not verify it). As we have established, such fictitious references are paid – a standard price is 5 per cent of the value of a contract in question.

Contractors vehemently object to the amendment of the Public Procurement Law, stipulating that companies with which the ordering party cancelled a contract and those which paid a contractual penalty amounting to 5 per cent of the value of their contract will be excluded from tenders in general. The amendment was passed by the Sejm in September notwithstanding doubts about its compliance with the constitution voiced by the Sejm Legal Analysis Office. The industry is lobbying for blocking this regulation in the Senate. The provision has been included in the amendment at the initiative of the Ministry of Treasury. According to Rafał Bałdys, the chairman of the Association of Employers of the Engineering Services Industry, the intended purpose was to eliminate the Chinese enterprise COVEC from energy industry contracts. The vice-chairman of the Polish Association of Construction Industry Employers Dawid Piekarz comments this issue emphatically:

– One does not set a barn on fire to trap one mouse.

The government side responds that it does not intend to tolerate the unreliability of contractors and all contractors who do sloppy work must take into account the possibility that they might be kept away from future contracts. What raises concern, however, is the fact that there is an increasing number of petitions being filed with courts requesting the ruling of such exclusions from tenders as groundless. There are already first court rulings which put the government side in an uncomfortable position. The Court of Appeals in Szczecin ruled in such a case in favour of the Rokpol company, which is now suing the Public Procurement Office for PLN 10 million in damages.

Legal counsel Hubert Tański from CMS Cameron McKenna doubts whether the black list of investment barriers will change in any significant way the government side approach to construction projects. – There is a general belief in Poland that every stage of the investment process must be described in detail. This stems from fear of corruption. In the West there is more trust towards government officers, and that is why procedures are more flexible.

Thanks to that investment projects are carried out according to the principle of risk sharing, and the government side allows the renegotiation of contracts, if problems have been encountered during construction. In Poland, a favourable attitude adopted by the investor towards the contractor would be grounds for suspecting corruption – he maintains.

1. settling contracts solely on the basis of price, which coupled with fierce competition leads to bidding much below real costs,

2. aversion on part of investors towards multi-stage tenders which allow to exclude ‘exotic’ contractors lacking the necessary experience at the pre-qualification stage,

3. no definition of ‘grossly undervalued price’ in the Public Procurement Law; even if the ordering party excludes a bid on such grounds, the contractor has a chance to win a reinstatement to tender before the National Chamber of Appeals,

4. contracts lacking market-review clauses which on the basis of price indices released by GUS would enable contractors to offset a possible rise in material prices,

5. asymmetric division of contractual risk between the contractor and the ordering party; most of the risk – e.g. risk related to changes in the project – is shouldered by contractors,

6. refusal on part of investors to accept contractors’ claims for increasing the value of contracts on account of additional works,

7. investors’ illegal use of proper performance guarantees granted by insurance companies and banks, e.g. for paying off subcontractors,

8. lenience shown by the tender ordering party towards the practice of paid reference sharing by companies which do not participate in the tender,

9. suggested amendments in the Public Procurement Law allowing to exclude companies with which the ordering party cancelled a contract and which paid a contractual penalty amounting to 5 per cent of the value of the contract from participating in tenders,

10. investors’ reluctance to renegotiate contracts in the case of unexpected events taking place during construction, if not anticipated in the project.

source: Association of Employers of the Engineering Services Industry, Polish Association of Construction Industry Employers, Association of Consulting Engineers.

The author is a journalist working for the Dziennik Gazeta Prawna newspaper.

OF