Tydzień w gospodarce

Category: Raporty

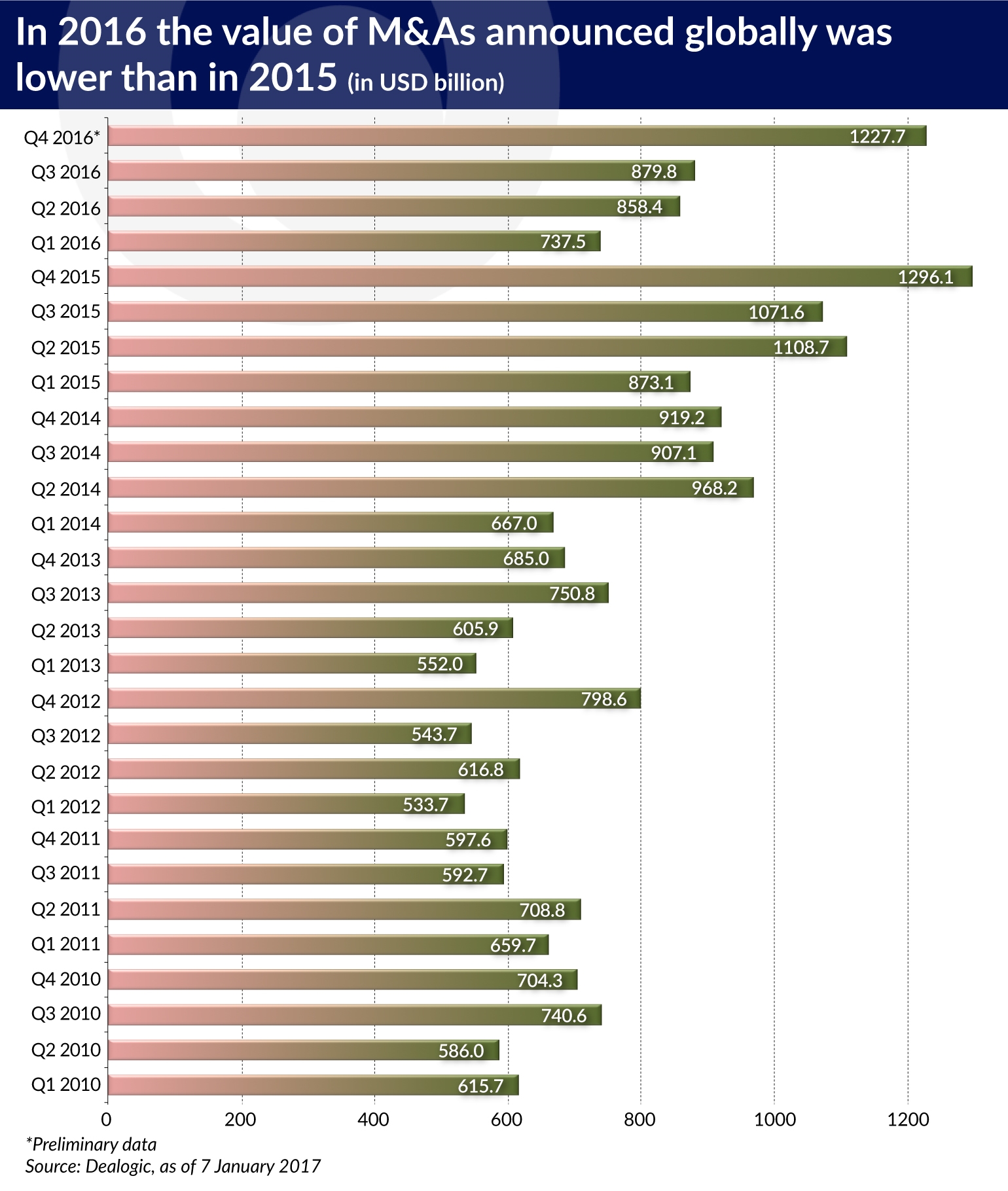

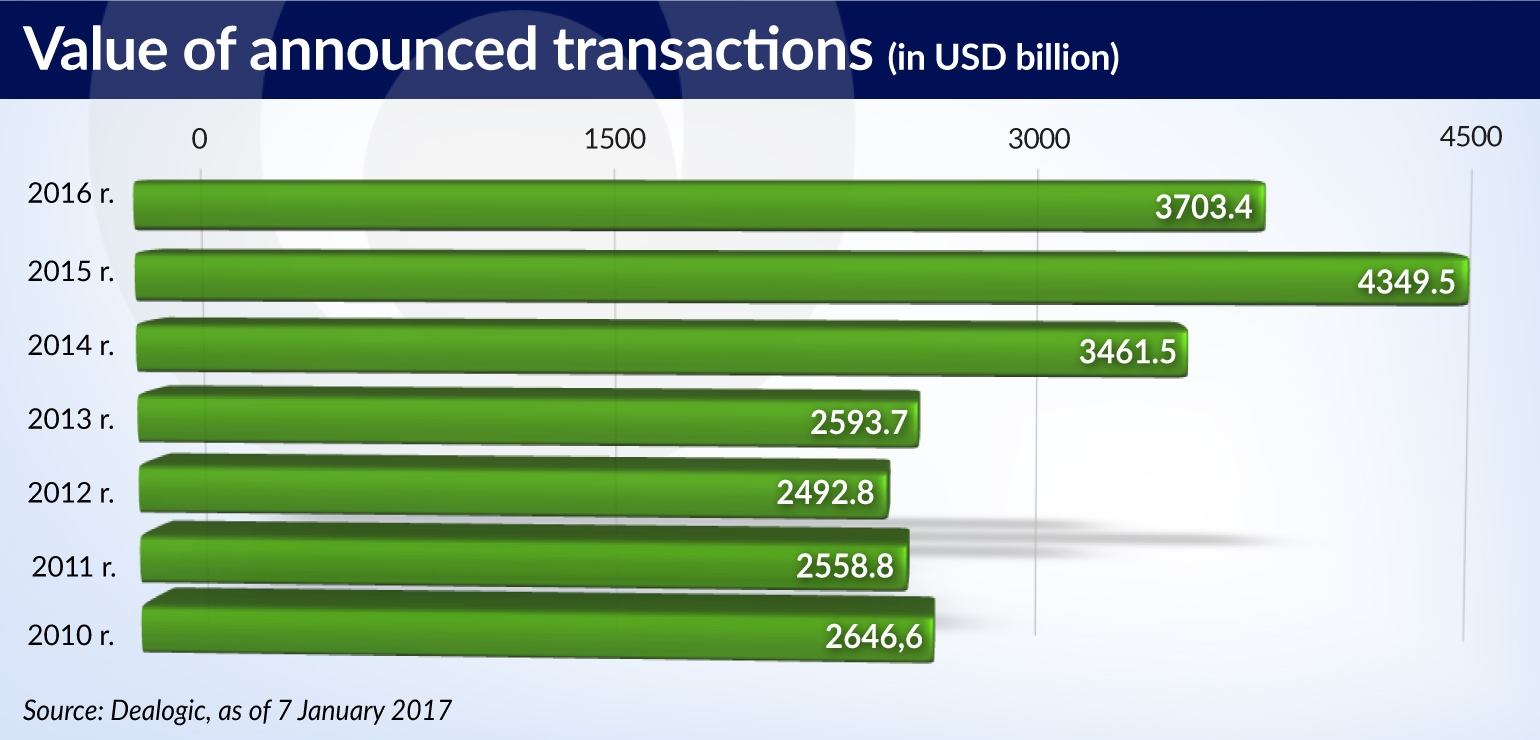

The total value of announced M&A transactions was nearly 15 per cent lower than the year before, but in the last quarter the decline only amounted to 5.3 per cent compared with the same period of 2015.

According to Dealogic, a company specializing in the collection of data on financial markets, last year the total value of announced M&A transactions slightly exceeded USD3.7 trillion compared to USD4.35 trillion a year earlier. It was more than USD200bn higher than in 2014.

Declines in the values of the announced transactions were recorded in all three major M&A markets – the United States, Asia (excluding Japan) and Europe. The value of the Asian market dropped the most ‒ by about 26 per cent to USD720bn. The European market decreased by 12 per cent to USD870bn, and the U.S. market decreased by about 17 per cent to USD1.66 trillion.

According to data from the Thomson Reuters agency, the number of announced transactions increased slightly compared to 2015 and exceeded 45,400 during the last year. According to Dealogic, 14 transactions had a value of at least USD20bn and in total such large transactions accounted for 7.7 per cent of the entire global M&A market.

The good result is due to the last quarter, when the value of announced transactions reached USD1.213 trillion. In terms of value of announced transactions, this was the second best quarter in this decade. Five of the ten largest transactions of 2016 (in terms of value) were announced in the fourth quarter.

A special month was October, when the M&A market almost exploded right before the presidential election in the United States. In the last ten days of that month, five giant transactions were announced: the acquisition of the media company Time Warner by the telecommunications company AT&T, the purchase of the tobacco company Reynolds America by British American Tobacco, the acquisition of semiconductor manufacturer NXP Semiconductor by Qualcomm, the acquisition of the manufacturer of equipment for oil and gas extraction Baker Hughes by General Electric, and the purchase of the Level3 telecommunications company by CenturyLink. These transactions had a value of (without taking into account the debt of the acquired company) USD85.7bn, USD46.9bn, USD39.2bn, USD32.2bn and USD24.3bn, respectively. In total, transactions worth USD504bn were announced in October – which is the seventh highest result in history ‒ out of which the United States accounted for USD329bn (the second highest result in history).

Some of the commentators believe that the wave of transactions, including huge transactions in the United States, coming just before the American presidential election, was based on the business community’s confidence that Hillary Clinton would be the next president. After Donald Trump’s victory the M&A market with the participation of American companies did not freeze up and new huge transactions were announced – i.e. the acquisition of the British pay TV station Sky by Twenty-First Century Fox for USD14.6bn and the purchase of Energy Transfer Partners, a company from the energy sector, by Sunoco Logistics Partners for USD21.3bn – it was considered that the business world was not afraid of the Republican president. This could signal the continued active participation of U.S. companies in consolidation in 2017.

The enthusiasm for mergers and acquisitions – especially those financed with non-investment grade debt ‒ could be cooled by a rapid increase of interest rates in the United States. In Europe, the M&A market will be impacted by the continued uncertainty associated with elections in Germany and France.

In addition to uncertainty about the elections in the United States, for the first three quarters of 2016 the M&A market was negatively impacted, first, by the worries about the results of the British referendum on the UK membership in the European Union, and later, for a while, by its results. It turned out, however, that foreign investors saw the weakening of the pound, resulting from the Brexit decision, as a great opportunity to buy British companies.

In the whole of 2016, the value of the announced M&A transactions concerning British companies reached USD177.5bn and was significantly lower than the year before, when it reached USD394.8bn. We should keep in mind, however, that in 2015 two of the three largest acquisitions in the world concerned companies based in the United Kingdom. According to analysts, last year’s value of M&A transactions in the United Kingdom was higher than the average of previous years, amounting to USD139.3bn per year. In 2016, foreign investors announced M&A transactions in the United Kingdom worth nearly USD144bn, which was well above the five-year average of less than USD86bn.

Already after the June 2016 referendum, the Japanese conglomerate Softbank announced the acquisition of ARM Holdings, a company designing semiconductors, for USD31.6bn, and in late autumn, when the pound was close to its annual low, Twenty-First Century Fox announced its intention to buy Sky television. While the first transaction seemed to confirm that in the assessment of the Japanese company Brexit did not matter for long-term business prospects, the latter was a typical “bottom fishing” acquisition, i.e. taking the opportunity created by the considerable reduction in share prices.

Brexit limited the number of mergers and acquisitions carried out in the UK by domestic companies. The value of transactions announced by them amounted to less than USD34bn and was almost USD20bn lower than the average, while their number – 1,355 – was the lowest in nearly two decades according to data from Thomson Reuters.

Experts expect this year in the British M&A market to be worse than 2016. A change in the structure of the market is expected. Because of the uncertainty as to how Brexit will look in practice, there will be fewer transactions relating to financial institutions and the sector of raw materials, but there should be an increase in the number of transactions concerning British technology companies and the health care sector.

The last quarter of 2016 brought a significant increase in the value of M&A transactions in Poland as well. The total value of the largest transactions, i.e. in excess of EUR100m, announced in the fourth quarter exceeded EUR6.3bn. It was therefore comparable to the total value of all transactions in 2015, which was estimated at EUR6.3bn in the „Emerging Europe M&A Report 2015/16” prepared by Euromoney Institutional Investor Company in cooperation with the law firm CMS. According to initial estimates of the company Mergermarket (data for December 2016), in the whole of 2016 the Polish M&A market was worth EUR10.95bn.

The largest transaction of 2016 and one of the largest transactions in Polish history was announced in October ‒ the purchase of the Allegro auction service for USD3.25bn by private equity funds managed by Cinven, Permira and Mid Europe.

The list of the largest transactions of the fourth quarter of 2016 also includes the purchase of a 32.8 per cent stake in the bank Pekao SA (from Unicredit) by PZU (the largest Polish insurer) and the Polish Development Fund (state-owned agency). The value of this transaction was EUR2.4bn. Other transactions include: the planned acquisition of the cable operator Multimedia by UPC Polska (worth EUR698m), the intention of the energy group Enea to purchase Engie Energia Polska (which owns the Połaniec Power Plant) for nearly EUR256m, the acquisition of Raiffeisen Leasing Polska by PKO Leasing (owned by the largest Polish bank PKO BP) worth EUR198m, and ITT’s purchase of Axtone, a Polish-German manufacturer of components for energy absorption for the railway sector, worth EUR114m.

In addition to Pekao SA and Raiffeisen Leasing Polska, the acquisition of Bank BPH (GE Money Bank) by the PZU-controlled Allior Bank was also announced and finalized (for almost USD1.5bn) last year as part of the “repolonization” of the banking sector. In the financial sector, the debt collection agencies GetBack (acquired by private equity funds, Abris Capital Partners for EUR192m) and Kredyt Inkaso (acquired for almost EUR47m by the Dutch fund Waterland) have also changed their owners.

The Polish market was traditionally dominated by acquisitions with a lower value ‒ up to EUR24m.

In 2017, at least one large acquisition can be expected in the energy sector – a consortium including PGE, Enea, Energa and PGNiG Termika is interested in the Polish assets of the French group EdF (their value is estimated at approx. EUR1bn), as well as the purchase of the construction company Polimex-Mostostal by a consortium consisting of Energa, Enea, PGE and PGNiG. The list of potential transactions also includes the acquisition of retail chains, including Żabka (the value of this transaction could reach approx. EUR1.2bn).

The government plan of the New Silk Road resulted in last year’s increased activity of Chinese companies and financial investors in M&A. On the one hand, they actively sought out their targets and were ready to pay handsomely, and on the other hand, in some cases the consultants hired by companies seeking new owners applied to the Chinese companies on their own, and this was often their first choice.

The value of foreign acquisitions announced by Chinese companies reached almost USD250bn. This was a record amount, almost two-and-a-half times higher than a year before. In Europe, Chinese companies announced transactions worth approx. EUR90bn, whereas in 2015 they amounted to EUR26bn, and in 2014 to less than EUR10bn. Companies which had not invested outside China before were responsible for nearly one-third of the value of overseas transactions announced last year by Chinese companies.

Chinese companies were mostly buying companies from the same industry – one example of such a transaction is China National Chemical’s intention to purchase the chemical company Syngenta for USD44.3bn, which was announced in February – but also entered into entirely new sectors through their acquisitions (Midea Group, a manufacturer of household appliances, purchased the German company Kuka, one of the world’s most renowned manufacturers of industrial robots, for USD4.2bn).

Many of the acquisitions announced by Chinese companies (including those controlled by the State) in 2016 concerned companies with advanced technologies, including European companies. In Finland, the China National Silicon Industry Group bought Okmetic, a manufacturer of silicon wafers used, among other things, for the manufacture of microprocessors and sensors. In Norway, a consortium of Chinese companies took over the assets of the web browser Opera. In Italy, Agic Capital acquired Gimatic, a manufacturer of grippers used by industrial robots. The online travel agency Ctrip.com International bought Skyscanner, a Scottish startup specializing in searches for the best deals on flights, for more than USD1.7bn.

Not all of the announced transactions were successfully completed. One of the reasons for failures were the growing concerns, especially among German politicians, concerning the acquisition of European technology by Chinese companies. This fear was sparked by the acquisition of Kuka, which the German government ultimately chose not to block. The Chinese intentions to purchase companies with advanced technologies were also blocked by the government of the United States. Due to national security concerns, the Committee on Foreign Investment in the United States (CFIUS) blocked the purchase of the American division of Aixtron SE, a German manufacturer of tooling for semiconductors. This resulted in a revision of an earlier positive decision of the German government and in effect led to the withdrawal of Fujian Grand Chip Investment Fund from the transaction worth USD680m.

The CFIUS also blocked Go Scale Capital’s acquisition of the American company Lumileds (owned by Philips), which is a manufacturer of components for LED lamps and automotive lighting. Lumileds was eventually bought for USD2bn (including debt) by private equity funds managed by Apollo Global Management. The price was approx. 40 per cent lower than that offered by the Chinese.

There are many indications that the Chinese foreign investments will slow down this year. According to signals coming from Beijing at the end of last year, the government wants to limit the Chinese companies’ purchases of enterprises from industries in which the acquiring entity does not operate. Restrictions on foreign acquisitions are also supposed to apply to heavily indebted Chinese companies. Chinese investment in the United States could also be negatively impacted by the policies of the new American administration.

According to data from Thomson Reuters, in 2016 more than a thousand M&As, worth a total of approx. USD800bn, were cancelled. This was partly due to changes in external conditions. Some transactions were blocked by regulators or governments. In some cases – particularly in the case of so-called hostile takeovers – the parties could not agree on the price.

The largest canceled transaction was the purchase of the Irish company Allergan by Pfizer, worth USD152bn. This merger of pharmaceutical companies was in fact blocked by the US government, which changed the tax regulations and introduced the principle that if a company from the United States moves its headquarters to another country following an acquisition ‒ as would happen in the case of Allergan and Pfizer ‒ it pays taxes in the country from which the majority of its capital is derived.

The European Commission blocked the purchase of the British mobile network O2, worth USD11bn, by CK Hutchison because it found that the decrease in the number of infrastructural mobile operators from 4 to 3, as a result of the transaction would be detrimental to consumers. The planned merger of Halliburton and Baker Hughes, worth USD35bn, failed because the regulatory authorities from the United States and from Europe gave a clear signal that they were against the merger of the second and third-largest oil field service companies in the world, fearing a loss of competitiveness in this market segment. In turn ‒ according to media claims ‒ due to the intervention of the Chinese government, a consortium of Chinese investors created by the insurance group Anbang made a last minute withdrawal from purchasing the Starwood hotel chain.

The changing market conditions (especially the drop in oil prices) prevented the finalization of an almost USD33bn merger of two American oil companies, Energy Transfer Equity and Williams Companies, worth . In turn, disagreements regarding the price, but also concerns about the possible legal problems, forced Mondelez to pull out from the takeover of Hershey, estimated at USD23bn.

In the opinion of the legal firm Allen & Overy, regulators and governments will continue to block transactions in the future, whether for reasons of competition or related to security. That is why all companies planning M&A activities should prepare packages of proposals, including divestments, which they could offer to the regulators in exchange for their permission to complete the transaction.