(©Shutterstock)

In order to curb the outflow of customers to companies outside the sector, Polish banks will have to go to great lengths to defend their position.

(infographics Darek Gąszczyk)

Why was the directive adopted and why did the European Union want to change the foundations of operation of the payments market? There were several reasons. The European Commission has long believed that the biggest potential of the common market lies in its scale. However, economies of scale will only be possible if the same rules for the provision of services apply throughout the common market and the market is not as fragmented as it is now. This is the most important objective of the new directive – to strengthen the functioning of the Single Euro Payments Area (SEPA).

The European Commission has also long claimed that fast growing internet commerce is one of the elements strongly cementing the common market. It comes up against high barriers – only 10 per cent of EU consumers make cross-border purchases online. According to the industry’s Ecommerce Europe association – in 2014 this market was worth EUR368.7bn, a 13.7 per cent increase compared with the previous year. The value of trade in Poland reached EUR6.5bn. Across Europe, just over 7 per cent of retail goods are sold by online stores.

In May, the European Commission launched a study of the entire sector. The final report will be published at the beginning of 2017 and then the EC will probably consider new steps to enhanced consistency and remove further cross-border barriers. An analysis conducted in 2011 showed that consumers were discouraged from online shopping due to concerns whether on-line payment systems used by Internet vendors were secure.

Principles of the intermediary’s access to the account

Because of new technologies, including the development of e-commerce, the market of payments – executed through an intermediary and not directly from a bank account – has seen dynamic growth. There are already dozens of institutions operating, with very diverse business models and offers. Meanwhile, the principles of the intermediaries’ access to a customer’s bank account have remained completely unregulated, even though the stakes are very high – the security of a customer’s money.

The new safety standard is so-called strong customer authentication. It involves the use of at least two elements from such categories only the user knows, i.e. the password and the PIN code, based on something the user possesses – a card or a device generating the authentication code, or the user’s innate or biometric characteristics. In September 2015, the Polish Financial Supervision Authority launched consultations concerning the draft of new recommendations requiring banks to establish minimum requirements for Internet payment security with the use of strong authentication.

In different countries, both banks and intermediary companies operate on the fringes of the law and even common sense. In Poland the PFSA has identified cases where banks demanded that potential customers seeking loans provide login data to their accounts in other banks, so they could check their history of operations.

The rules governing access for the intermediary – defined by the PSD2 directive as a Third-Party Payment service provider (TPP) – to the account, make up the most important provisions of the new directive. This is where the biggest revolution will occur, because access to the payment account kept by the bank is of crucial importance to the functioning of the TPP business. The PSD2 directive forbids banks from blocking or hindering access to the accounts of their clients and orders them to ensure that access is „non-discriminatory and proportionate.” Although the directive creates a legal framework, it does not say exactly how banks are to achieve the outlined objectives.

Banks across Europe have waged war against payment intermediaries, well aware that such access could loosen their grip on the payments market. In Germany a court battle was recently fought between the payment system Giropay, which belongs to the Postbank and the savings banks, and Sofort , a „rising star” in this industry. The German Federal Antitrust Office sided with Sofort, claiming that Giropay was restricting competition.

„Banks sometimes show a tendency to eliminate third parties from the market, because they think that in economic terms these entities are getting a `free ride’ and are depriving them of a part of the income from payment services,” Wojciech Springer and Mariusz Springer wrote in an article on the changes brought by PSD2.

What will be the result of the reduction in Interchange fees?

The European payment services market is being observed by American giants such as Amazon, Google and Apple. If there is no level playing field, they could operate according to their own rules. That makes it important that the rules are the same for everyone.

“Amazon, Apple, Google and others are concentrating new types of payments in their hands, thereby obtaining the effects of scale,” Massimo Arrighetti, the President of SIA – a company providing designs and solutions for payment systems – said at a September conference.

Ultimately, Europe is dominated by Visa and MasterCard duopoly. The PSD 2 directive is linked with the regulation on interchange fees, which lowers maximum rates for debit cards to 0.2 per cent and for credit cards to 0.3 per cent. This reduction is likely to lead to very controversial outcomes, both in Poland, as well as throughout the EU.

According to NBP’s August analysis of the effects of the reduction of interchange fees, it appears that it is not consumers who benefit – the goal of the changes – but mainly the large card merchants. Similar effects are also expected across the EU, where the reduction in interchange fees enters into force on December 9th.

“Supermarkets in Poland are increasing their profits from card payments. The greatest benefits from the reduction in interchange fees are reaped by the 100 largest card merchants (in the EU). Big retail companies will benefit the most, smaller card merchants will see smaller gains and the smallest ones will benefit little,” Peter Jones, executive director of PSE Consulting, said at the SIA conference.

At the same time Polish banks estimate that their revenues from fees and commissions will decrease by about PLN840m due to the reduction in interchange fees. They are already passing this loss of revenue on to customers, charging them additional costs. On an EU scale, banks stand to lose billions of euros in revenue.

“Issuers of credit cards in the European Union will lose EUR3.2bn in revenues annually, and the issuers of debit cards – EUR1.8bn euro,” Peter Jones estimates.

Despite this, the PSD2 directive stands a chance of achieving its intended objectives, that is increasing the efficiency of the payments system in the EU, leading to the development of a broader range of services, increasing their transparency and strengthening confidence in the payments market.

Innovation and competition

This refers to Payment Initiation Services (PIS). The PSD2 directive opens the market for PIS and for the „information service providers” (Account Information Services – AIS). PIS are intermediaries who collect money from our bank account and immediately transfer it to the account of the recipient. These intermediaries therefore form a kind of bridge between accounts across which money travels.

The matter is more complicated and less intuitive in the case of AIS. These are companies that may also provide payment services, but their services mainly consist in the „integration” of their clients’ numerous accounts. They create platforms for the management of funds and liquidity on all of them, thanks to the possibility of categorizing expenses, budget planning, etc. This is the business model of Yodlee from California.

The model most commonly found in Poland, used for example by online currency exchange offices, involves an intermediary (PIS) who simultaneously keeps his own accounts at all banks. After a transfer order is submitted on the part of the client, the client’s funds are transferred to the intermediary’s account in the same bank, and then the funds are sent to the recipient’s account from the intermediary’s account in the recipient’s bank. Intrabank transfers are executed instantly and therefore the intermediary can execute such transfers much faster than an interbank transfer would allow. The PIS profits from the commission of the payment recipient.

This business model is threatened by the Express Elixir payment, introduced by the National Clearing House in 2012. A transfer from an account in one bank reaches an account in another bank within seconds. When the interbank transfer is as fast as an internal transfer, an intermediary is no longer needed.

Skycash has a different business model in Poland. It executes the transfer to the recipient immediately, but from the account of the client, who has to credit it beforehand. Clients deposit their funds on an account kept by the intermediary, at least for a certain period of time. The intermediary earns not only on the commission, but also on this liquidity.

Banks have to build interfaces

The PSD2 directive is to enter into force a year and a half after the European Banking Authority (EBA) issues the corresponding technical standards. The main areas they will apply to are strong authentication and the creation of a „non-discriminatory” interface for intermediaries by the banks.

“This means the necessity of an additional layer for the existing infrastructure,” Douwe Lycklama, president of the Dutch consulting firm Innopay, said at the SIA conference.

In his opinion, banks could apply several strategies towards the changes – from a reactive strategy, consisting only in the fulfilment of the regulations, through entering the business currently provided by the intermediaries or creating such intermediaries, and finally making all services available to clients, including, for example, social financing.

Although banks’ business models will evolve in different directions, banks should already undertake the broadest possible cooperation in order to develop a common standard of access to customers’ accounts.

“If every bank has a different interface and has to provide access to every PIS, which will generate high costs. An alternative to cooperation is fragmentation, involving, for example, groups of six to seven banks in Europe developing their own standards. That is not the point. In Poland all the banks could agree to create a common standard. If there was one European solution, it could be implemented in Poland or we could engage in the development of the European standard,” said Lycklama.

The chances of a Polish payment card

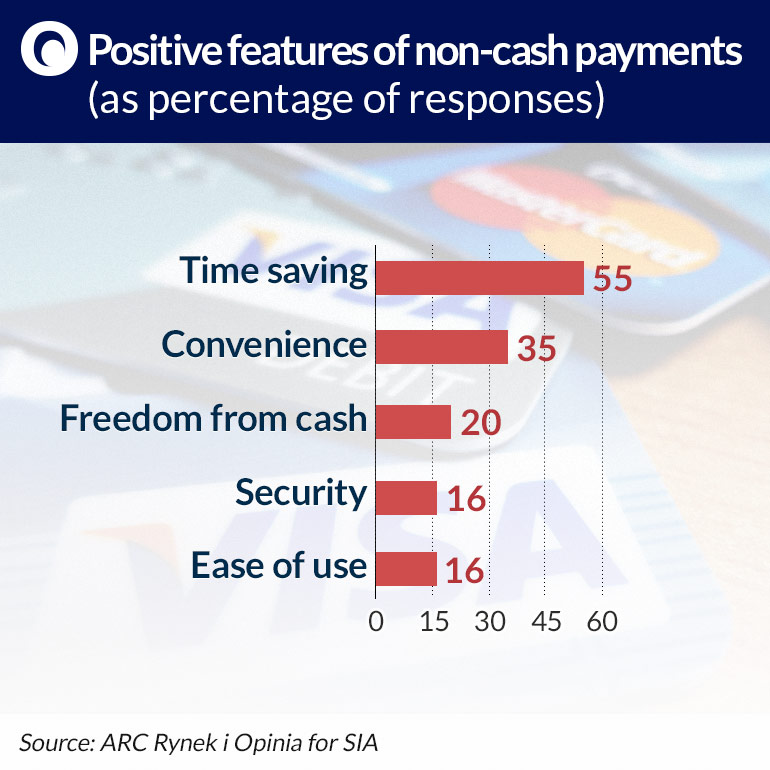

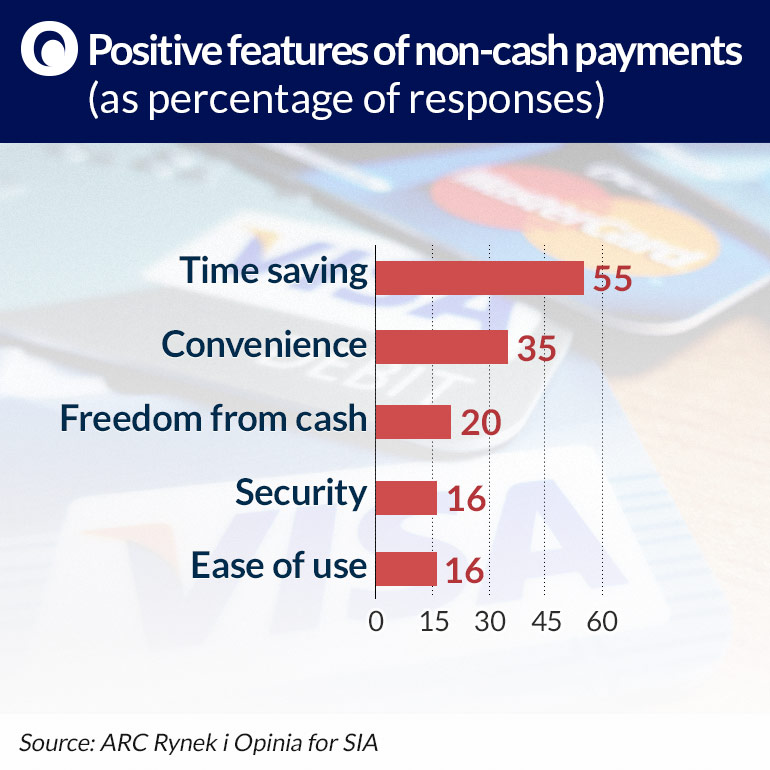

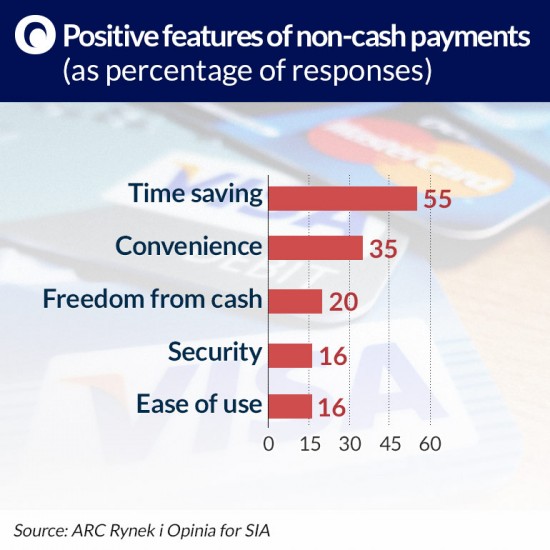

What is the outlook for payments intermediaries – PIS and AIS companies – operating in Poland? Market studies indicate that so far Poles have approached innovation with reserve. In addition, money circulation is still dominated by cash.

“Poles have not made up their minds yet on whether projects that go beyond the standard framework of banking available to the average Joe are attractive or not. According to studies, 65 per cent of respondents don’t have an opinion on whether a given solution is attractive or not. We are, however, rather skeptical of `banking’ with an institution that is not a bank,” Marek Lekki, director at ARC Rynek i Opinia, which recently carried out a study on the attitudes of Poles towards new forms of payment, said at the SIA conference.

The security of non-cash transactions is assessed relatively well in Poland. In the study, 62 per cent of respondents said that they didn’t know anyone who had fallen victim of fraud while paying electronically. Only 15 per cent knew someone who had, but one-fourth claimed that this person had neglected the safety rules.

“Security of transactions is rated higher with every passing year. The safety of individual payment methods is assessed similarly,” said Lekki.

Studies show the market is completely dominated by payment cards and especially contactless payments, which have a huge advantage over all the other methods. Contactless payments were used by 82 per cent of respondents in 2015, compared with 73 per cent the year before. At the same time recent research by the IBRiS institute shows that more than 60 per cent of Poles would welcome more competition on the payment cards market, where Visa and MasterCard have a 99 per cent market share.

EU regulation on interchange fees aims to increase competition on the cards market, as it introduces the possibility of suspending interchange fees for three years in relation to the so-called „tripartite systems,” provided they do not obtain more than 3 per cent of market share per year. Poland has taken advantage of this possibility and the Sejm has recently adopted such a law.

This paves the way for the introduction of a Polish payment card, which is what the National Clearing House has already been planning for several years. It is possible that this concept will now enjoy a broad support of banks.

“The idea of a Polish payment card is a very good one. This is a project for the reduction of transaction costs, which are currently only pocketed by Visa and MasterCard,” Mateusz Morawiecki, former president of BZ WBK bank and now deputy prime Minister and Minister of Development, said at a press conference.

Banks have not yet lost the battle for the payments market, also due to the fact that they have already created many technological solutions that allow them to create added value for customers, rather than leaving it to intermediaries. A Polish payment card would allow them to strengthen their position on their own market.