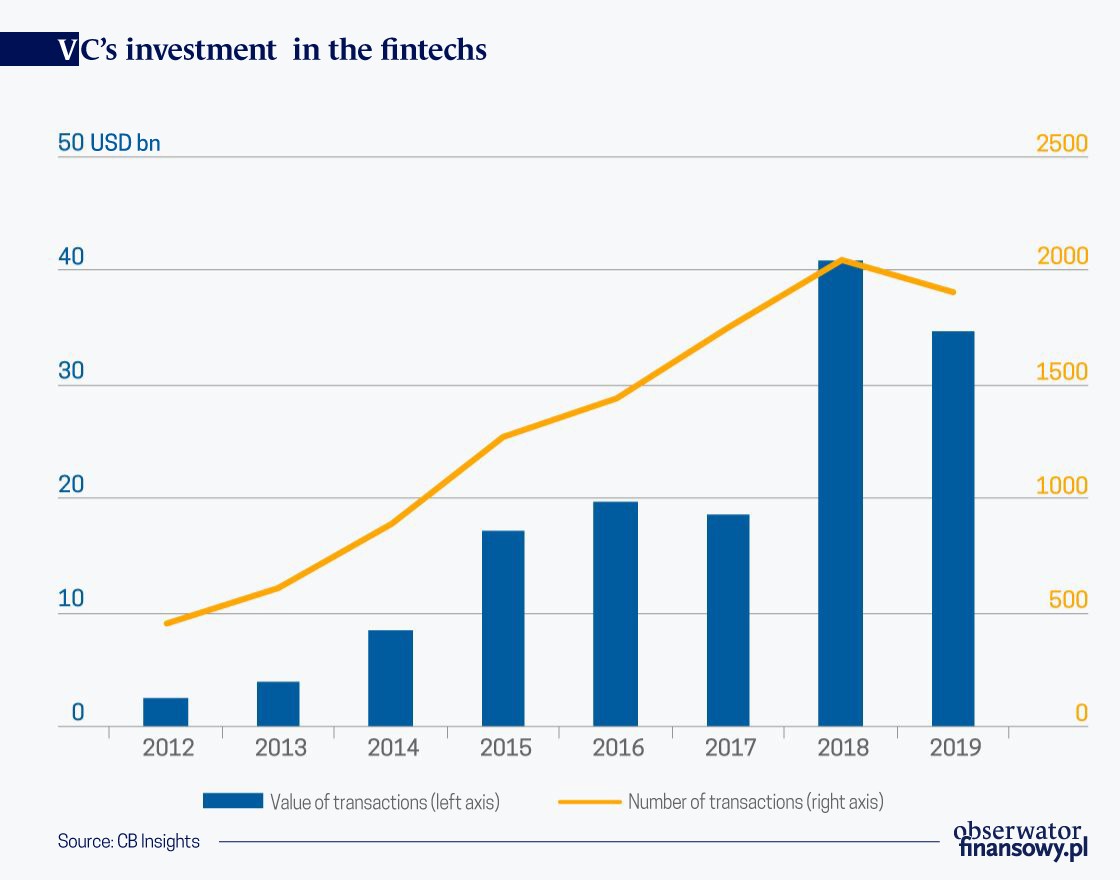

Last year, fintechs received venture capital (VC) of the USD34.5bn from investors. This is slightly less than a year before (the USD41bn), when the final result was affected by a mega deal of the USD14bn related to the Chinese giant, Ant Financial.

More unicorns

The report of CB Insights “State of Fintech: Investment & Sector Trends to Watch” indicates that the dominance of investments in large, solid and winning players, rather than in start-ups at the initial phase of development, signals the maturity of the market.

Investment rounds exceeding USD100m constitute as much as half of the value of the annual investments. The consequence is an increase in start-up valuations and gaining a unicorn status, i.e. companies worth at least the USD1bn. In mid-February this year, the fintech industry included 67 such entities, whereas their total value reached USD245bn. The United States has “bred” the highest number. Only 12 of them operate in Europe, including: Klarna, Revolut, Transferwise or the German digital bank N26.

Investors’ attention has also been attracted by companies that create new forms of business services referred to as Fintech as a Service (FaaS). They include the British Rapyd, which, based on the cloud computing platform, has become the global payment integrator for companies representing various industries, especially eCommerce. The package offers solutions such as e-wallet, verification of the customer’s digital identity, cross-border payments and loyalty scheme management. This enables contractors to consolidate their financial management in their relations with customers, and thus allows a faster scalability of many businesses.

New unicorns also operate in adjacent areas, such as Ivalua (management of expenses and relations with suppliers) and Checkout (business payment platform). Another area of investors’ interest was insurtech start-ups which gained USD6.7bn, twice as much as in 2018.

More customers

So far, last year was the best one not only because of the value of the investment but also due to the record number of customers. The so-called challenger banks, operating exclusively in virtual space, have raised the USD3.7bn, while the number of customers has grown to over 54 million, excluding India and China.

The biggest transaction was recorded by the Indian Paytm (the USD1bn) and the Chinese Beike (the USD0.8bn), but the highest investment and development leap in the area of digital banks was in Latin America. The region’s largest digital bank, established in 2013, the Brazilian Nubank, has increased its investment capital to over the USD900m and its customer base to 15 million, which made it the largest mobile bank worldwide. It addresses its low-cost services to a poorly banked population, unlike other local challengers, such as Neon Bank and Banco Original, which target wealthier clients.

However, this is not the only market in the region where fintechs and digital banks are growing quickly, since 40 per cent of the continent’s population has practically never used expensive banking services before. Such entities as the Argentinian Uala (personal finance) and Albo (personal finance), Creditjusto (loans), Konfio (SME finance) and AlphaCredit are interesting to well-known investors: the Chinese Tencent Holding, the Japanese Softbank Group and Goldman Sachs.

To complete the picture of capital flows in the global fintech market, it is necessary to mention the record value of mergers and acquisitions (M&A), which amounted to the USD234bn. This is as much as 84 per cent more transactions (989) than a year before, 23 of which exceeded the value of the USD1bn. The two largest transactions were the acquisitions of Worldpay for the USD34bn and First Data for the USD22bn by the financial technology giants, FIS and Fiserv, respectively.

However, it is worth mentioning an interesting transaction going beyond last year, announced in February, i.e. the intention to take over Boston’s Radius Bank by a fintech start-up which has been a public company for several years now, i.e. LendingClub (the USD185m), a consumer loan operator. This is the first transaction of this type since so far fintechs have been the subject of acquisitions, often also by banks and not the other way round.

The rationale behind this venture is the intention to gain access to the deposit base and take over the banking license, since it is much more difficult for American fintechs to obtain it than for the challenger banks in Europe.

Solution for the excluded

All over the world, traditional financial players are losing customers in favor of new digital players. In some emerging markets, more than half of the population already uses their services.

The surveys of the consulting company Bain show that 75 per cent of clients of financial institutions in India use Paytm’s applications, while in China 70 per cent use those from Alipay. In Southeast Asia, digital payment services have been developed by transport companies Grab and Go-jek — with over 100 and 150 million users, respectively.

In Brazil, there are already over 50 million e-wallet accounts offered by almost 100 companies. The biggest one is the aforementioned NuBank; however, local retailers such as Lojas Americanas and Mercadolibre are also important.

In traditional markets, the achievements of fintechs are not so impressive and less visible, since, as Bain notes, the escape of customers to digital players does not mean closing an account with a traditional bank.

The failure to perform digital transactions at a bank (remote opening of an account or taking out a loan) — for example, in the Netherlands, 18 per cent of new customers were affected, and in Korea 7 per cent — results in a transition to fully digital players.

In Canada, 18 per cent of respondents aged 25-34 took advantage of such an offer. On the British market, on the other hand, in the same age group, more than 10 per cent of respondents opened an account last year in the Monzo challenger bank and in Revolut.

The growing dynamics of using digital channels to make purchases, including financial products, will favor such players. Some banks are trying to adapt quickly to these trends.

The Royal Bank of Scotland has implemented a digital mortgage offer which already covers 91 per cent of new loans — this has enabled elimination of 66 pages of required documents and allowed limiting the time of concluding the contract to 11 days. This has obviously translated into a considerable increase in customer satisfaction.

Necessary transformation

Accenture, in its latest report “Purpose-Driven Banking: Can Trust Create Win-Win Banking Relationships?”, says that if banks do not adapt to digital requirements, they risk losing billions of dollars in revenues in favor of new players over the next three years.

This is the most relevant for Australia (9 per cent of revenues), the UK (8 per cent), Hong Kong, Spain and the USA (7 per cent). In addition, banks will not be favored by regulators granting easier market entry to digital players and open banking rules, to which more and more jurisdictions are opening up (Brazil, Mexico, Australia, Asian countries).

A digital transformation into a trusted customer advisor is supposed to be the remedy for banks, which will enable them to offer personalized solutions. However, this could require a change of business models. Consumers would be willing to pay for such solutions — this is declared by 55 per cent of respondents surveyed by Accenture. Such is the philosophy behind Aion Bank just being launched on the European market, which in its subscription model does not offer financial products but rather tools for managing personal finance, thus providing access to the use of products of other financial entities.

More and more companies in various industries are opening up to fintech solutions. Thomson-Reuters research shows that as many as 83 per cent of large organizations have a positive attitude towards such innovations. On the other hand, the PwC report indicates that almost 50 per cent of financial institutions and entities representing the TMT sector take them into account in their business strategy as they generate revenue growth. The most promising technologies include artificial intelligence, cloud computing, big data and the Internet of things.

PwC surveys show that 47 per cent of traditional financial entities and 35 per cent of TMT sector companies want to start cooperating with fintechs. However, security, personal data protection and compliance with regulatory requirements are seen as the greatest challenges in this respect. An additional risk for banks is posed by obsolete IT systems, the combination of which with fintech technologies may cause greater complexity of management at the level of the whole organization.

Undoubtedly, the crisis related to the coronavirus pandemic may also be a challenge. In the times of growing uncertainty, investors will lose even more of their eagerness to support start-ups at an early stage of development and are more willing to invest in large, developed companies.

There is concern that many of the former may not survive. The slowdown in global economic activity means a reduction in the stream of payments and thus lower profitability for many companies specializing in such solutions. It also means a possible decline in lending and P2P loans. However, everything depends on the duration of the epidemic and the related crisis.

On the other hand, non-cash payments, including eCommerce purchases, provide greater security during an epidemic. This may give fintechs a privileged position and encourage banks to cooperate.

It is difficult to make predictions at this point in time but it can be expected that the importance of fintechs using advanced data analysis models and artificial intelligence enabling the personalization of financial services will be growing. Governmental policies may also encourage the development of digital platforms and payments.