German automotive industry at a crossroads

Kategoria: Business

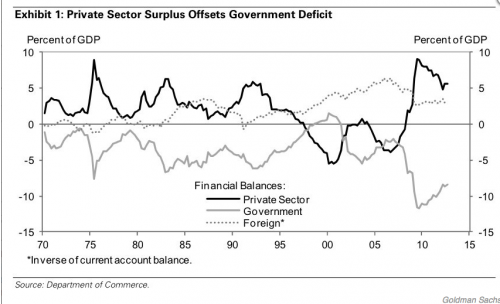

Business Insider met with Goldman’s Chief Economist Jan Hatzius and learned he is bullish on the US economy largely because he believes his Wynne Godley-inspired model of the US economy shows likely releveraging in the household sector. Here’s the chart he comes up with based on it.

For his part, Hatzius says:

Since mid-2009, that surplus has gradually come down as businesses and households have gotten closer to where they need to be from a long-term balance sheet perspective. They’ve paid down debt, they’ve eliminated the excess supply of housing, and that’s basically allowed them to reduce the financial surpluses that they run. They’re still running large surpluses – still 5.5 to 7 percent of GDP, but they’re no longer as large. We expect those figures to come down as the balance sheet adjustment process makes further strides and that’s an underlying source of boost to the economy that’s happening on the one side.

I am going to post a more indepth analysis of his approach for members, but I wanted to point out here that he finds the sectoral balances approach useful in his forecasting. This is part and parcel of the MMT approach that some economists have dismissed as an accounting “tautology”. For other examples of this approach, see my post on “How austerity in Europe works” and Randall Wray’s analysis showing “Government Deficits Translate into Surpluses for the Non-Government Sector“. These are exactly the kinds of analyses Hatzius is using. …and it works.

Source: Business Insider