German automotive industry at a crossroads

Kategoria: Business

Suddenly, a growing number of commentators are suggesting that the worst is behind us — in housing, employment,manufacturing, the auto sector, the technology industry, and elsewhere in between.

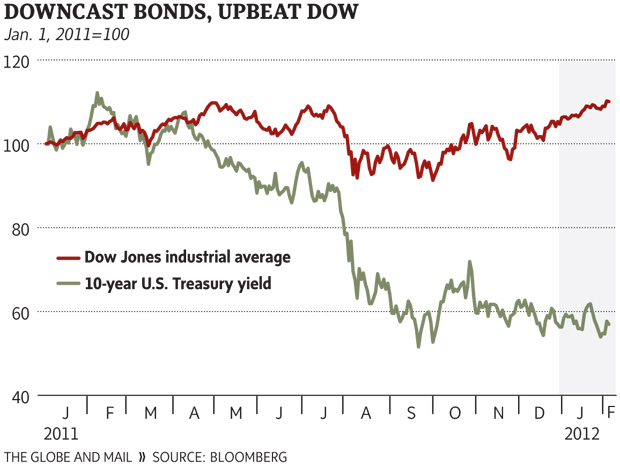

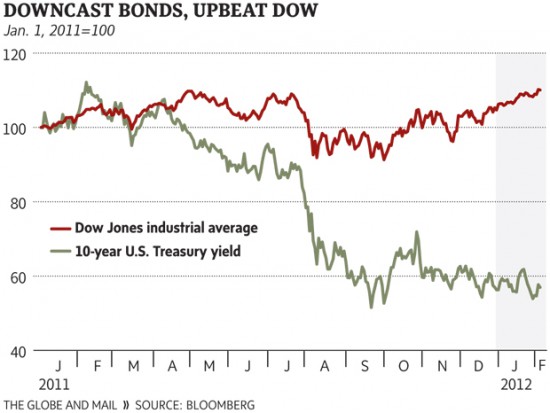

Aside from the fact that, historically at least, bursting bubbles have generally been followed by drawn-out and messy overshoots to the downside (e.g., more than four years), while genuine bottoms have, historically at least, gone unrecognized until well after their arrival, I have one question: why are share prices approaching intermediate term highs at the same time that bonds yields are hovering near record lows?

(Source: The Globe and Mail)

The truth is that it doesn’t make any (economic) sense — unless, of course, you attribute the development to unprecedented central bank intervention. In that case, the notion that things are returning to „normal” would seem to be a complete crock of sh*t (if you’ll pardon my English).

I know — I’m just a grumpy old permabear. Grrrr.