Bogactwo i bieda bez granic

Kategoria: Raporty

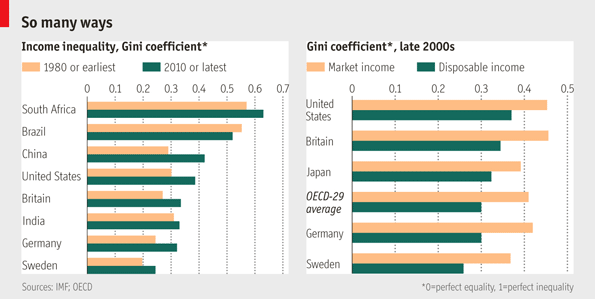

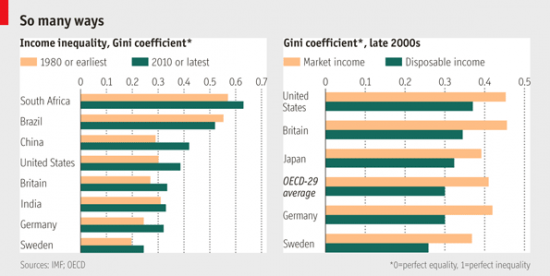

This Great Graphic is from the Economist. It shows the Gini coefficient that measures income inequality. If every one has the same income, the Gini coefficient would be zero. If one person received all the income the coefficient would be 1.

The Economist reports that with the exception of Latin America, countries in most regions have experienced an increase in the Gini coefficient.

There are, of course, numerous factors that determine the distribution of income. Some inequality can be a motivation factor to the extent people believe (and act) that it is a meritocracy and hard work is rewarded. However, extreme inequality can retard growth and contribute to financial crisis. Rather than wage income funding consumption, transfer payments and debt were increasingly how aggregate demand was supported in the period leading up to the crisis.

Government de-leveraging is may reduce transfer payments and household de-leveraging and bank’s rebuilding balance sheets reduces the interest in new debt. The key issue is where will aggregate demand come from in sufficient scale to reduce the output gap. Reduced income inequality is one way to divide the pie; but as we have argued, this is just as much a political question as economic.