German automotive industry at a crossroads

Kategoria: Business

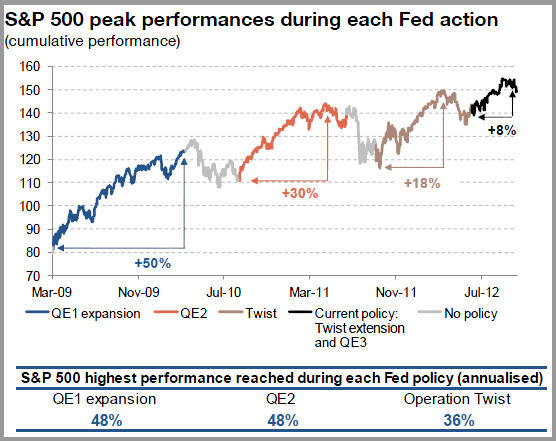

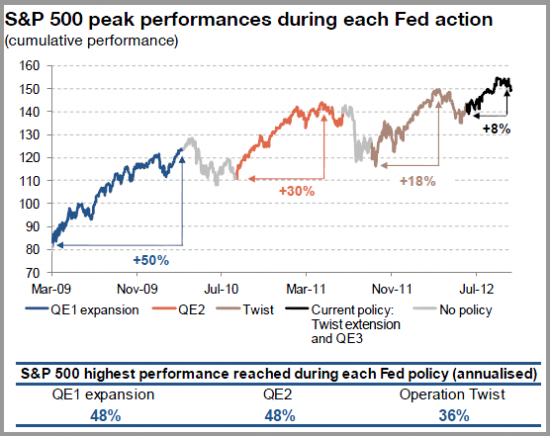

This Great Graphic comes from Zero Hedge, who got it from SocGen It purports to depict the performance of the S&P 500 and concludes that QE is generating diminishing returns.

Although our eyes can deceive us, we shouldn’t let it confuse our thinking. There is a logic fallacy embedded in here: post hoc ergo propter hoc. Just because something happened before some else does not mean it caused it.

The stock market rally during the period of QE1 is flattered by the end of the sharp downturn following the Lehman debacle. The poor performance noted under Operation Twist also corresponds to weaker earnings and concerns about the looming debt ceiling and fiscal cliff.

Moreover, we know that because the S&P 500 is weighted by market capitalization, the role of Apple has single-handily boosted the index. The Federal Reserve’s monetary policy cannot explain the stellar performance of Apple. Since March 2009, the start of QE1, the S&P 500 has risen almost 122% to the mid-September high. Apple shares have rallied over 800% in the same period.

Similarly, the poorer stock market performance of late is partly a function of a 16% slide in Apple over the past month. In addition, corporate earnings more broadly, and the future guidance provided, was the weakest since 2009.

It does not seem right or fair to reduce the S&P 500 to a function of US monetary policy. Does not the ebb and flow of the European debt crisis impact the investment climate? The reduction of the immediate tail risk,s first by the LTROs and then by OMT, helped shape the investment climate, no?

By focusing on the start and finish of the Fed’s balance sheet operations, the chart glosses over two other important considerations. First and foremost, the markets are anticipatory in nature and the Fed has telegraphed its intentions, especially after QE1. For example, the record will show the Bernanke tipped his hand at the Jackson Hole confab in Aug 2010 that a new round of asset purchases was likely and underscore that point at the following month’s FOMC meeting. Likewise the market knows when the program ends and this anticipation may also change behavior.

Second, it assumes that it is the purchases of new securities that is important. The Federal Reserve and many private sector economists argue that to the contrary, it is the stock not flows that is the key to the unorthodox monetary policy.

Lastly, the data does not bear out the conclusion. As measured by Soc Gen, the S&P 500 rally from low to high was essentially the same for QE1 and QE2. Operation Twist, arguably is not as strong as outright purchases (QE) and its impact on the market is a bit less, though in fairness it has not been completed, but the effects may be distorted by concurrently buying more Treasuries outright as well.