English

Obserwator Finansowy features views and analysis of economy in Poland and other countries, written by some of the best journalists, economists and analysts. Our mission is to share knowledge of economics and financial markets in the world.

Obserwator Finansowy is a project under aegis of the Poland’s central bank, Narodowy Bank Polski. We have published thousands of articles about the Polish and global economy. Our journalists have conducted hundreds of interviews with Nobel laureates, distinguished economists, business leaders and politicians with views across the political spectrum.

In this section you can find selected articles in English.

A jubilee week of central banking in Poland and abroad

Karol Rogowicz, Paweł KowalewskiThis week marks two anniversaries: the 20th anniversary of the initiation of unconventional monetary policy by the Bank of Japan and the first anniversary of the launch of quantitative easing by NBP.

Interview with Stefan Ingves, Governor of Sveriges Riksbank

Piotr SzpunarPiotr Szpunar, Director of the Economic Analysis Department at NBP, interviews Stefan Ingves, the Governor of Sveriges Riksbank, for the NBP Obserwator Finansowy:

EBRD: The Polish economy will recover to its pre-pandemic level in early 2022

Maciej DanielewiczIn spite of another wave of the pandemic and the continued shutdown of many of the EU’s major economies, Poland’s return to its pre-pandemic GDP levels will already be possible in early 2022, Beata Javorcik, EBRD’s...

Central and Eastern Europe still has time to improve its demographics

Piotr SzpunarRising economic activity rates and levels of education, the growing role of immigration, and incentives for Poles to return home, will mitigate the impact of demographic changes, writes Dr. Piotr J. Szpunar, Director of the...

IMF: NBP’s response to the pandemic appropriate, Poland well positioned for a strong recovery

Maciej DanielewiczNBP’s response to the challenges posed by COVID was agile, forceful, and added innovative elements to existing policy frameworks. Poland is well positioned for a strong recovery. 2021 should be much better than 2020 –...

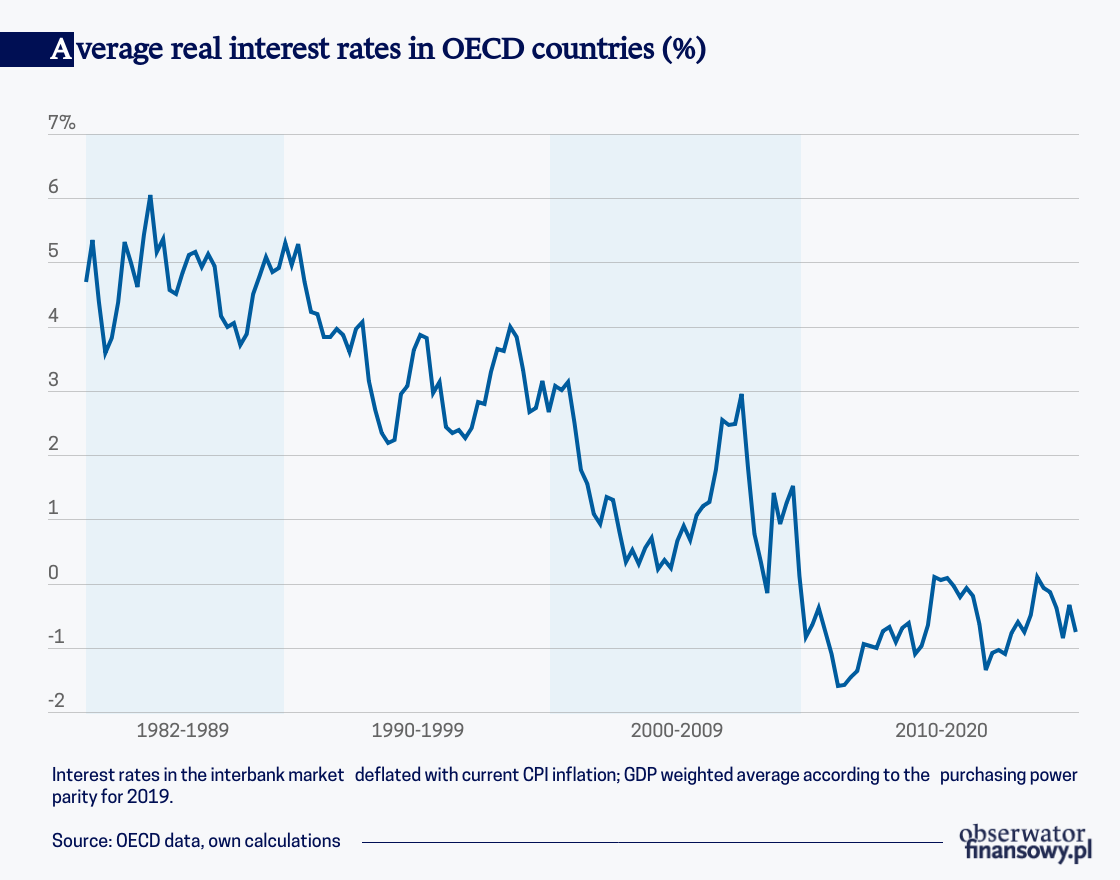

What causes negative interest rates?

Piotr SzpunarNegative interest rates are not so much the effect of discretionary decisions of central banks but are mainly driven by changes in economic conditions. In the past decades real interest rates worldwide have been...

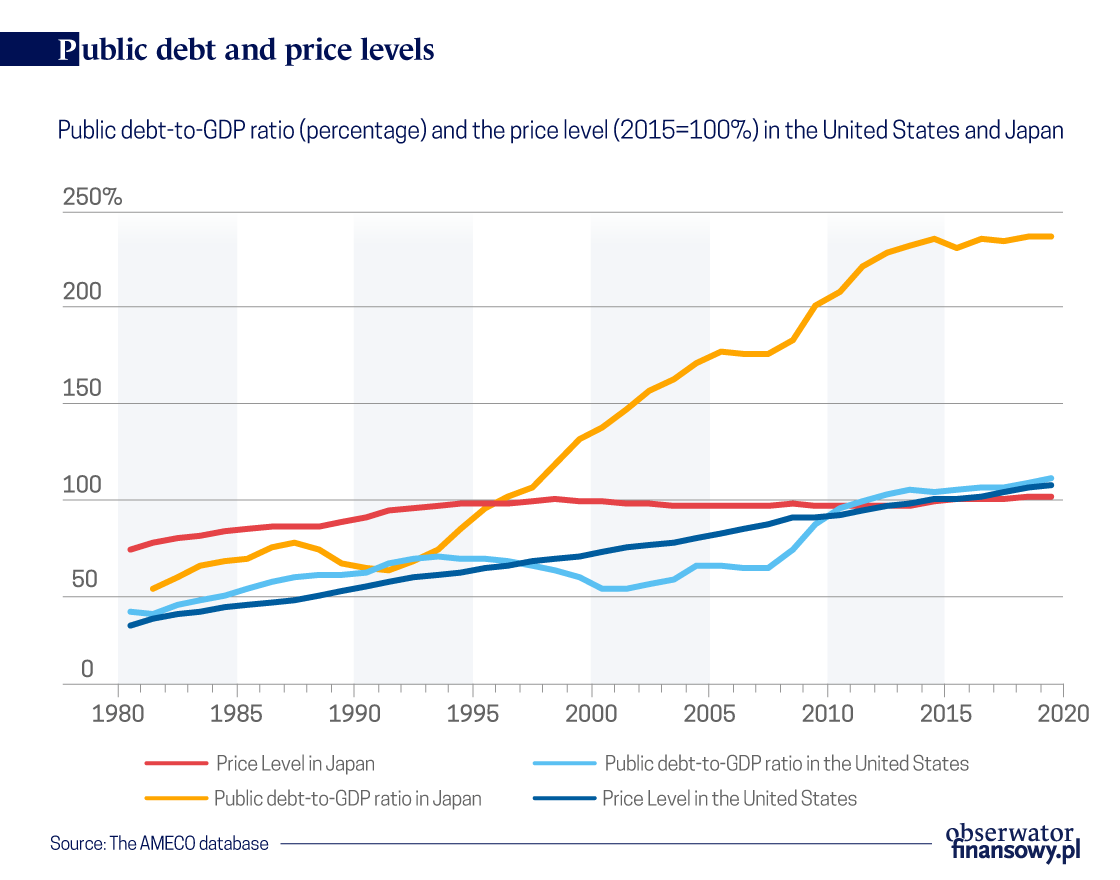

Is public debt a source of inflation? The data does not confirm it

Leon PodkaminerIn conditions of a global recession caused by the coronavirus pandemic, massive fiscal deficits and rising public debt levels have become unavoidable. However, the size of those deficits may prove insufficient – also...

World Bank: The recovery in Central Europe in 2021 will be underpinned by, among others, interest rate policy in Poland

Maciej DanielewiczThe recovery in Central Europe will be supported by a rebound in global trade and activity in the euro area, and by exceptional policy accommodation throughout 2021, including near-zero policy interest rates in Poland –...

Benefits and risks of central bank digital currency

Piotr Szpunar, Piotr ŻukThe concept of a central bank digital currency (CBDC), i.e. publicly available electronic money issued by a central bank, has become a hot topic for economists in recent years.

The banking industry is opening up slowly

Mirosław CiesielskiThe principles of open banking have been in force in the EU for over a year, but the availability of open banking services is still low. However, the philosophy of open banking is being adopted by more and more countries,...