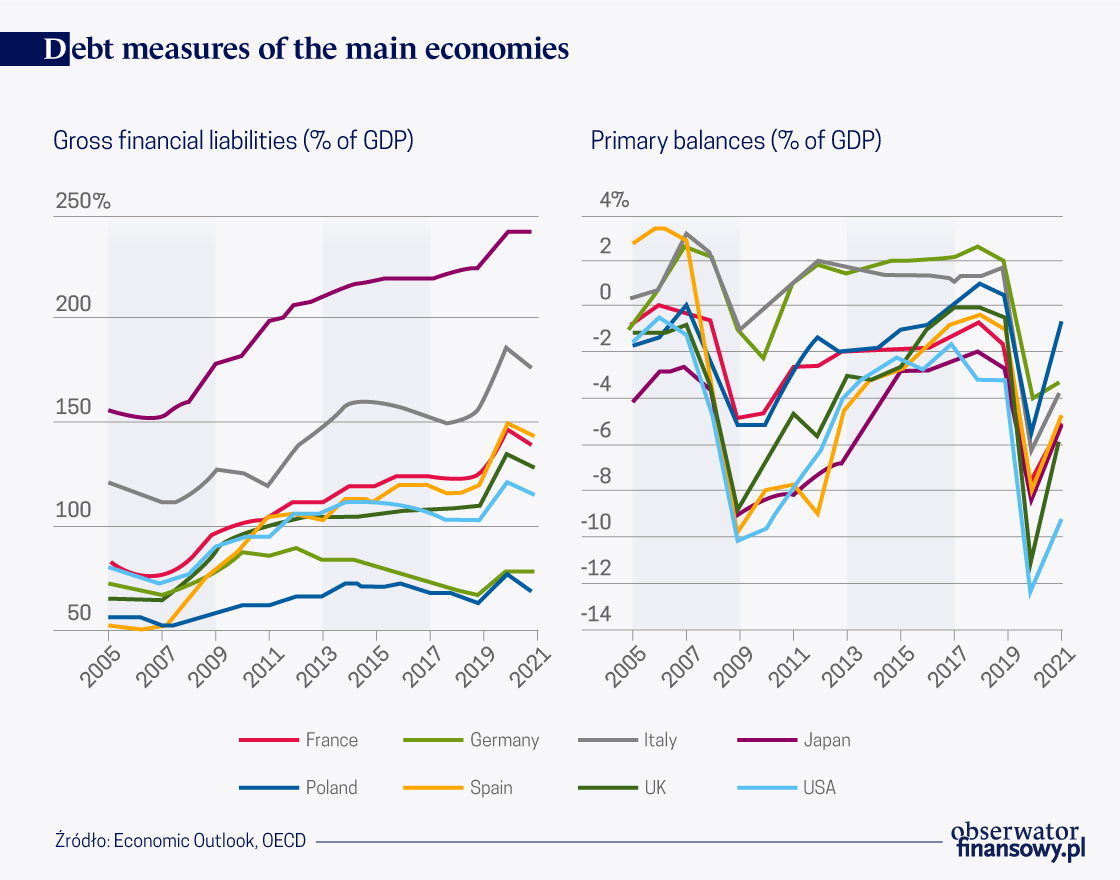

For well over a decade, governments in the developed countries have been borrowing at very low interest rates, sometimes even at negative rates. This is going to end, and probably for a long while.

Cash is a safe and highly liquid instrument for payment of goods and services and other transactions which is issued by a central bank.

We live in an era of urgency, where we have to cope with multiple crises at the same time. Europe is currently facing a major historical shock.

The past decade has taught the central banking community the important lesson that negative shocks can happen more frequently, and the time between the shocks may not be long enough to let central banks regain policy space.

Digital transformation is taking place at a rapid pace, and its consequences for society and the economy are very much in evidence. Virtual meetings, instant messaging and online shopping have become part of our daily life.

The concept of a central bank digital currency (CBDC), i.e. publicly available electronic money issued by a central bank, has become a hot topic for economists in recent years.

The policy response of Narodowy Bank Polski has been swift and large and effective in limiting the economic scarring effects of the pandemic – adequate liquidity provision remains critical in the short-term. The anti-crisis...

Since mid-December 2020, the NBP Management Board has been purchasing foreign currencies on the FX market in order to strengthen the impact of NBP’s monetary policy easing on the economy, said the President of NBP, Prof. Adam...

The central banks of the world’s major economies responded relatively quickly to the economic and financial threats caused by the pandemic by using several measures. The goal was to ensure the availability of preferential loan...

March and April 2020 will go in history as months with historically weak economic indicators. The representatives of the Fed and the ECB believe that the worst is behind us, but they are concerned that we may not return to the...