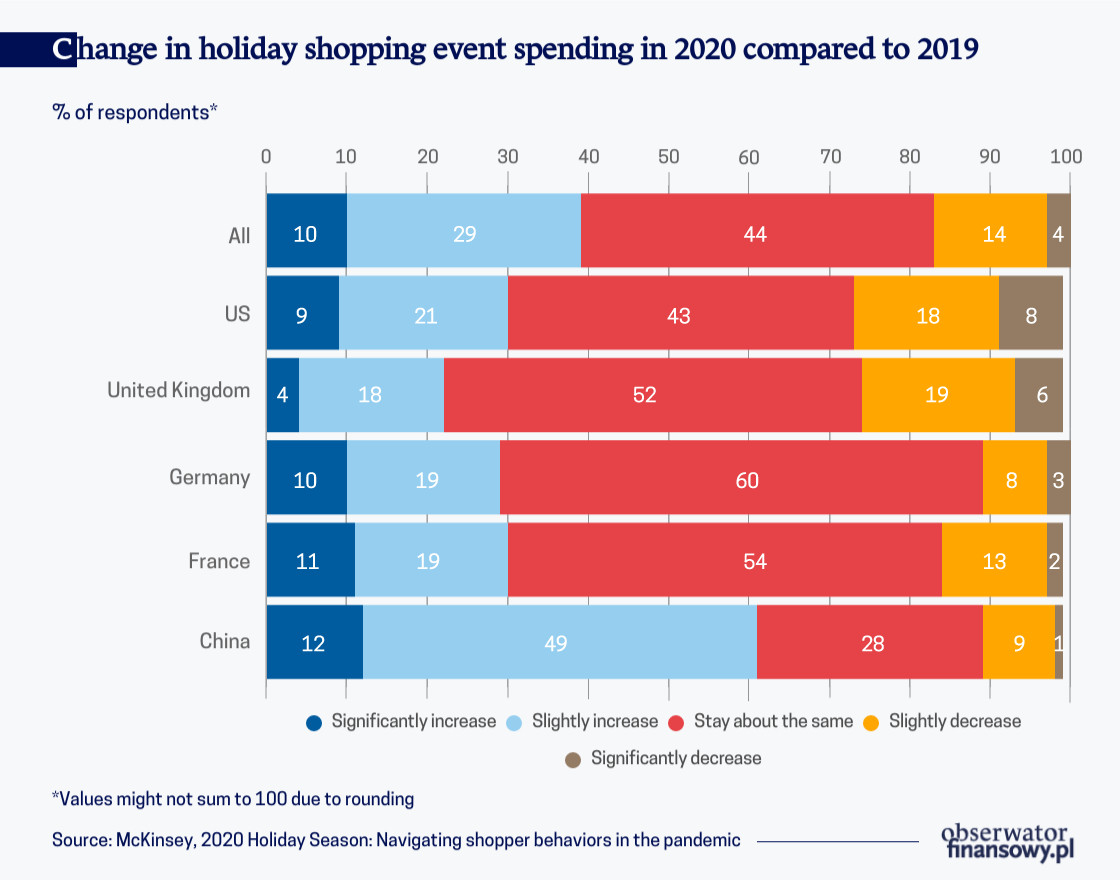

This year holiday shopping is going to be different. Consumers are buying online because of the health safety and convenience. According to McKinsey the COVID-19 pandemic is upending the retail industry to an extent that would...

International Monetary Fund (IMF) calls to increase public investment to boost the recovery. The European Commission, World Bank and OECD representatives are saying the same. There is a change in the opinions of Troika and other...

Lockdown changed the way business is done. Everyday management, conferences, trade fairs moved online. It seems that virtual tourism may be the new way of traveling. Will virtual reality become the new reality?

Gold has once again become a safe haven for investors. However, a return to the gold standard is a scenario that is unlikely to materialize – says Krishan Gopaul, Market Intelligence Analyst at the World Gold Council (WGC).

In October 2020, central bankers from the Western Balkans discussed monetary policies and financial stability in the COVID-19 era, as well as the financial sector's response to the corona crisis during their meeting in Croatia.

The crisis caused by the coronavirus does not create favorable circumstances for changes in business operations. Most managers seek to maintain their current levels of activity and to limit the possible losses. But the crisis...

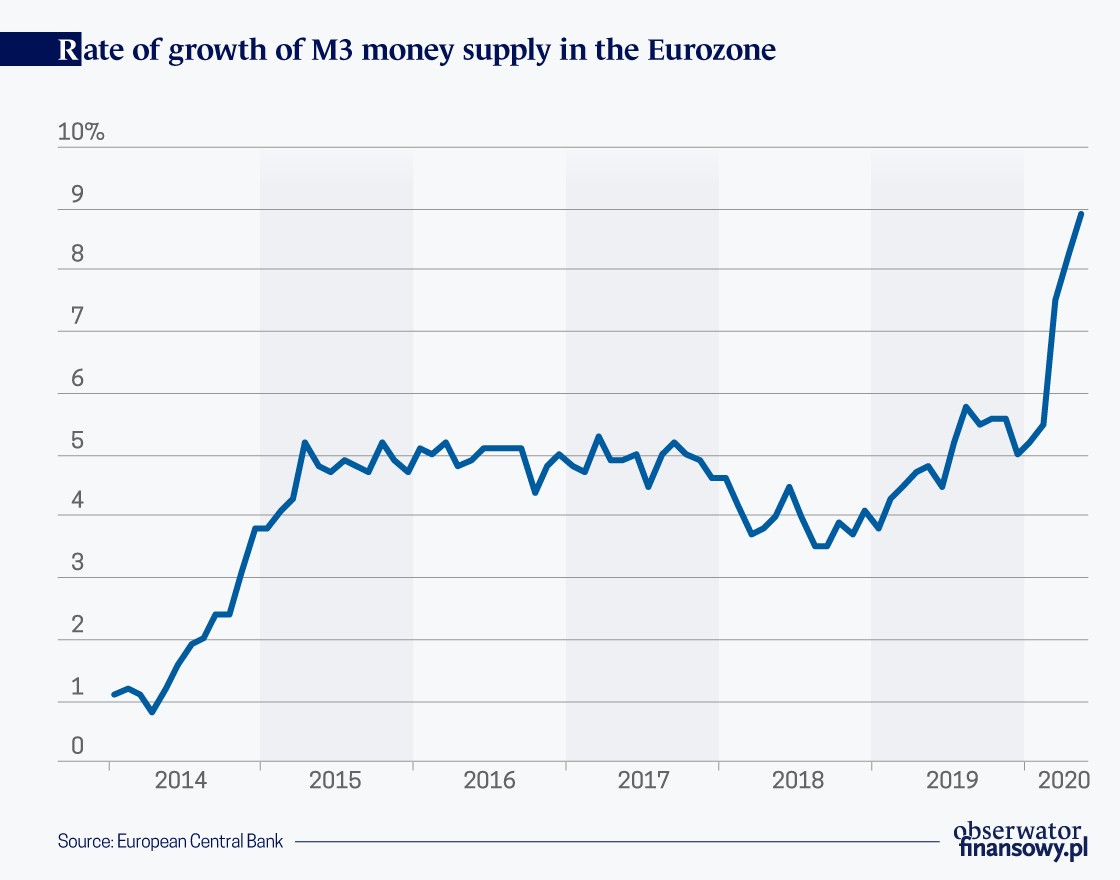

The outbreak of the pandemic has led to the introduction of unprecedented anti-crisis fiscal and monetary policy measures aimed at supporting economic activity and the stability of the world financial system. Their effectiveness...

A lot is being said and written about the central banks’ reactions to the crisis caused by the coronavirus pandemic. However, much less attention is paid to whether and how the crisis affected the central banks themselves.

According to official data, during the first month of the pandemic approximately 400K economic migrants returned to Ukraine. The biggest group of Ukrainian migrant workers, reaching 180K, came back from Poland.

“In the period from March 16th to the end of September NBP injected PLN158bn (approx. EUR 35bn) into the Polish banking system. This corresponds to approximately 7 per cent of Poland’s GDP – said Adam Glapiński, the...