German automotive industry at a crossroads

Kategoria: Business

The literary event of the year is shaping up to be the March release of Constitutional Money, the latest magnum opus from Richard Timberlake, the greatest historian of the dollar since his professor Milton Friedman.

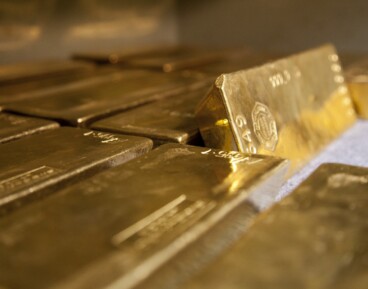

If you follow the Timberlake oeuvre from over the years, you see it laid out beyond any question that the United States used to have a monetary system that was consistent with things like the Constitution, moderation, the rule of law, and the common sense accumulated over the ages. The United States coined or backed its money in metal, silver or gold usually, and aside from a few forays into “Banks of the United States” left matters of management of U.S. monetary issue with a small professional office called the Comptroller of the Currency.

Such was life back in the 19th century. And what happened under such auspices? Bank panics, runs, depressions, hard times? Well, you can find that stuff if you really want to paw over things, but the Everests you have to deal with are growth at 5% per year, prices so stable they decline gently every year on account of ever-improving products, entrepreneurial fortunes by the gobs, and the invention of the mass middle class.

Still, G-men got ideas. The United States started outlawing and otherwise making difficult non-U.S. money. Supreme Court case after Supreme Court case it came, and by the end of it all, in the 1930s, we had a Federal Reserve, and owning a scrap of gold was punishable by a fine and a jail term. Real conditions coinciding with this change, when all was said and done? The Great Depression.

So read the Timberlake book when it comes out. It’s the narrative of our economic history and our funny old government’s development from prudent accompanist to the producers and keepers of wealth to know-it-all blunderbuss.

Here in 2013, a dozen years of Federal Reserve blowouts have produced about the worst twelve years of economic growth the nation has ever seen outside of the gift the government’s money masters gave us in the 1930s. About 1.5% growth per year is what we’ve had since the 2000 peak. This is nicely lower than the average population growth of the 19th century. Put our economy back in the old days, and we’d have what Karl Marx called “immiseration”—everyone getting poorer every year.

You know who wants to do something about it? Virginia (and Utah too). Last week, the lower legislative body in the Old Dominion passed a measure requiring a study of whether metal-based money could be feasible again. If the measure progresses, and if Utah’s efforts in a similar direction also bear fruit, we’ll have multiple states querying whether the United States wants to learn from its monetary history.

There are many obstacles in the way. Chief among these is that private people who mint money are thrown in jail. The utterly outrageous case of the Feds’ nailing of Bernard von Nothaus on this score is exhibit A. “Domestic terrorism” is what the they called it. As Dorothy Parker once said, “and I am Marie of Romania.”

Then there is taxation. If you use gold as money for holding your savings (like you do now with dollars), and the dollar-price of gold goes up—bam, the IRS wants its cut on the “profits.” Not at the capital-gains rate, either, but the full-fledged marginal tax rate.

Such are the glories of attempting to rectify the U.S. monetary system after the century-long process of the usurpation of power by the federal government. Timberlake writes of that process beautifully and expertly. Doing something about it? Courage, Virginia.