Well, there is such a saying – the only constant thing in this world is change. And that’s how I also see this very broad question on globalisation. Even if nothing happened, even if we had no pandemic war against...

Maybe we have now got used to extremely low interest rates, but we have to keep in mind that these are not normal interest rates that we had in the past – says Boris Vujčić, the Governor of the Croatian National Bank. I would...

In fact, it’s only the central banks that can fight inflation in a proper manner and there is a lot of discussion going on all over the world and especially in Europe on how governments could address inflation. But by...

W handlu międzynarodowym będą decydować inne czynniki niż tylko minimalizacja kosztów. Będziemy się zastanawiać, kto i co produkuje oraz w jakich warunkach. Mam nadzieję, że to zbliży podobne do siebie kraje...

Nasze działania są próbą ograniczenia wystąpienia efektów wtórnych, aby – gdy negatywne szoki podażowe znikną – inflacja również spadła szybko – mówi Mārtiņš Kazāks prezes Banku Łotwy i członek Rady...

The past decade has taught the central banking community the important lesson that negative shocks can happen more frequently, and the time between the shocks may not be long enough to let central banks regain policy space.

OECD expects inflationary pressures to ease in the course of 2022-23. As inflation is spreading through various components, central banks must be vigilant and be ready to respond – says Mathias Cormann, the Secretary-General...

Inflation in Britain has remained well under control since the financial crisis. Monetary and government debt management policies have become much more closely connected, and it will be important to loosen the connection while...

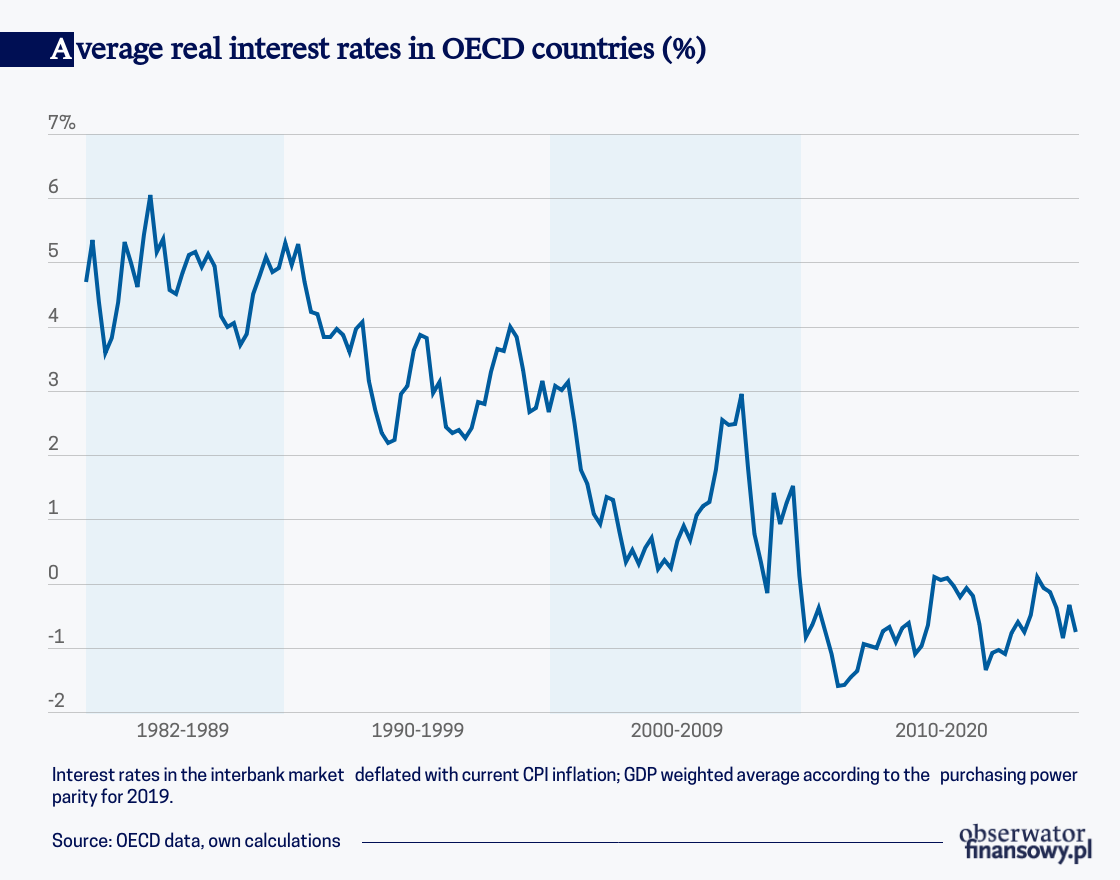

Negative interest rates are not so much the effect of discretionary decisions of central banks but are mainly driven by changes in economic conditions. In the past decades real interest rates worldwide have been systematically...

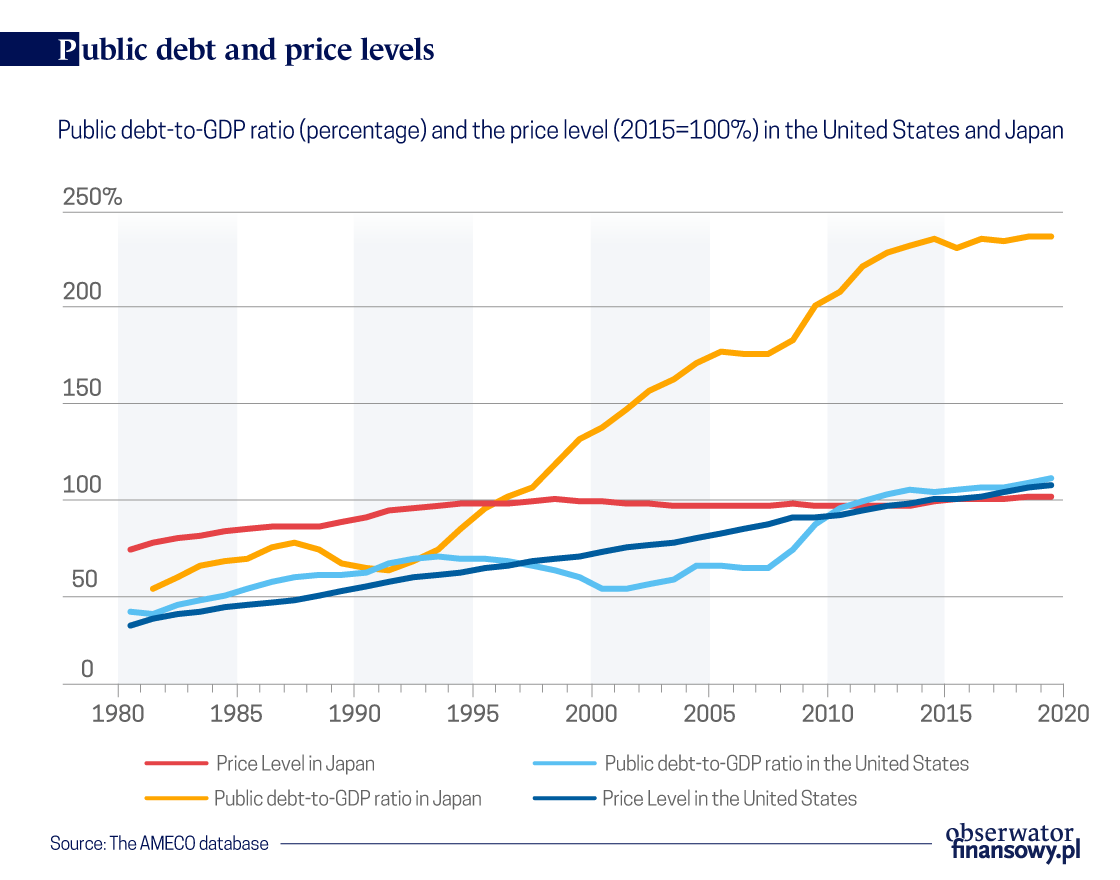

In conditions of a global recession caused by the coronavirus pandemic, massive fiscal deficits and rising public debt levels have become unavoidable. However, the size of those deficits may prove insufficient – also because of...