Housing markets are affected by general long-term movement of interest rates so discussion about monetary policy shocks may be a little bit tricky in context of housing markets and so preferably we should separate those two...

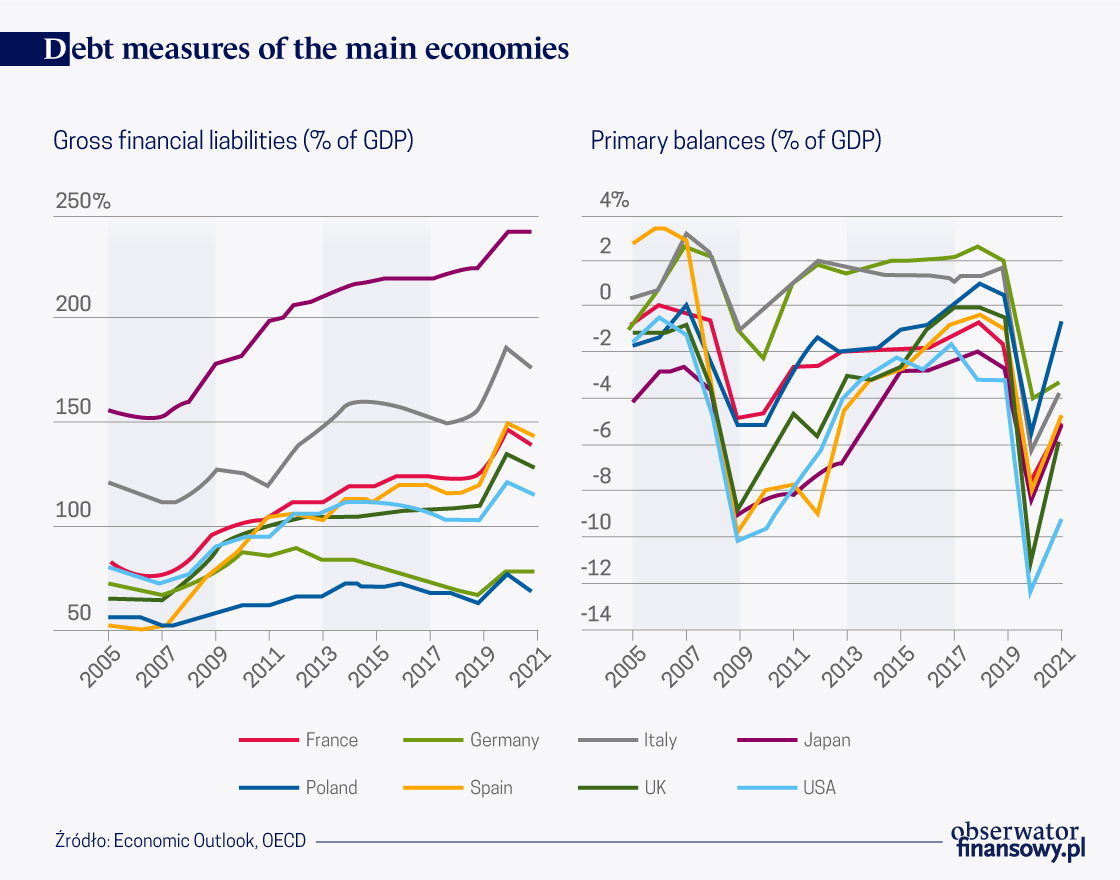

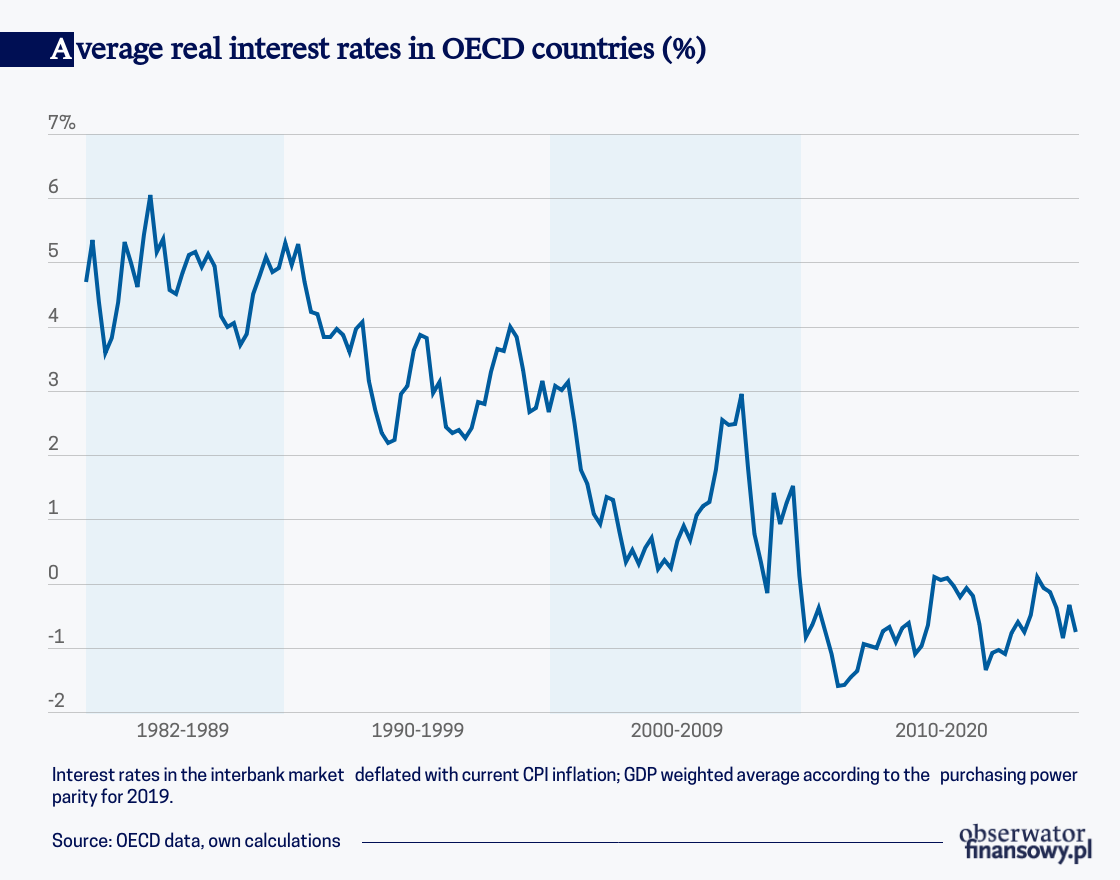

For well over a decade, governments in the developed countries have been borrowing at very low interest rates, sometimes even at negative rates. This is going to end, and probably for a long while.

The past decade has taught the central banking community the important lesson that negative shocks can happen more frequently, and the time between the shocks may not be long enough to let central banks regain policy space.

We have welcomed the initiation of the tightening of monetary policies early in the Fall. Determining an “optimal” timing of the decision to change the monetary policy stance is difficult - says Alfredo Cuevas, economist at...

NBP’s response to the challenges posed by COVID was agile, forceful, and added innovative elements to existing policy frameworks. Poland is well positioned for a strong recovery. 2021 should be much better than 2020 – says...

Negative interest rates are not so much the effect of discretionary decisions of central banks but are mainly driven by changes in economic conditions. In the past decades real interest rates worldwide have been systematically...

Since mid-December 2020, the NBP Management Board has been purchasing foreign currencies on the FX market in order to strengthen the impact of NBP’s monetary policy easing on the economy, said the President of NBP, Prof. Adam...

The standing of banks affects the real sector of the economy and the situation in the economy determines the functioning of banks. Their lending and financial plans for the next year, as well as medium-term strategies, turned out...

Poland has seen the second highest increases in residential property prices in the EU in 2020. Despite the fact that prices slowed due to the coronavirus, the average price of apartments on the secondary market in the Q2...

Financial analyst James Stack predicted a collapse in the real estate market in 2008 and announced a slowdown in real estate last year. If there is a recession, there is a significant risk to property prices, said Stack in an...