German automotive industry at a crossroads

Kategoria: Business

Gospodarka amerykańska nareszcie ruszyła z wymiernym skutkiem. Nareszcie wzrost gospodarczy wydaje się mieć wpływ na zmniejszanie się bezrobocia. Po raz pierwszy od 5 miesięcy bezrobocie spadło poniżej 10 proc.

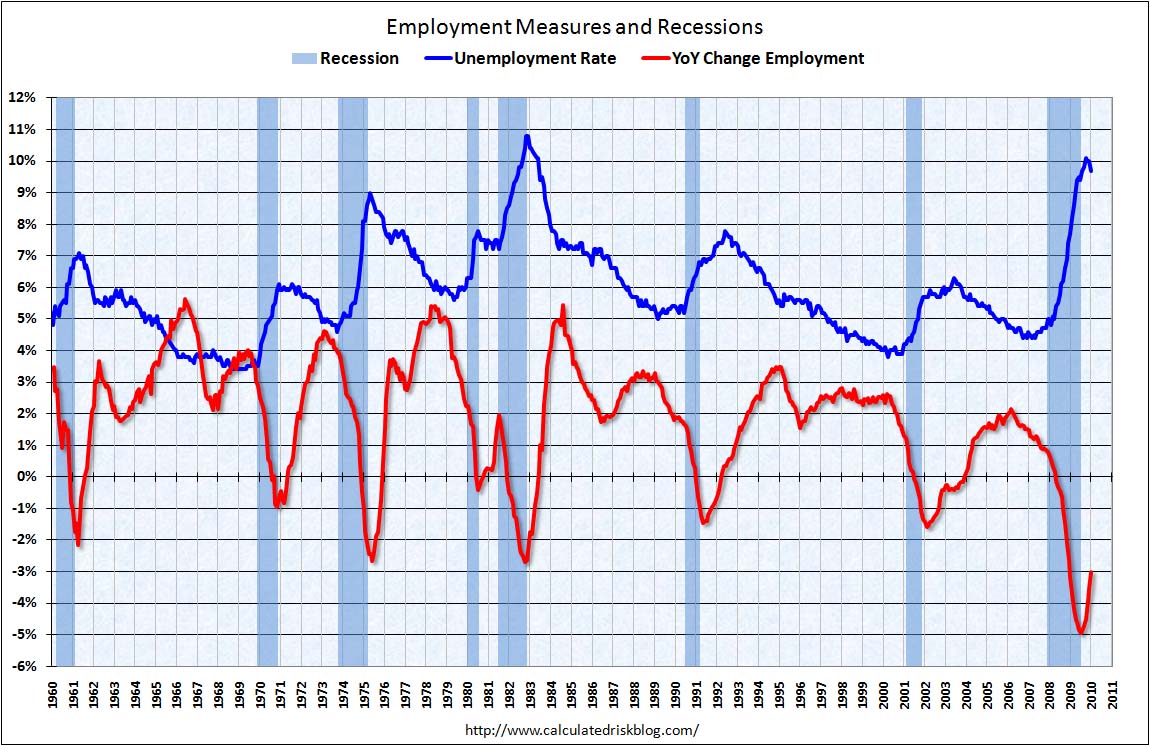

Calculated Risk pokazuje na wykresie zmiany stopy bezrobocia w stosunku do recesji.

Nonfarm payrolls decreased by 20,000 in January. The economy has lost almost 4.0 million jobs over the last year, and 8.42 million jobs since the beginning of the current employment recession. (note: job losses were 7.2 million before benchmark revision).

Wobec nowego raportu na temat stopy bezrobocia w USA wydaje się być sceptyczny Paul Krugman

Both surveys are subject to error, both strict statistical sampling error and things like incomplete coverage, uncertain seasonal adjustments, and so on. When employment growth is near zero, on either side, it’s not that surprising that the surveys should point in opposite directions.

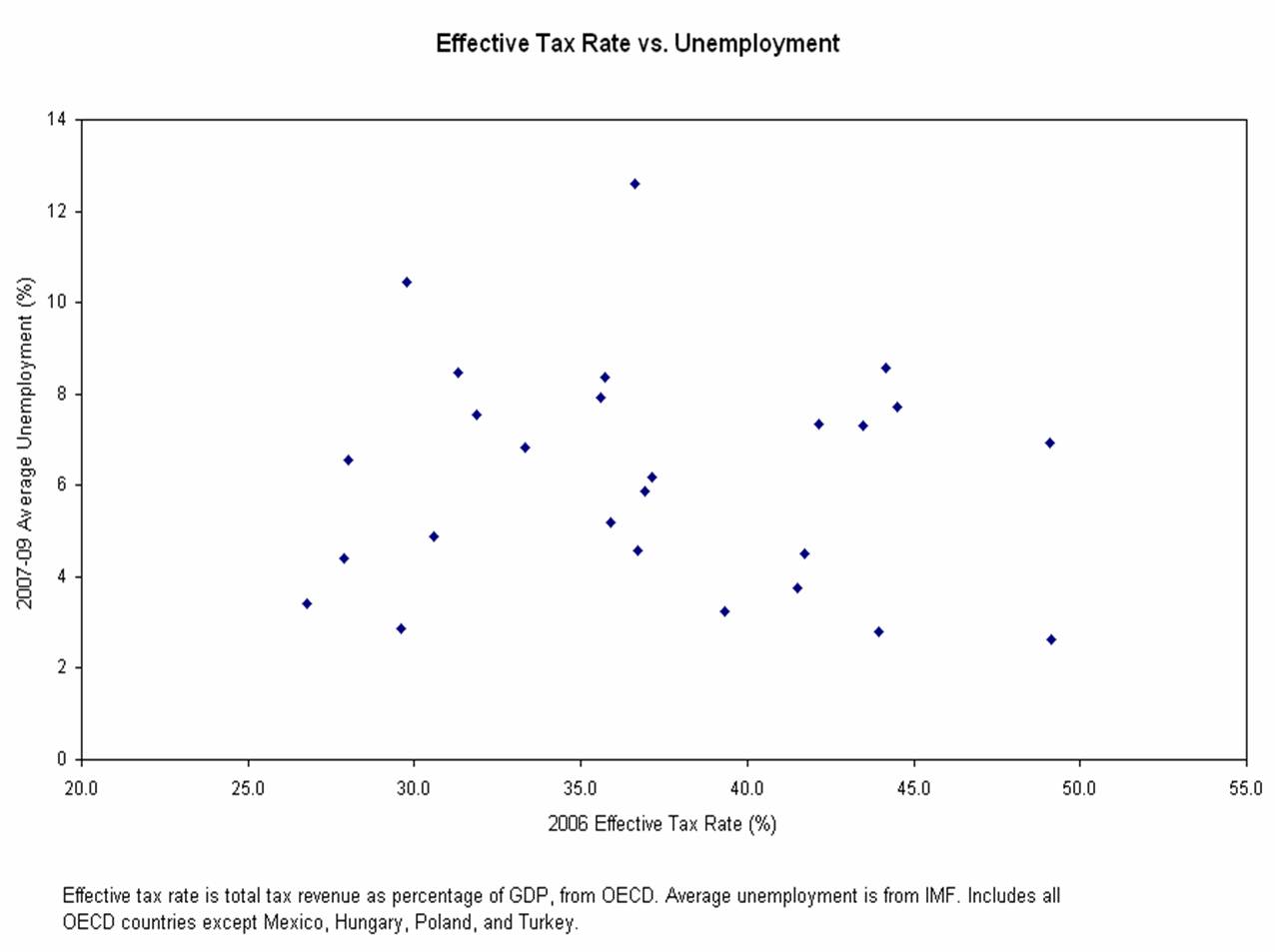

Ciekawe obserwacje na temat podatków zamieszcza na Baseline Scenario prof. James Kwak z Massachusets Institute of Technology

the idea that high taxes and the nanny state cause people to work less hard, preferring unemployment to an honest day’s work. If you believe that, I recommend this picture to you:

I don’t think these pictures prove anything. Well, maybe they prove one thing: that the real world is more complicated than the first-year economics textbook. Maybe higher taxes do result in less effort and less growth when you control for everything else. (…) If there’s one thing I’d like people to take away, it’s that any theoretical economic argument that can be stated in a sentence is as likely to be untrue as true in the real world, no matter how clever or intuitive it is.