Suwerenna waluta, suwerenny naród

Kategoria: Trendy gospodarcze

It may have originated in the eurozone, but the current crisis looks to be following along the lines of the one that began in the U.S. subprime mortgage market four years ago. That is, a problem that authorities assured us was „contained” (the Bernank’s famous last word) and resolvable has morphed into one that is uncontained and more dangerous by the day.

As the chart shows, an average of credit default swap (CDS) spreads for 71 countries around the world has now surpassed the peak seen in September and is hitting its highest level since April 2009. (Simply put, CDS are bets on the creditworthiness, or lack thereof, of a particular borrower.).

While skewed higher by fiscal basket cases such as Greece, in particular, Portugal, Venezuela, and Pakistan, the overall trend is clearly to the upside — which is not, despite repeated assurances from those „in charge,” a good thing (unless, of course, you’re a clueless equity trader who still doesn’t quite understand why credit markets matter).

Time to get those helmets on?

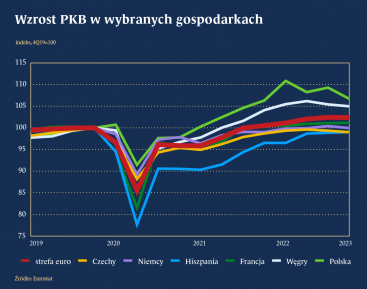

W styczniu 2020 roku Wielka Brytania formalnie opuściła Unię Europejską. Oczekiwane korzyści z brexitu, poza odzyskaniem suwerenności w zakresie kształtowania prawa i zewnętrznych relacji gospodarczych, jednak się nie zmaterializowały. Widoczny jest natomiast spadek wydajności i konkurencyjności brytyjskiej gospodarki, co wpływa także na kondycję rynku pracy.