Tydzień w gospodarce

Kategoria: Trendy gospodarcze

Stephen Roach points out:

„In real terms, the trade-weighted renminbi [yuan] is up 7.5% over the past six months and fully 20% over the past five years.”

And as Scott Sumner pointed to before, the yen have increased fourfold in value relative to the U.S. dollar since the 1970s (in nominal terms, less in real terms due to lower Japanese inflation, but even in real terms it’s exchange rate has risen dramatically), yet Japan still has a sizeable current account surplus. It thus seems unlikely that further yuan appreciation will really eliminate the Chinese surplus, much less the American deficit.

And as the Japanese example shows, China will continue to be a scapegoat for the likes of Paul Krugman and Charles Schumer (the Senator most active to initiate a trade war) regardless of what it does since the underlying causes of America’s problems aren’t addressed, at least until the hypothetical appearance of a new even more suitable scapegoat (The rise of China is why Japan has now finally lost the scapegoat role it had in the 1980s, 1990s and to a lesser extent in the early 2000s).

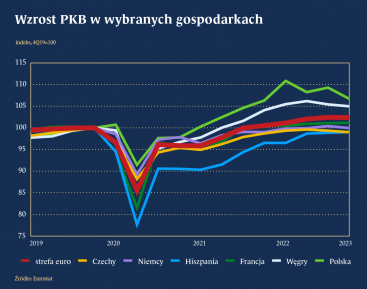

W styczniu 2020 roku Wielka Brytania formalnie opuściła Unię Europejską. Oczekiwane korzyści z brexitu, poza odzyskaniem suwerenności w zakresie kształtowania prawa i zewnętrznych relacji gospodarczych, jednak się nie zmaterializowały. Widoczny jest natomiast spadek wydajności i konkurencyjności brytyjskiej gospodarki, co wpływa także na kondycję rynku pracy.