Tydzień w gospodarce

Kategoria: Trendy gospodarcze

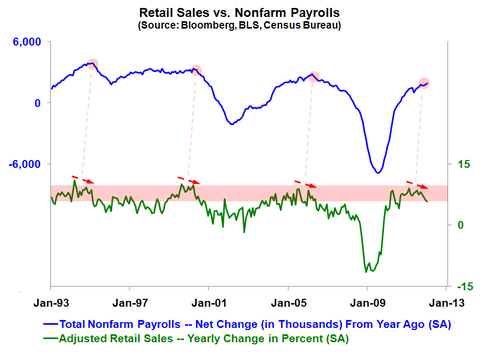

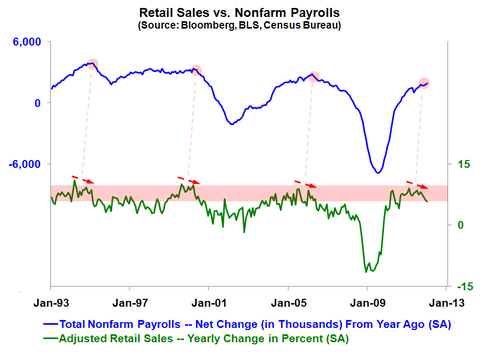

If recent history is any guide, a notable deceleration in the pace of U.S. retail spending following a period of strong gains signals trouble ahead for the jobs market.

As the chart shows, each time that monthly retail sales growth has risen above 8.5 percent and subsequently reversed course (by roughly two percentage points or so), the turnaround has preceded a peak in year-on-year increases in total nonfarm payrolls.

Whether it reflects the fact that people are quick to rein in spending when they sense trouble brewing at work (or in the economy as a whole), or are having a harder time finding a job than previously, is not clear, but it makes intuitive sense that spending shifts would become evident before companies begin the difficult process of freezing or slashing head counts.

Of course, correlation is not causation, and two decades worth of monthly data is not what some would consider sufficient for a rigorous analysis. Nonetheless, it may be another reason not to take today’s „unexpectedly” weak retail sales report, or the less-than-robust data reported in last year’s final two months, too lightly.