Tydzień w gospodarce

Kategoria: Trendy gospodarcze

Those who draw their income primarily from wages have been squeezed. However, those that draw more income from their savings and investments have fared better. This is the story behind the growing disparity of income in the United States.

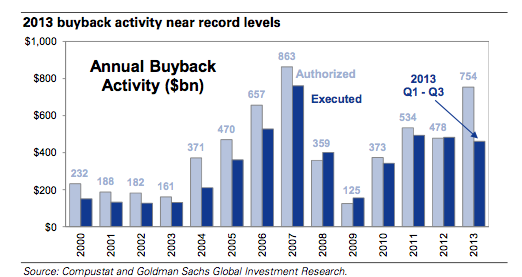

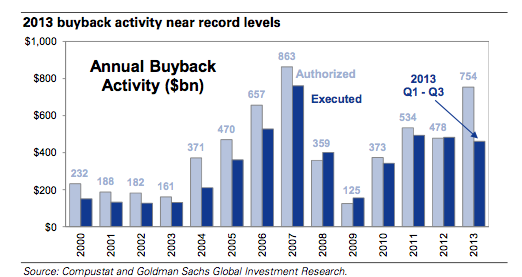

Shareholders have been rewarded. The top Great Graphic was posted by Matt Phillips on Quartz. It was taken from Goldman Sachs Research. It shows both the authorized and executed share buyback schemes among the S&P 500 through Q3 13. The authorized programs area approached record size.

There are a number of ETFs that try to capitalize on share buyback programs or favorable insider activity or strong hand buying. The Bloomberg chart here shows a the S&P 500s performance since the beginning of last year (purple line), with three ETFs in this space. The white line is PowerShares Buyback Achievers Portfolio (PKW). The yellow line is the Guggenheim Insider Sentiment (NFO), which looks at trends in insider buying and analysts’ opinions. The green line is TrimTabs Float Shrink (TTFS). It uses a screen for to assess the quality of the reduction in the free float. This summary of ETFs in this space should not be confused with a trade recommendation or investment advice.

We are skeptical, though of Phillips effort to draw a connection between the cash holdings of almost $2 trillion to the share buyback efforts. Yet, it seems as if many corporations are borrowing to fund the repurchase programs.