Tydzień w gospodarce

Kategoria: Raporty

Despite pumping trillions of yen into the economy over the last decade, Japan’s M3 money stock is barely higher now than it was at the beginning of the last decade as the private sector has deleveraged.

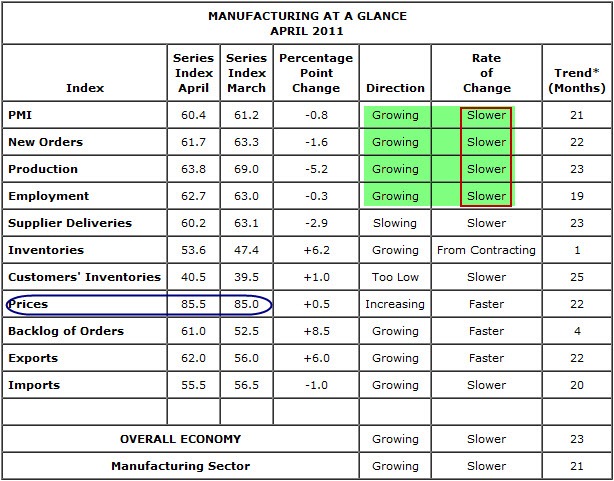

I am going to call a top here however. If you look back at the historical data, there have been no readings higher than this in nearly three decades. The last ISM number higher than 61.4% was a monster 69.9% reading from December 1983. So what does that mean going forward. In terms of growth of the manufacturing sector, it means that we are hitting maximum growth. I would expect the manufacturing sector to add less to overall GDP going forward. – Manufacturing still firing on all cylinders, 1 March 2011

The April 2011 Manufacturing ISM Report On Business came out today and confirmed the slight downward path we have seen since I wrote that paragraph two months ago. Mind you, 60.4% is still a very robust reading. Nevertheless, I still believe the manufacturing sector’s contribution to overall GDP growth has peaked.

Watch out for inflation though. Costs are poised to feed through in a demand destroying way.