Tydzień w gospodarce

Kategoria: Raporty

Like the bursting of the housing bubble and the financial crisis that began in the spring of 2007, the unfolding disaster in commercial real estate — which I made reference to in my remarks for the 2010 Bespoke Rountable — is neither surprising nor containable (to use an old favorite of clueless policymakers).

In fact, aside from the spinmeisters in Washington and Wall Street and their enablers in the mainstream media who keep trying to downplay the threat, it’s been obvious to anyone who has taken the time to think about it that things are going to get pretty ugly in CRE.

As it happens, one group of informed experts — as opposed to individuals like Treasury Sector Timothy Geithner, who just over two months ago said woes in the sector „won’t set off a new banking crisis” — is lending support to that claim, as Bloomberg reports in „Commercial Property Is Biggest Risk, U.S. Bank Examiners Find”:

Losses on commercial real estate loans pose the biggest risk to U.S. banks this year, troubling smaller lenders while unlikely to threaten the entire financial system, U.S. bank examiners concluded during a review.

“Losses from commercial real estate will be quite high by historic standards,” said Eugene Ludwig, former Comptroller of the Currency who is now chairman of Promontory Financial Group, a Washington-based consulting firm to financial institutions. “Hundreds of banks will fail or will be resolved over the course of the cycle.”

Federal Reserve Governor Elizabeth Duke said in a Jan. 4 speech that credit conditions in commercial real estate “are particularly strained.” Fed Governor Daniel Tarullo cited commercial real estate as one of the “key trouble spots” in congressional testimony in October after the Fed stepped up a review of banks’ exposure to such loans.

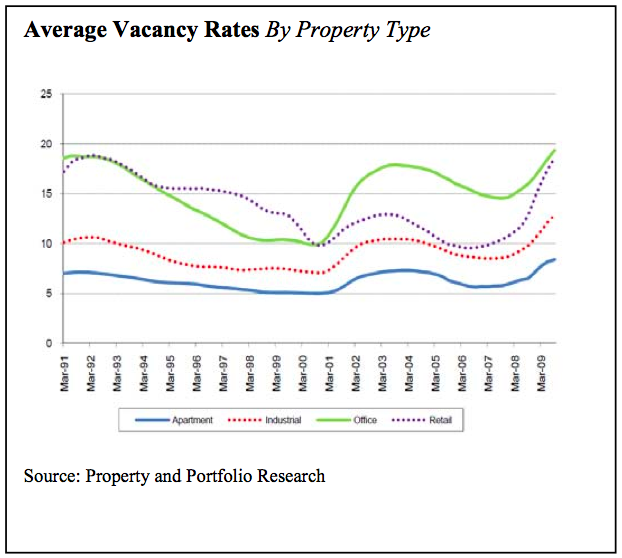

The failure of loans backing malls, hotels and apartments may impede the U.S. recovery as small- and medium-sized banks reduce lending and conserve capital to absorb losses, analysts said. Tight credit could slow the cycle of investment and hiring that is critical for sustained growth, they said.

Fed Chairman Ben S. Bernanke, in a Dec. 7 speech, cited tight credit among “formidable headwinds” likely to hinder growth. Total loans and leases by banks in the U.S. fell to $6.79 trillion in November from $7.23 trillion in the same month a year earlier, according to Fed data.

More Than Doubled

The default rate on commercial mortgages held by U.S. banks more than doubled to 3.4 percent in the third quarter, according to Real Estate Econometrics LLC, a property research firm in New York. Default rates in the first three quarters of 2009 have been the highest since 1993, according to the firm.

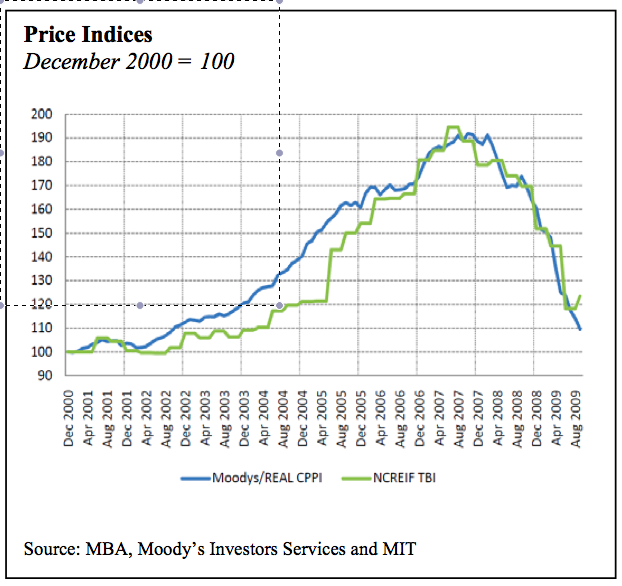

Losses on the debt will “place continued pressure on banks’ earnings” because collateral values have fallen, Jon Greenlee, associate director of the Fed’s bank supervision division, said in Nov. 2 testimony to the domestic policy subcommittee of the House Committee on Oversight and Government Reform.

Banks and investors held about $3.5 trillion of commercial real estate debt in June 2009, with about $1.7 trillion of that total on the books of banks and thrifts, according to Fed data. About $500 billion of the loans will mature each year over the next few years, Fed officials say.

Regional banks are almost four times more concentrated in commercial property loans than the nation’s biggest lenders, according to data compiled by Bloomberg on bailout recipients.

Vulnerability of Banks

Investors have recognized the comparative vulnerability of smaller banks. The KBW Regional Banking Index, which includes shares of Old National Bancorp of Evansville, Indiana and Glacier Bancorp Inc. of Kalispell, Montana, fell 24 percent last year compared with a 3.6 percent decline for the KBW Bank Index, which includes shares of JPMorgan Chase & Co. and Citigroup Inc.

“The strong get stronger and the weak get weaker,” said Joel Conn, president of Lakeshore Capital LLC in Birmingham, Alabama, which specializes in financial stocks. “It is very difficult to come up with a scenario where earnings get anywhere back to normal for small banks with large commercial real estate exposures.”

Fed officials stepped up reviews of commercial real estate loans at banks last year. The Fed is focusing on banks smaller than the 19 largest lenders examined in May. Those institutions held assets exceeding $100 billion.

Defaults among prime borrowers for residential mortgages will probably accelerate this year, according to Robert Shiller and Karl Case, the economists who created the S&P/Case-Shiller Home Price Index.

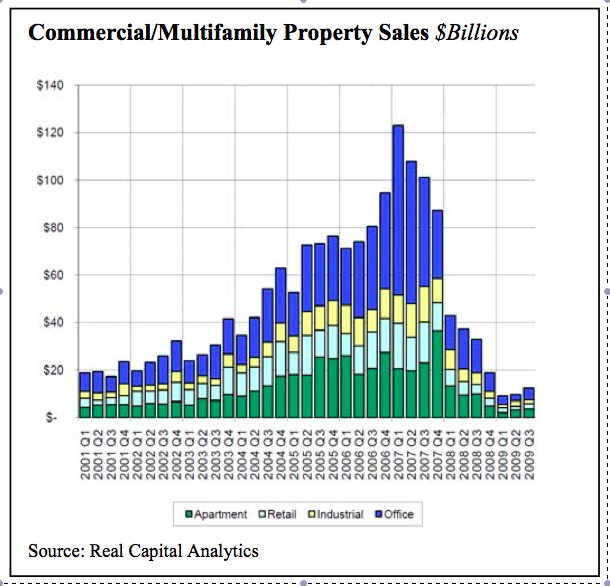

From the Mortgage Bankers Association’s Quarterly Data Book: