German automotive industry at a crossroads

Category: Business

The relationship between demographics and the outlook for economic growth is an intriguing research topic. Many countries, especially in Europe, are experiencing the aging of their populations, caused primarily by low fertility rates, and secondly, by increasing life expectancy. For a long time the fertility rate has remained below 2 not only in Poland, which means that there is no substitution of subsequent generations. Meanwhile, increasing life expectancy is the result of the improving health of societies and beneficial civilizational changes.

The fertility rate in Poland is lower than in many countries of the European Union. Life expectancy also remains lower, but in this case the differences are evening out. This means that life expectancy in Poland is catching up with the values recorded in the EU.

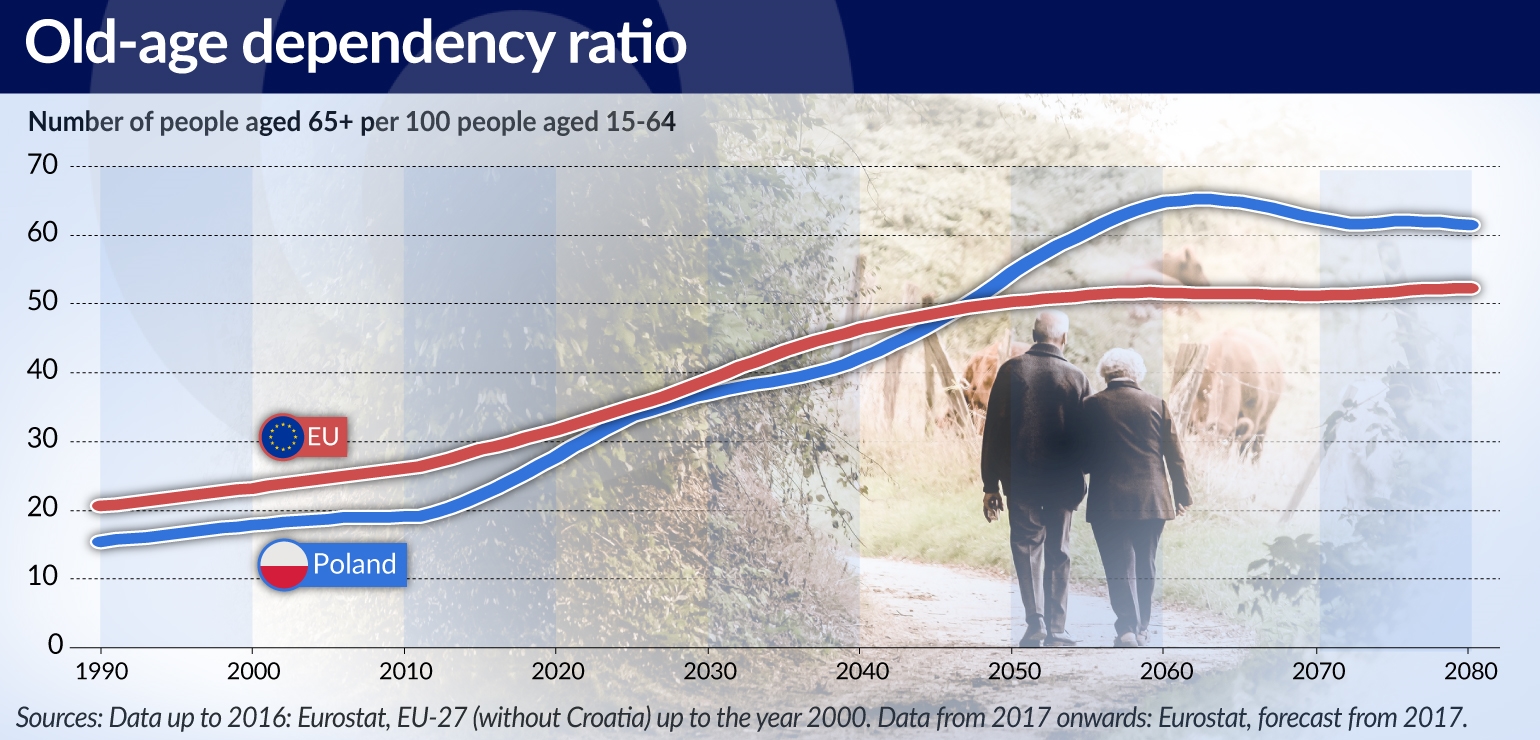

“The old-age dependency ratio in Poland is still lower than the average for the European Union. However, according to the available forecasts, from 2050 the situation will be reversed and this ratio will be higher in Poland than in the EU,” said Marcin Bielecki, from Poland’s central bank, NBP Economic Research Department and the University of Warsaw, during a seminar on the impact of demographics on monetary policy in a small open economy.

According to numerous studies and empirical experience, in an economy with an unfavorable demographic structure, there is a decrease in productivity. Greater assets are accumulated, whether in the form of shares, bonds or bank deposits, as well as in investment funds, but at the same time risk-taking propensity decreases. Productivity does not increase as fast as it used to because there are fewer young people who take risks and engage in projects that generate economic growth. The unfavorable demographic structure also clearly affects the stability of the pension systems. The financing of pensions becomes more difficult. At the same time, public expenditure increases, in particular expenditure related to health care.

This also has consequences in the form of a declining average return on capital, i.e. the natural real interest rate. This trend has been observed for years in the European Union. It is also taking place in Poland. We should also expect a decline in the natural real interest rate in the future. A model study conducted by Marcin Bielecki and professors Michał Brzoza-Brzezina and Marcin Kolasa from the NBP Economic Research Department – indicates that in the Eurozone countries the decline in the natural real interest rate will reach about 1 percentage point in the years 2010-2030. In Poland this process will be longer (it will last until 2050) and deeper – as a result, the real interest rate will drop by approx. 1.8 percentage points.

The mutual relationship between the two components of the unfavorable demographic trend is also important. The decline in the natural real interest rate in Poland will be to a greater extent the result of the increased life expectancy (which will account for two-thirds of the change, according to estimates) rather than the low fertility rate.

The decline in the natural real interest rate will be an important factor for the conduct of monetary policy, the objective of which is to keep price growth in line with the inflation target. With a lower real interest rate, the risk of deflation will increase.

“It is important for the central bank to be able to observe the natural real interest rate in real time,” said Marcin Bielecki. “If it fails to do so, a deflationary burden is created. In such a situation, it may seem to the bank that the natural real interest rate is higher than in reality. It will therefore conduct a more restrictive monetary policy and generate a deflationary burden, which can reach up to 0.8 percentage points. Such a situation could last for 5-10 years,” he added.

Demographic changes will also affect the direction of capital flows. As a result of the rapid aging of Polish society, the international investment position (the difference between a country’s assets and cross-border liabilities) will improve. The authors forecast that due to demographic changes the ratio of the international investment position to GDP will have improved by approx. 15 percentage points by 2050. Importantly, the openness of the Polish economy to international capital flows has little influence on the predicted decline in the natural interest rate in Poland.