German automotive industry at a crossroads

Category: Business

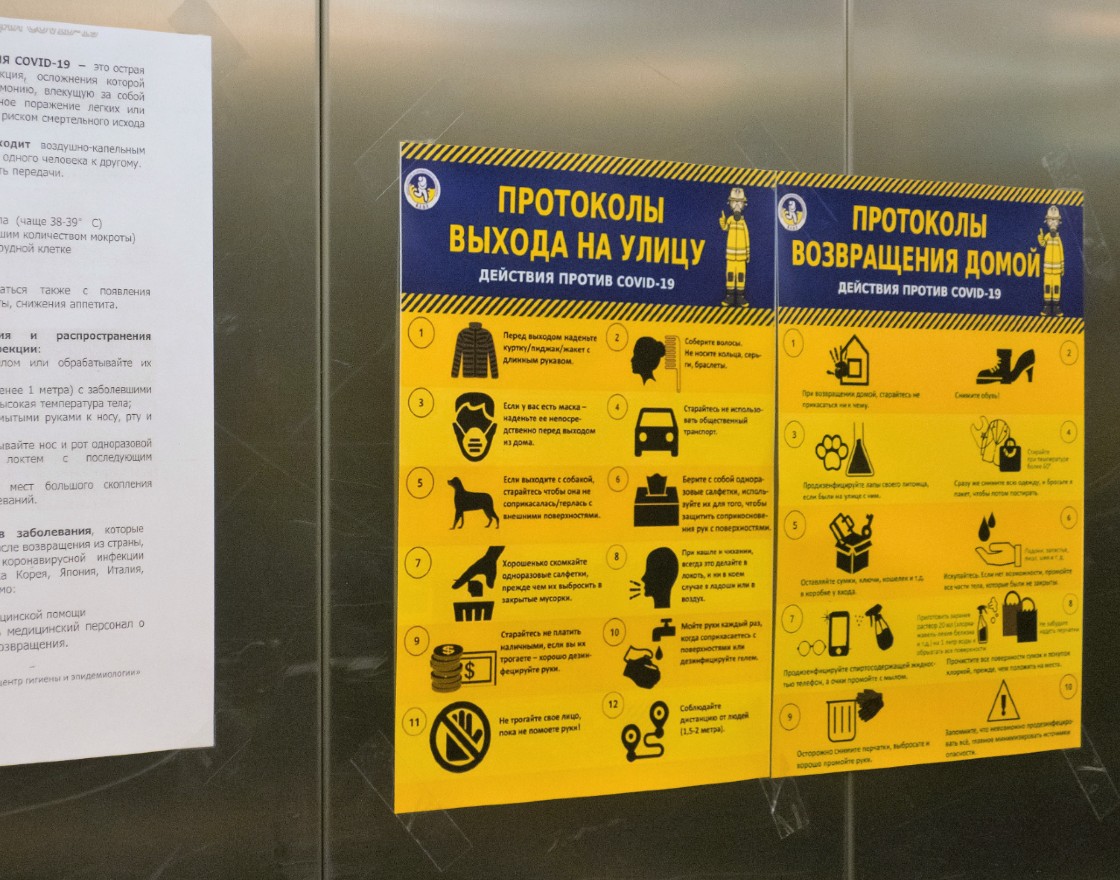

Coronavirus preventive measures, National Library, Minsk, Belarus (Homoatrox, CC BY-SA 4.0)

In late March, after protracted high-level negotiations, Belarus secured a deal for the purchase of Russian crude oil following three months of suspended supplies. However, this deal brought little of immediate comfort to Minsk. The coronavirus pandemic, which resulted in tough lockdowns in Europe and other markets, dramatically reduced demand for the petroleum products that Belarus intended to produce using Russian oil.

As a result, in April and May, Belarus purchased oil at around 50 per cent of the maximum load capacity of its two state-owned refineries. In June, the situation with oil imports is expected to be similar — Minsk will have purchased only a million tons of crude from Russia, or about half of what the Belarusian government intended to purchase before the coronavirus crisis.

Meanwhile, Moscow’s decision to suspend its multi-billion-dollar credit support program to Belarus at the beginning of this year has posed an even larger challenge for Minsk, as it enters a peak of its public debt repayments. According to the country’s finance ministry, Belarus is due to repay around USD3.4bn of public debt including interest in 2020, and USD3.2bn in 2021. Two thirds of these are accounted for as the external public debt.

In order to meet these obligations, as well as to support major state-owned companies that have been severely hit by the coronavirus crisis, and to avoid a dramatic reduction of the nation’s foreign reserves (these stood at USD7.9bn as of early June), the Belarusian government plans to borrow around USD3bn by the end of this year.

In late March, the Belarusian central bank said that Minsk was seeking a USD900m support package from the International Monetary Fund (IMF) “in the face of economic challenges stemming from the worsening global economic situation and the coronavirus pandemic”. Belarus wants to secure loan from the IMF’s Rapid Financing Instrument (RFI), which support the authorities’ policies in response to emergency financing needs, according to the central bank.

According to IMF data, it has already provided around USD1.5bn to the European region during the coronavirus crisis, via the RFI and another emergency instrument, the Rapid Credit Facility (RCF). The funding was channeled to Albania, Bosnia and Herzegovina, Kosovo, Moldova and North Macedonia. In May, the IMF’s spokesman Gerry Rice confirmed the receipt of a request from the Belarusian government. However, he refused to provide any details, pointing out that the IMF’s staff were “in discussions with the authorities and evaluating the situation and the policies”.

Meanwhile, Belarus’s initial plans appear to be crumbling amid the ongoing presidential election campaign in Belarus. Shortly after Rice’s statement, president Alexander Lukashenko, who is seeking re-election for a sixth consecutive term, announced his intention to dismiss the nation’s cabinet, arguing that he wanted to show “the people we will work with” after his expected victory. “We will not do this after the elections, after you have voted. Almost a final government will be formed before the presidential election,” he said at the time. On June 4th, Lukashenko fired then-PM Sergei Rumas, who had started negotiations with the IMF in March.

More importantly, due to the dramatic pre-election crackdown on opposition groups, the issue of human rights in Belarus has reappeared on the radar of the EU member states and other Western nations, whose stance towards Minsk will be crucially important for financial support from the IMF and many other multinational donors. “The Belarusian authorities must respect fundamental freedoms and human rights, in line with Belarus’ international commitments,” the European Commission’s spokesman said in a statement on June 19th.

Belarus is the only country in Eastern and Southeast Europe that refused to impose a coronavirus quarantine, despite recommendations from the World Health Organization (WHO). According to Mr. Lukashenko, this tactic was chosen in order to prevent severe damage to the nation’s already struggling economy. However, it looks like this move has also become a serious hurdle on the way to an IMF support package. “The IMF continues to demand quarantine measures, isolation, a curfew. This is nonsense. We will not dance to anyone’s tune,” Mr. Lukashenko told the nation’s new cabinet.

“It seems clear that an IMF deal is off the table,” Mark McNamee, a London-based practice leader at the DuckerFrontier consulting company, tells Obserwator Finansowy. “This latest political crackdown, the removal of the prime minister, and replacing him with a member of the security services also reflects the government’s willful turning away from the IMF, particularly as Belarus (like many other emerging markets now) feels confident in turning to international debt markets for funds,” he added

Indeed, in June, Belarus raised USD1.25bn via a new Eurobond placement, a five-year tranche worth USD500m at 6.125% and a 10-year tranche totaling USD750m at 6.375%. Demand for the nation’s securities exceeded USD4.8bn, according to the finance ministry.

The failure to secure a deal with the IMF undermines Minsk’s chances for success following its request for macro-financial assistance from the EU, filed during the coronavirus crisis. “We have received a request from the Belarusian authorities for macro-financial assistance. In order to be eligible for macro-financial assistance, a country must have a program with the IMF and fulfill certain political preconditions,” the European Commission’s spokesperson told Obserwator Finansowy, without elaborating. “Should Belarus be granted funding by the IMF, the EU stands ready to engage with the Belarusian authorities in a constructive dialogue on the steps necessary to fulfill the political preconditions,” the spokesperson added.

Dirk Schuebel, EU ambassador to Belarus, gave an exclusive comment to Obserwator Finansowy, saying that Minsk would benefit from the total emergency support package for the Eastern Partnership (EaP) countries — Armenia, Azerbaijan, Belarus, Georgia, Moldova and Ukraine — which includes EUR80m for the most urgent needs (mainly healthcare), and more than EUR900m to support the socio-economic recovery (mainly to the public sector as well as SMEs). This package includes both regional and bilateral funds. “Let us underline in particular the support to the health system through a dedicated EUR30m program for the Eastern Partnership implemented by the WHO. The first substantive delivery of various personal protective equipment and patient ventilators took place in June in Minsk and will be sent to health centers and front line health workers throughout the country,” Mr. Schuebel added.

In addition, Belarus will have access to EUR120m of regional funds on top of EUR200m of existing credit lines to provide liquidity to SMEs. “When it comes to the bilateral assistance, we are discussing now with the Belarusian authorities how to further reorient and accelerate the delivery of over EUR60m in assistance under bilateral programs to address socio-economic needs and to provide liquidity, making sure that the most burning needs deriving from the pandemic are met,” the ambassador said.

Belarus is also talking with the European Investment Bank (EIB) for an additional investment loan to support coronavirus crisis-related measures and to re-enforce ongoing credit lines for SMEs, the diplomat says. However, growing tensions over human rights between the Belarusian authorities and the EU’s member states, which comprise the EIB’s shareholders, may complicate negotiations with the bank. Germany, France and Italy have the largest stakes in the EIB.

A similar threat is looming over Minsk’s cooperation with the European Bank for Reconstruction and Development (EBRD), which invested almost EUR400m in Belarus last year. The bank has already had experience of limited cooperation — both financial and technical — with the Belarusian authorities for around four years after the disputed presidential elections in December 2010. However, an improvement in relations between Belarus and the EU allowed Brussels to endorse “reviewing the EU’s restrictive approach to EBRD lending” in early 2015, according to a classified EU roadmap seen by Obserwator Finansowy.

“Can this approach be reinstated if the situation in Belarus deteriorates? The bank’s shareholders will have a meeting and provide their recommendations to the bank in such a case,” an EBRD official said. “There have been no changes in our work with Belarus so far.”

In April, the Belarusian government requested urgent EBRD financial assistance for the major state-owned bank and major government-controlled companies, which have been severely hit by the coronavirus crisis, specifically, Belavia airlines, the Belarusian railways and Minsk international airport.

“We are ready to provide financial support quite swiftly to companies that are already known to the bank. As for the state-owned companies named by the government, we are ready to consider any options. However, this will be done in accordance with our rules and procedures — after a detailed financial analysis,” the EBRD official told Obserwator Finansowy.

Belarus’s central bank and finance ministry declined to comment on their negotiations with the EU, IMF and other lenders. The media office of the Belarusian government did not respond to two requests for comment.